Forex Signals Brief May 10: UK GDP Closing A Loaded Week for GBP

Yesterday started with the release of Japan’s Average Cash Earnings for March revealed some disappointing figures. The actual earnings of 0.6% fell short of the predicted 1.5%, indicating weaker-than-expected economic performance in terms of household earnings. Moreover, the downward revision of February’s earnings from 1.8% to 1.4% further highlights the challenges facing Japan’s economy.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

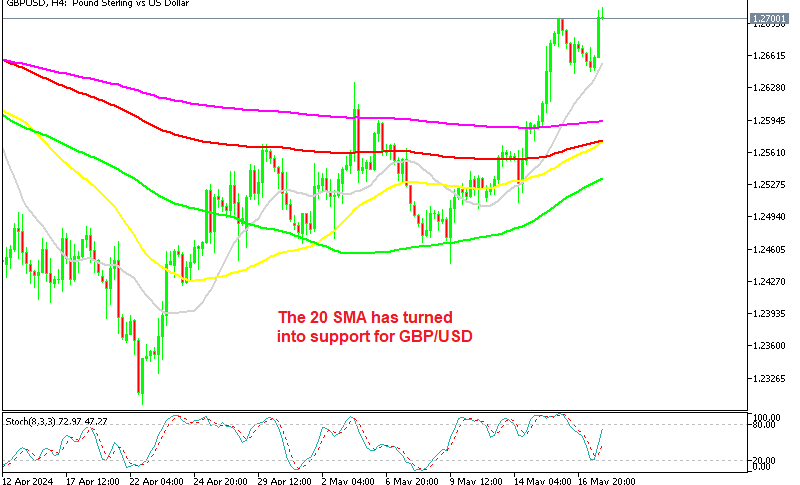

The Bank of England (BoE) appears to be teetering on the edge of potential rate cuts, evidenced by a downward revision to inflation forecasts. However, the addition of cautious wording regarding upcoming data releases has put any immediate action on hold. This suggests that while the BoE is actively monitoring developments and may consider a rate cut in June if inflation data surprises to the downside, the likelihood of such a move is modest. Market sentiment is leaning more towards a rate drop in August. Governor Bailey’s remarks indicating that a rate cut in June cannot be ruled out, and that the BoE may reduce rates more than currently expected, underscore the dovish tone of the BoE’s policy stance. However, these are considered minor points in the overall context. Consequently, the future policy direction of the BoE and the outlook for the GBP remain uncertain.

In the US session we had the weekly reporting of initial unemployment claims. The statistics came in higher than expected, at 231K, vs a projected 215K, representing the highest level since November last year so the USD closed as the weakest of the major currencies. Given the weakness in the US Non-Farm Payrolls (NFP) report last Friday, the market is paying close attention to today’s jobless claims report. However, it is important to note that one week’s data does not always imply a substantial trend shift.

Today’s Market Expectations

Today started with the data for Japan’s household spending in March indicates a year-on-year (YoY) decline of -1.2%, extending the streak of decreases for the 13th consecutive month. This ongoing trend suggests persistent challenges in household consumption within the Japanese economy. February’s YoY household spending showed a smaller decline of -0.5%, which was better than the median market forecast of a 2.4% decrease. This suggests that household spending performed relatively better than expected in February. On a seasonally adjusted basis, month-on-month spending in March increased by 1.2%, surpassing the estimated decline of -0.3%. This indicates a positive momentum in monthly spending compared to expectations. In February, seasonally adjusted month-on-month spending saw a 1.4% rise, further highlighting a positive trend in household spending on a monthly basis.

The main economic event today is the UK Q1 and March GDP report. The numbers for March are anticipated to indicate another month of modest growth of 0.1%, following a 0.1% month-on-month (M/M) increase in February. This follows a robust 0.3% reading in January, implying that the UK economy is poised to emerge from the technical recession that began at the end of 2023.

For the first quarter, growth is expected to be around 0.4% quarter-on-quarter (Q/Q), a significant improvement from the previously estimated -0.3%. Politically, this data will likely be welcomed, providing Prime Minister Sunak with an opportunity to shift the media narrative away from the recent poor local election results and potential leadership challenges. However, while this print allows the Bank of England (BoE) to maintain its cautious stance, dubbed the “Table Mountain approach,” its impact may be limited. This is because the BoE remains firmly focused on inflation and wage growth dynamics.

In the US session we have the Canadian labor market data for April is anticipated to show an addition of 17.5K jobs compared to a loss of 2.2K jobs in March. However, the unemployment rate is expected to rise slightly to 6.2% from the previous 6.1%. The previous labor market report fell short of expectations, with job losses and a notable increase in unemployment.

Despite this, there was also an uptick in wage growth, which is a key concern for the Bank of Canada. However, a looser labor market may dampen future wage gains. Given the recent labor market performance and other economic indicators, the market anticipates the central bank to decrease interest rates for the first time in June, with a move in July being considered more likely.

Yesterday the USD started retreating again after the soft unemployment claims, which raised concerns about the US labour market. We were long on the USD from the previous day since the Buck was trending higher this week and got caught on the wrong side with a couple of signals, but we also had some winning forex signals, so we ended up with two winning trades and two losing ones.

Gold Heads for the 20 Daily SMA

Gold has been experiencing some fluctuations above the $2,300 region, initially falling from above $2,400 but then finding support between $2,310 and $2,350. However, the recent resumption of a downtrend has seen gold prices drop below $2,300. The decrease in geopolitical tensions has contributed to a reduction in risk sentiment across financial markets, leading to decreased demand for gold initially. However, following the recent Federal Open Market Committee (FOMC) meeting, gold prices managed to climb back above $2,300 where they have stabilized in range and this week the range is getting narrower.

XAU/USD – Daily chart

Opening Another Buy Position in USD/JPY After the Slight Retreat

The USD/JPY pair experienced a significant surge above 162 last month. However, Japanese officials intervened in the yen market last week, causing the USD/JPY pair to drop by 10 cents below 152. This intervention aimed to strengthen the yen and stabilize the currency market. Following the intervention, the USD/JPY pair recovered and developed a positive trend since Friday. The price rose above the 155 mark and approached 156 yesterday. However, the pair fell following lower US unemployment claims, indicating a potential shift in market sentiment. But we decided to buy this dip, as buyers remain in control.

USD/JPY – H1 Chart

Cryptocurrency Update

Bitcoin Reverses at $61,000

Bitcoin’s price experienced a reversal recently, dropping from approximately $65,000 last week to around $61,000 yesterday. Technical indicators such as the 50-day and 20-day Simple Moving Averages (SMAs) have now turned into resistance levels for Bitcoin. Additionally, the cryptocurrency has been forming lower highs since March, indicating a potential downward trend. However, there was a bullish reversal yesterday, with Bitcoin experiencing a $2,000 climb in price, pushing it above $63,000. This movement suggests renewed buying interest and potential support around the 100-day Simple Moving Average (SMA) (green line).

BTC/USD – Daily chart

Ethereum Returns Above $3,000

Ethereum (ETH) has indeed exhibited volatility, with its price dipping below the $3,000 level multiple times and occasionally trading below the Simple Moving Averages (SMA) on the daily chart. However, despite these fluctuations, Ethereum has demonstrated resilience, consistently recovering and rising back above the $3,000 threshold. This resilience suggests that there is strong demand for Ethereum, with buyers willing to enter the market at lower price levels.

ETH/USD – Daily chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |