Lower German Factory Orders, EURUSD Rejected by the 200 SMA

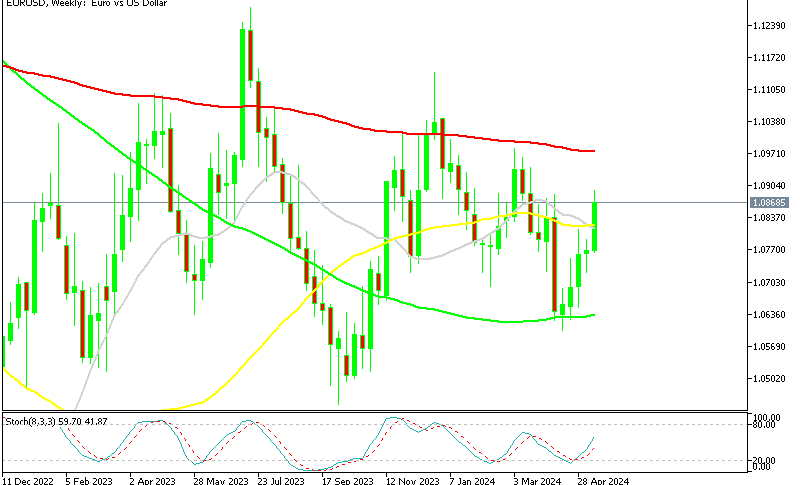

Last week, the EUR to USD rate saw a surge above 1.08, driven by events such as the FOMC meeting and the US non-farm payrolls (NFP) report. However, it appears that this upward momentum may have reached its peak. The acceleration in the rise was particularly notable on Friday, buoyed by the disappointing NFP report. Despite this, the 200-day Simple Moving Average (SMA) continues to act as a resistance level for EUR/USD, leading to a subsequent decline in price by approximately 50-60 pips.

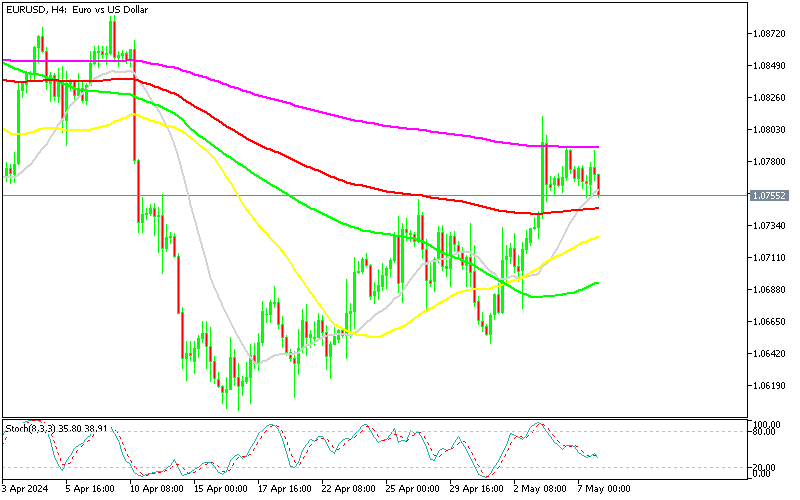

EUR/USD Chart H4 – The Price Falls to the 100 SMA

EUR/USD has seen significant gains since mid-April, but its upward momentum has stalled upon reaching resistance zones around the 1.08 level, where the 200 moving averages (purple) is located. The pair surged above 1.08 on Friday after the soft NFP figures, but faced rejection at the 100-day simple moving average (SMA) several times, subsequently falling back below 1.0.8 again where we decided to open a sell EUR/USD signal last night.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Today, after some negative events such as the decline in the German factory orders and dovish ECB comments are weighing on this forex pair, sending it down to the 100 SMA (red). Remarks by ECB policymaker Gediminas Šimkus yesterday indicated that there is room to ease restrictions and anticipates further rate cuts after June, with a total of three rate reductions this year, which is mildly dovish, but perhaps the market was expecting more. Today we had the German Factory orders which came in negative for April.

- German March industrial Orders Released by Destatis – 7 May 2024

- March industrial orders MoM -0.4% vs +0.4% expected

- April industrial orders MoM were +0.2%

German industrial orders for March, as reported by Destatis on May 7, 2024, showed a month-on-month decline of 0.4%, falling short of the expected increase of 0.4%. However, industrial orders for April rebounded, showing a month-on-month growth of 0.2%. So, Germany’s factory orders disappointed compared to expectations, primarily due to a decrease in major or large orders. However, when excluding these, manufacturing orders saw a slight increase of 0.1% month over month. Within specific categories, capital goods and intermediate goods orders declined by 0.4%, while consumer goods orders increased by 0.7%.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |