JSE Top 40 Eyes 86,113 as Rand Struggles Amid Dollar Strength and Data Risks

The JSE Top 40 Index is trading at 84,779 and holding steady despite the rand coming under pressure. The currency has been under pressure...

Quick overview

- The JSE Top 40 Index is stable at 84,779 despite pressure on the rand due to a stronger US dollar following the US-China trade deal.

- Upcoming South African data, including unemployment figures and mining production, could significantly influence market sentiment and the rand's performance.

- Preparations for the G20 Summit in South Africa are generating cautious optimism, with potential policy announcements on key themes that may attract investor interest.

- From a technical standpoint, the JSE Top 40 Index remains bullish, with defined buy opportunities if certain support levels are maintained.

The JSE Top 40 Index is trading at 84,779 and holding steady despite the rand coming under pressure. The currency has been under pressure since the stronger US dollar following the US-China trade deal that cut tariffs across key sectors. While the deal was welcomed by the market, it has seen a shift away from safe-haven assets like gold and has dragged bullion down 3% and in turn the rand.

This is how global events – especially those involving large economies – can impact emerging markets. For South Africa the rand’s decline shows how vulnerable it is to changing investor sentiment even as domestic equities like the JSE Top 40 show resilience.

Local Data and G20 Summit in Focus

Now investor attention turns to South African data. First quarter unemployment figures out Tuesday and March mining production data on Thursday will likely influence near term sentiment. Analysts at Oxford Economics are forecasting 1% GDP growth for 2025 due to weak domestic fundamentals. If data disappoints it could put further pressure on the rand and stall equity momentum.

Meanwhile preparations for the November G20 Summit in South Africa have sparked cautious optimism. International Relations Minister Ronald Lamola confirmed over 50 diplomatic meetings have been held since December 2024 and the country is on track. Key themes like disaster relief funding, green economy transitions and sovereign debt sustainability could boost investor interest if policy announcements follow.

Technical Outlook: Buy Opportunity Above Support

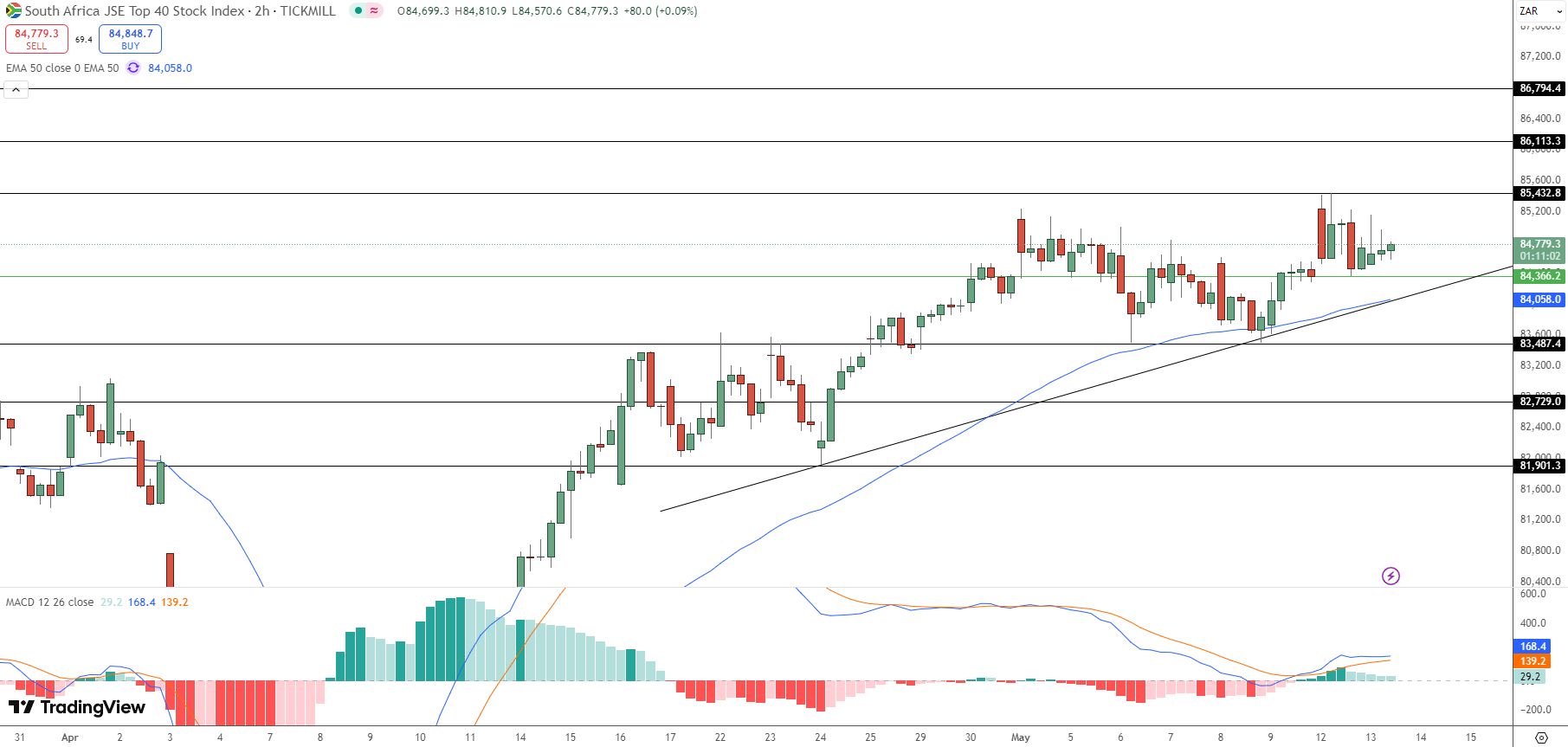

From a technical perspective the JSE Top 40 Index is still in a bullish structure above the trendline and the 50 period EMA at 84,058. The MACD is showing early signs of a bullish crossover so momentum could build if support holds.

For traders this is a defined opportunity:

-

Buy Zone: 84,300-84,600

-

Target 1: 85,432 (horizontal resistance)

-

Target 2: 86,113 (next supply zone)

-

Stop Loss: Below 83,480

Watch for a MACD crossover or a strong bullish candle above 85,000 to confirm entry. A break below 84,000 will undermine the setup.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account