Litecoin (LTC) Forecast: Bulls Eye $104.58 as Key Support Holds

Quick overview

- Litecoin (LTC) is currently testing critical support levels around $100, with a potential bullish breakout if it can close above $100.68.

- Key resistance levels to watch include $100.68 and $104.58, while immediate support is found at $97.12.

- The 4-hour chart indicates a solid base forming, suggesting accumulating buying interest and a possible surge towards $104.58.

- Litecoin's strong technological foundation and vision for efficient digital payments position it well for long-term growth.

Litecoin (LTC) has recently delivered an intriguing technical structure, with price action hovering near critical support levels while attempting to reclaim bullish momentum.

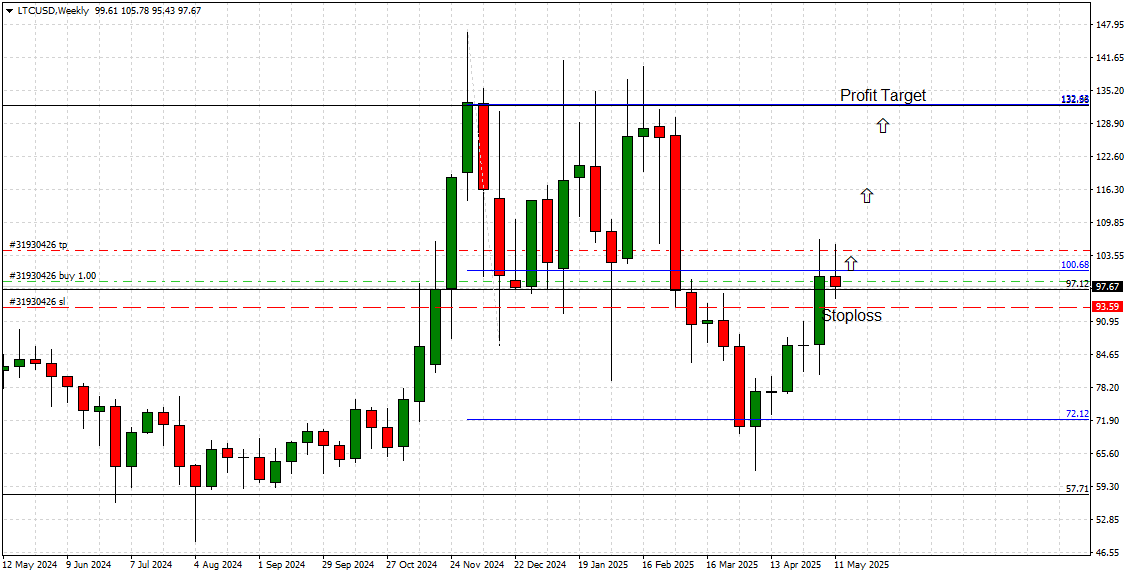

Both the weekly and 4-hour charts reveal a decisive battle unfolding between buyers and sellers around the $100 handle — a pivotal level that could dictate Litecoin’s near-term trajectory and long-term breakout potential. In this forecast, we’ll dissect both the short-term and long-term outlooks for LTC, assess breakout levels, and revisit Litecoin’s technology and broader vision for context.

Key Breakout Levels to Watch

On the Weekly timeframe, Litecoin is consolidating below the major resistance level at $100.68. This price point has proven to be a formidable barrier, with several failed breakout attempts over recent weeks. A sustained weekly close above $100.68 would confirm bullish control and open the path towards the next major resistance at $132.70, with intermediate resistance near $104.58 as seen on the 4-hour chart.

Conversely, failure to decisively break above $100.68 would expose LTC to downside pressure, with $97.12 acting as immediate support zone. A breach below $97.12 could lead to a deeper retracement back towards the low levels of which price action had fully recovered from, around the 70’s.

Short-term breakout levels include:

-

Resistance: $99.85 → $100.68 → $104.58

-

Support: $97.12 → $95.63 → $93.60 (Stoploss)

Price Action Momentum and Trade Structure

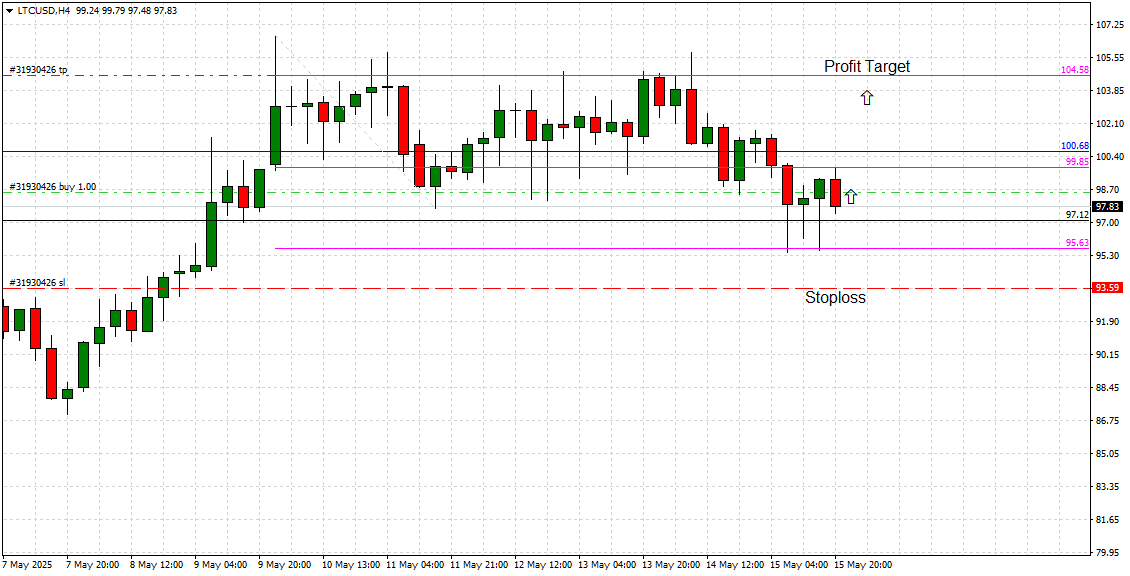

The 4-hour chart reveals a solid base forming around $97.12 and $95.63, levels that have successfully absorbed bearish pressure in recent sessions. The formation of higher lows and bullish candlestick patterns suggests accumulating buying interest.

A potential bullish surge towards $104.58 appears increasingly likely, especially if Litecoin can reclaim and sustain above the $99.85 – $100.68 resistance cluster. This local breakout would pave the way for a retest of the $104.58 level in the short term.

Current Trade Setup (Based on 4H Chart):

-

Buy Entry: $97.83

-

Profit Target: $104.58

-

Stop Loss: $93.59

Risk-reward remains favorable, particularly with a tight support cluster beneath the entry level and ample upside space towards the immediate resistance at $104.58.

Technology and Vision

While price action is always the final arbiter in trading, it’s essential to consider the fundamentals and broader vision driving investor sentiment. Litecoin was created by Charlie Lee in 2011 as a “lighter” version of Bitcoin, designed for faster, cheaper, and more scalable peer-to-peer transactions. With 2.5-minute block times and reduced transaction fees, Litecoin has earned a reputation as a reliable and efficient alternative to Bitcoin for everyday transactions.

Over the years, Litecoin has maintained its position as one of the most actively traded cryptocurrencies, widely supported by major exchanges, payment processors, and wallet providers. Its focus on simplicity, security, and network efficiency continues to resonate with both retail and institutional traders.

As Litecoin continues to evolve, its core mission remains unchanged: to offer a fast, cost-effective, and secure digital currency for global payments. With increasing adoption in both consumer-facing and institutional applications, Litecoin is well-positioned to capture long-term growth as crypto payments gain mainstream traction.

Conclusion

In summary, Litecoin’s technical landscape suggests a bullish bias in the short term, provided key support levels at $97.12 and $95.63 continue to hold. A breakout above $100.68 would confirm upward momentum, targeting $104.58 in the immediate run and potentially $132.70 on a longer-term basis.

Traders should remain vigilant for a sustained push above $100.68 to validate bullish continuation, while maintaining disciplined stop placement at $93.60 to manage risk. Litecoin’s solid technology foundation, privacy upgrades via MimbleWimble, and enduring vision as a decentralized payment asset further support its bullish case amid market volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account