eth-usd

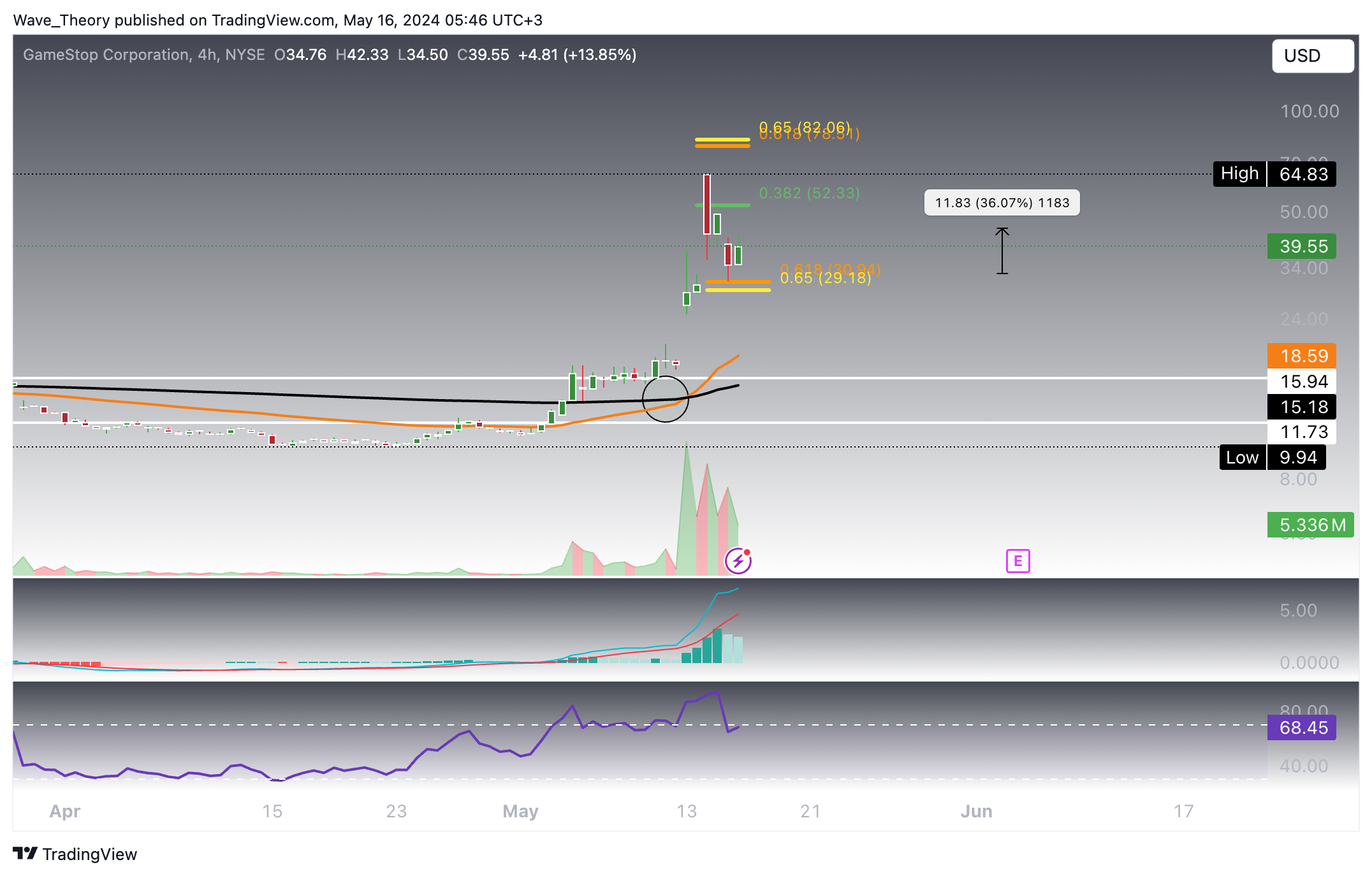

GameStop Stock (GME): Primed for a Second Surge?

Konstantin Kaiser•Thursday, May 16, 2024•2 min read

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments