EURUSD Heads To 1.10 Despite ECB-FED Rate Policy Divergence

The EUR to USD rate has been bullish for 5 weeks, with EURUSD gaining almost 3 cents since this forex pair bottomed out at 1.06 in April.

The EUR to USD rate has been bullish for 5 weeks, with EURUSD gaining almost 3 cents since this forex pair bottomed out at 1.06 in April. FED members are not giving any signs of rate cuts yet, while the ECB has all but announced a June rate cuts, with the US economy being in a better shape, but the Euro has been taking advantage of the USD nonetheless. However, looking at the weekly chart, EUR/USD has been trading in a range for around 18 months, which shows a lack of direction and certainty.

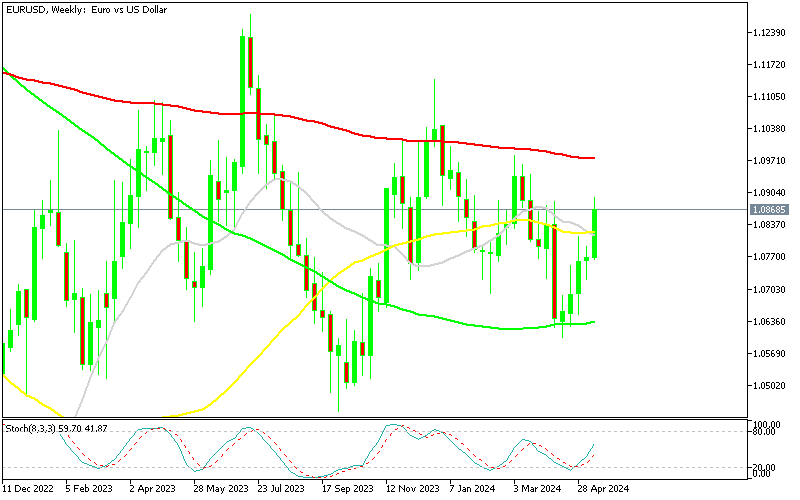

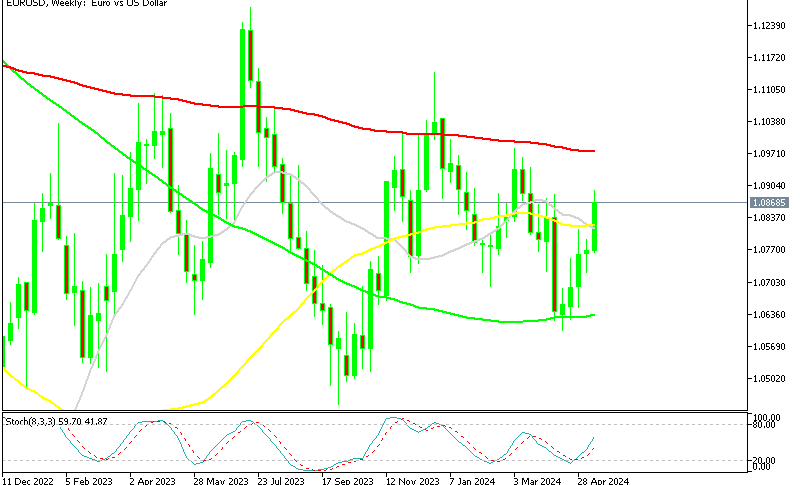

EUR/USD Chart Weekly – Bouncing Off the 100 SMA

This pair found support at the 100 SMA (green) in April, which stands at 1.06 low and now seems to be heading to the 100 SMA (red). Given the current market conditions, the price action in EUR/USD hasn’t really followed comments from both, the ECB and Fed officials.

The potential for a rate cut by the ECB in June should have been weighing a lot more on the Euro, while hawkish comments from the Fed should have supported the USD. Yesterday, ECB member Vasle comments reinforced the dovish outlook from the ECB, while the Fed maintains a more hawkish stance. This dynamic has kept the EUR/USD near higher levels, closing at 1.0869, however it is facing resistance below 1.09.

ECB’s Member Vasle Comments

- Rate Path and Possibilities:

- Vasle stated that the ECB is awaiting more data and remains open to possibilities on the rate path, suggesting flexibility and a data-dependent approach.

- Potential Rate Cut:

- Vasle indicated that cutting rates in June would be reasonable, pointing towards a potential easing of monetary policy.

- GDP Growth Outlook:

- Vasle mentioned that 2024 GDP growth is expected to be better than previously anticipated, suggesting optimism about the Eurozone’s economic prospects.

- US Economic Developments:

- Vasle highlighted attentiveness to developments in the US, indicating the importance of global economic conditions in shaping ECB policy.

Amid these comments, Fed Governor Bowman’s hawkish stance yesterday as well as comments from other FED members, contrast with the more dovish tone from Vasle and other ECB officials gearing towards a potential rate cut in June. Despite this, the EUR/USD pair remained near higher levels for the week, closing near the top.

ECB Vice President De Guindos Expects CPI to Fall to 2%

ECB Vice President Luis de Guindos also made some dovish comments yesterday. He expressed anticipation that inflation will continue falling towards the 2% target by 2025. This suggests increasing confidence in the ECB’s projections toward monetary policy easing soon. However, there remains a possibility the price growth could remain in the 2% to 3% range until next year.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account