WTI Crude Oil Holds $61.30 as U.S. Inventories Rise by 1.3M Barrels

WTI Crude Oil is trading at $61.54, down 0.26% in early Thursday trading after the U.S. Energy Information Administration (EIA) reported...

Quick overview

- WTI Crude Oil is trading at $61.54, down 0.26% after a surprise increase in U.S. crude inventories by 1.3 million barrels.

- The inventory build, attributed to high imports and reduced gasoline demand, raises concerns about U.S. oil demand.

- Traders are focused on the $61.30 support level, which is crucial for maintaining bullish momentum.

- Market volatility is expected as U.S.-Iran nuclear talks approach, alongside geopolitical tensions affecting oil prices.

WTI Crude Oil is trading at $61.54, down 0.26% in early Thursday trading after the U.S. Energy Information Administration (EIA) reported a 1.3 million barrel increase in crude inventories. Analysts had expected a draw of the same size. The surprise build, driven by a 6 week high in imports and a drop in gasoline and distillate demand, has raised concerns over U.S. demand.

According to Emril Jamil at LSEG Oil Research, the inventory build puts downward pressure on WTI and could redirect more U.S. barrels to Europe and Asia. But summer driving season may provide demand support, limiting the downside.

Market participants are also reacting to news of a 5th round of U.S.-Iran nuclear talks on Friday in Rome. The talks and a CNN report that Israel may be preparing to strike Iranian nuclear facilities are adding to the already complex macro backdrop.

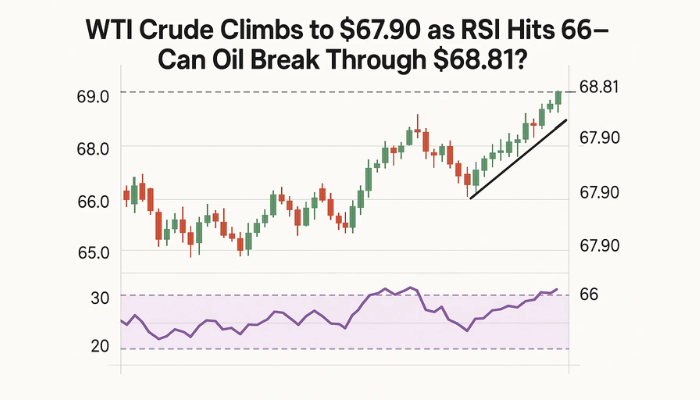

WTI Crude Oil Technical Setup: $61.30 Trendline Remains Key

From a charting perspective, WTI is holding onto the $61.30 support zone – the trendline from May 8 and the horizontal demand level. This confluence has caught several recent dips and is the key level for traders.

-

Support: $61.30 and $60.09

-

Resistance: $61.89 (50-EMA), $63.81, $64.80

-

Momentum: MACD has crossed below the signal line; histogram is red

A clean bounce above $61.30 with MACD confirmation could open up another leg to $63.81-$64.80. Failure to hold $61.30 would invalidate the bullish structure and expose $60.09.

Traders React to Inventory Data and Iran Risks

As oil traders position themselves, the overall outlook is mixed. The increase in U.S. crude inventories has raised demand concerns, while Iran risks are still in play. With the U.S. dollar weakening and energy stocks under pressure, WTI bulls need to hold $61.30 to maintain short term momentum.

Get ready for more volatility before the Iran-U.S. talks in Rome and more macro headlines. Until then, stay patient and set your risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account