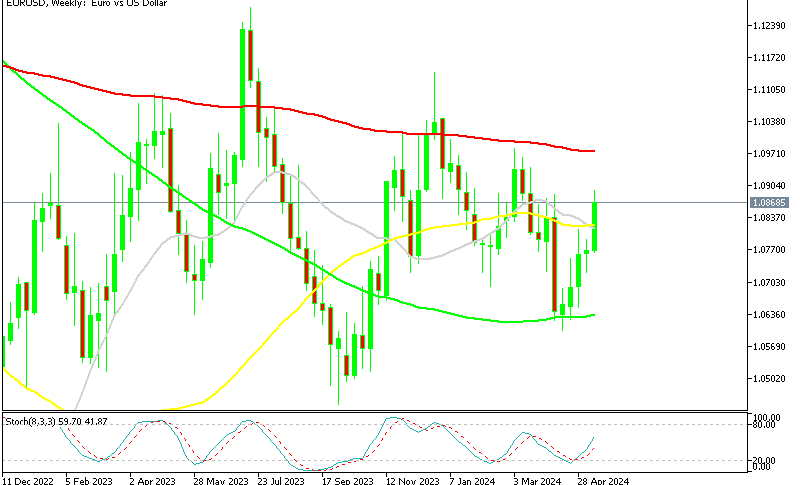

Dax Index Trades Between MAs on Eurozone Uncertainty

The Dax index has been rallying since October 2023, but is in a consolidation mode now. The price retreated lower during the first half of April, but has been stuck between two moving averages in the last two weeks, bouncing between the 50 SMA (yellow) at the bottom and the 20 SMA (gray) at the top.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Yesterday the Germany’s stock market exhibited mixed performance but ended up lower once again at the day’s close, there were some small gains in the Food & Beverages and Utilities sectors but losses in the Technology, Construction, and Consumer & Cyclical sectors were larger, which pushed this index lower eventually. At the close, the DAX index experienced a 0.2% decline, while the TecDAX index plummeted by 1%. Zalando SE emerged as the day’s worst performer, experiencing a drop of approximately 5%.

This comes after another rejection at the 20 daily SMA (gray), which has been acting as resistance this year. The softer FED stance on Wednesday evening didn’t help much. The Eurozone economy is showing some positive signs recently, but it’s still brittle, so European stock traders remain uncertain.

DAX Chart Daily – Stuck Between the 100 and 200 SMAs

Signs of Improvement in the German and Eurozone Economies

Eurozone core CPI inflation was anticipated to slow to 2.6% from 2.9% but it came at 2.7%, while the German GDP rose to 0.2% quarter-on-quarter from 0% in the fourth quarter of 2023. This week’s German retail sales showed an 1.8% increased for last month, which have surpassed expectations, although overall sentiment has remained relatively unchanged. Following a dip in February, retail sales rebounded in March, indicating a positive trend in consumer spending.

This trend is encouraging for the broader economic recovery and reinforces the notion that the German and the Eurozone economy is making progress. These results align with recent data showing a stronger-than-expected business climate index and positive business and consumer confidence report from the previous week.

German DAX Index Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |