USD/JPY Keeps Uptrend After BOJ Intervention and Japan Data

The Yen-to-USD exchange rate experienced significant volatility yesterday after the BOJ intervention but USD/JPY remains bullish. Today’s Unemployment Rate and Prelim Industrial Production released early in the morning didn’t have much impact, but the BOJ volatility still remains in JPY pairs.

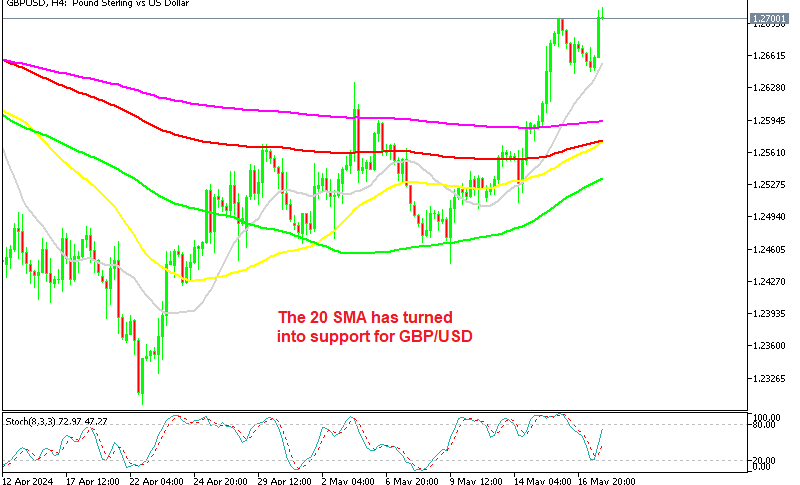

USD/JPY Chart H4 – The 50 SMA Holds As Support

The focus at the start of the new week is on the Japanese Yen, as USD/JPY surged above 160 early yesterday, but the Bank of Japan (BOJ) intervened, pushing it 600 pips lower in total. Despite a 300-pip rebound, the price reversed down again, indicating continued extreme volatility in this forex pair. USD/JPY dropped from 160.22 to 154.53 a few hours later. However, the 50 Simple Moving Average (SMA) (yellow line) on the H4 chart halted the decline, with the price heading back up. So, the BOJ intervention is just buying time.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Japan March Unemployment Rate

- March unemployment rate 2.6% vs 2.5% expected

- February unemployment rate was 2.6%

- Job/Applicant ratio 1.28 vs 1.26 expected

- Previous Job/Applicant ratio was 1.26

Japan Prelim Industrial Production for March 2024

- March Industrial Production MoM +3.8% vs +3.3% expected

- February Industrial Production was -0.6%

- Industrial Production YoY -6.7% vs -6.6% expected

- Prior Industrial Production YoY was -3.9%

Japan Retail Sales for March 2024

- March Retail Sales MoM -1.2% vs -0.6% expected

- February Retail Sales MoM were 1.5%

- Retail Sales YoY 1.2% vs +2.4% expected

- Previous Retail Sales YoY were +4.7%

Japan’s unemployment rate for March 2024 came in at 2.6%, slightly higher than the expected 2.5%. The job/applicant ratio for the same period was 1.28, surpassing expectations of 1.26 and indicating a favorable job market. Preliminary industrial production for March showed a month-on-month increase of 3.8%, beating expectations of 3.3%. However, year-on-year industrial production saw a decline of 6.7%, slightly worse than the expected 6.6%. In terms of retail sales, March 2024 saw a month-on-month decrease of 1.2%, below the anticipated -0.6%. Year-on-year retail sales growth stood at 1.2%, falling short of the expected +2.4% and reflecting a slowdown compared to the previous year’s figure of +4.7%.

USD/JPY Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |