usd-jpy

USD/JPY Dives Below 155 After Powell and Yen Intervention

Skerdian Meta•Thursday, May 2, 2024•2 min read

The USD to JPY rate resumed the volatility yesterday, with USD/JPY falling 4 cents lower, following FED decision and BOJ intervention. We have the minutes from the last BOJ meeting last night, however, they didn’t change much in the market’s perception, since the Bank of Japan is not expected to make any more changes soon.

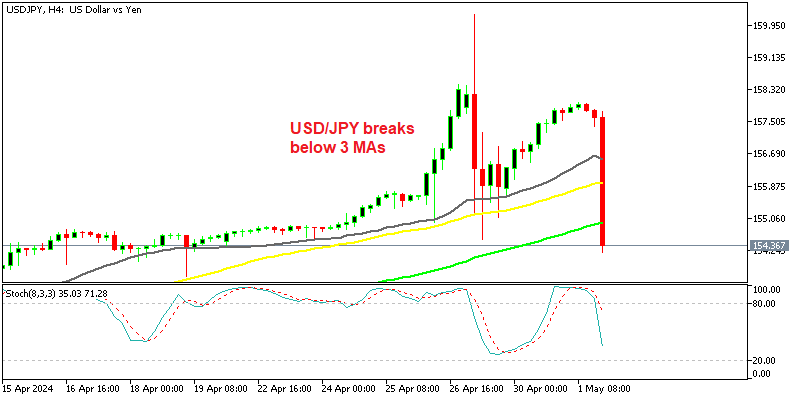

USD/JPY Chart H4 – Breaking Below MAs

Early this week, the Japanese yen grabbed the attentions, with USD/JPY surging above 160, but the Bank of Japan (BOJ) intervened, leading to a 6 cent drop overall. However, the 50 Simple Moving Average (SMA) on the H4 chart acted as support, halting the decline and pushing the price back up toward 158.

But, last evening they intervened again after the FED meeting, probably taking advantage of this liquidity, sending USD/JPY below 155. Once more, Japanese authorities have intervened in the market and their action occurred shortly after the US market closed. As a result of their intervention, USD/JPY dropped below both the 50 and 100-day moving averages. The price descended further, breaching the moving averages and hitting a low of 153.00.

BOJ Meeting Minutes

- One member stated that the impact of raising short-term rates to around 0.1% on the economy is likely to be limited.

- Many members expressed the view that long-term rates should primarily be determined by market forces.

- Another member suggested that adjustments to the BOJ’s bond buying should be made gradually to avoid causing significant market volatility.

- A few members proposed that the BOJ should consider reducing its bond buying amount and scaling back its bond holdings in the future.

- Some members highlighted that the BOJ’s actions in March differed from the monetary tightening observed in the US and Europe.

- One member advocated for the gradual normalization of policy by the BOJ, keeping an eye on economic and price developments.

- Several members mentioned the possibility of Japan’s inflation overshooting, although it’s not a significant risk presently.

- The representative from the Ministry of Finance expects the BOJ to continue pursuing the achievement of the 2% inflation target in a stable and sustained manner. They noted positive movements in wages and capital expenditure but highlighted the lack of strength in consumption and existing overseas risks.

- The representative from the Cabinet Office echoed the sentiment that a positive wage-inflation cycle is emerging. They emphasized the necessity for the BOJ to continue supporting the economy from a financial standpoint to achieve a sustained, domestically driven economic recovery.

- Full text of the BoJ minutes

USD/JPY Live Chart

USD/JPY

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

16 hours ago

Save

Save

17 hours ago

Save

Save

18 hours ago

Save

Save