GBPUSD Opens 2-Month High, House Price Up by 1.3%

The recent price behaviour in GBP to USD rate has indicated upside momentum after the 2-week consolidation in GBP/USD, which it above 1.27.

The recent price behaviour in GBP to USD rate has indicated upside momentum after the 2-week consolidation in GBP/USD, which propelled the price above 1.27 by the end of last week when the market closed. The GBP/USD pair experienced a decline in the first week of May but recovered following disappointing Non-Farm Payrolls (NFP) data from the United States announcement, which suggested a weaker US employment sector, leading to a depreciation of the US dollar and supporting the Pound.

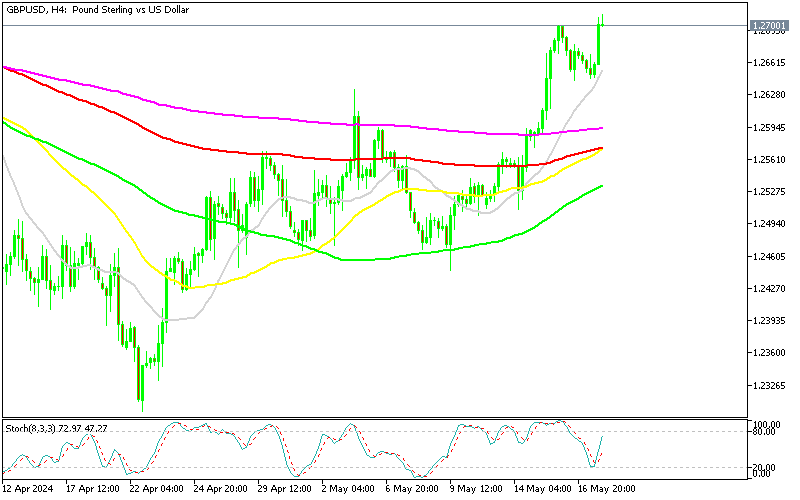

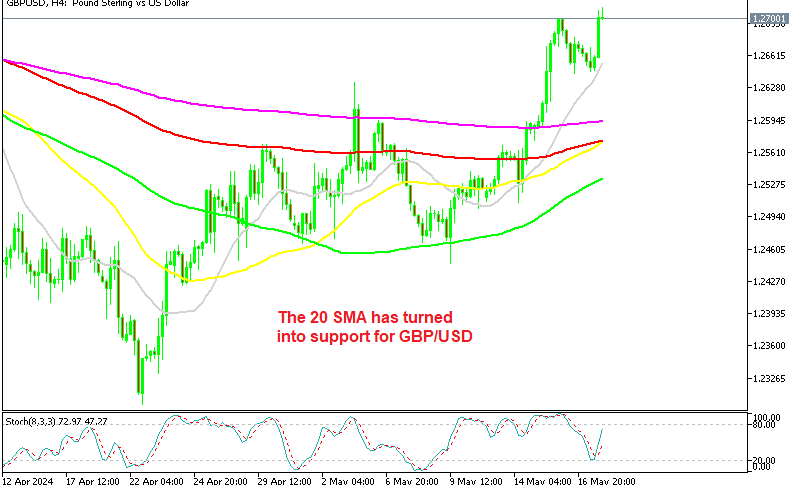

GBP/USD Chart H4 – MAs Have Turned Into Support

GBP/USD was shown signs of bullish breakout momentum, supported by movements above key resistance levels and moving averages several times on the H4 chart. Buyers did push above 1.27 which milestone, and now they are eyeing near-term targets below 1.29 which is the high from March and the round level at 1.300, while remaining data-dependent for further direction. As the market continues to react to economic data releases and broader macroeconomic factors such as thee inflation report late this week, we will follow the price action closely in this pair.

Today’s focus was on the Rightmove House Price Index for May, which is a decent indicator for the Bank of England to analyze the UK housing market. By providing detailed data on price changes and market dynamics, this index helps the BOE stakeholders understand current inflation trends in the UK housing sector and take a decision, since the BoE has linked the possibility of future rate cuts to economic data, including inflation and wages. Today’s report came in weaker than last month, so this was a bearish news for the NGP, but it didn’t mind much, as GBP/USD climbed above 1.27 last night.

UK Rightmove House Price Index for May

- The UK Rightmove House Price Index for April shows a month-on-month increase of 0.8%.

- This is down from the previous month’s rise of 1.1%.

- The UK Rightmove House Price Index for April grew by 0.6%

- This was a decrease from the previous month’s YoY growth rate of 1.7%.

The Bank of England’s uncertainty regarding the timing of the first rate cut has kept the market on edge. The BoE has indicated that its decisions will be closely tied to key economic indicators, so every piece of data receives extra attention now. However this week markets are concentrated mostly on the UK CPI inflation report for April, which will be released on Wednesday.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account