JPMorgan Chase to Accept Bitcoin ETFs as Loan Collateral in Major Crypto Shift

JPMorgan Chase, the biggest bank in the US by assets, is getting ready to let customers use Bitcoin exchange-traded funds as collateral for

Quick overview

- JPMorgan Chase is set to allow customers to use Bitcoin exchange-traded funds as collateral for loans, marking a significant shift in its approach to digital assets.

- The bank will accept BlackRock's iShares Bitcoin Trust as collateral, which is the largest U.S. spot Bitcoin ETF with $70.1 billion in net assets.

- This policy change reflects a broader acceptance of cryptocurrencies in the banking sector, as JPMorgan begins to consider digital assets alongside traditional holdings for loan assessments.

- JPMorgan's move may influence other major banks to adopt similar practices, accelerating the integration of digital assets into the financial system.

JPMorgan Chase, the biggest bank in the US by assets, is getting ready to let customers use Bitcoin exchange-traded funds as collateral for loans. This is a big departure for the bank when it comes to digital assets.

Bloomberg says that the bank would soon start taking BlackRock’s iShares Bitcoin Trust (IBIT) as collateral. With $70.1 billion in net assets, IBIT is the largest U.S. spot Bitcoin ETF. It holds more than half of the total $128.13 billion held by all U.S. spot Bitcoin ETFs.

The shift in policy goes beyond merely how collateral is handled. When figuring out how much money a client has and how much they may borrow, JPMorgan will now look at their cryptocurrency holdings as well as their stocks and real estate. This is a change from the bank’s previous method of lending money based on each individual situation.

The decision applies to all of JPMorgan’s retail and institutional clients around the world. This puts the bank in a good position to take advantage of the growing demand from institutions for digital asset integration. JPMorgan doesn’t presently offer custody or execution services for crypto ETFs, but this loan policy shows that the bank knows that regulated crypto exposure is becoming more common.

This change shows how the banking industry’s relationship with Bitcoin is changing. The new government has made a big change to the rules, and the Federal Reserve has stopped telling banks not to get involved in crypto activity. The Office of the Comptroller of the Currency said in May that banks can now take care of customers’ crypto assets that are being held in custody.

This action also shows a big change in JPMorgan CEO Jamie Dimon’s public views on Bitcoin. Dimon declared in May that the bank would soon let clients buy Bitcoin directly, even though he has been very clear about his doubts about the digital currency. At the firm’s investor day, Dimon stated, “I don’t think we should smoke, but I defend your right to smoke.” He was making a comparison to crypto investment. “I support your right to buy bitcoin.”

JPMorgan is one of many big banks that are getting into digital assets. Morgan Stanley has been working on adding crypto trading to its E*Trade platform. Standard Chartered, on the other hand, has started offering digital asset trading services through a partnership with FalconX. The trend shows that more and more institutions are starting to see cryptocurrencies as real investment assets.

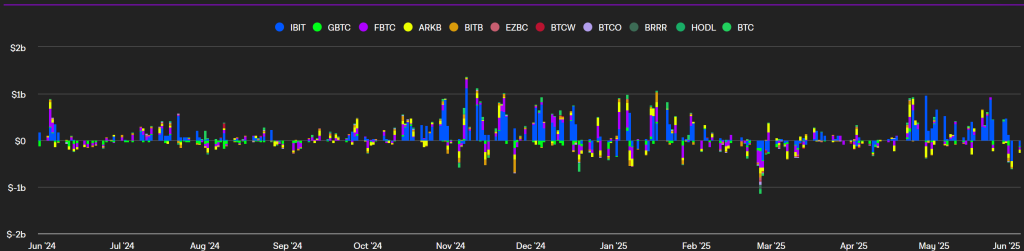

The time is right because the crypto market is picking up speed again. The U.S. spot Bitcoin ETFs, which were approved in January 2024, are now one of the most successful ETF launches in U.S. history, with more than $128 billion in assets under management. These ETFs saw $378 million in inflows on Tuesday, ending a three-day sequence of outflows.

JPMorgan’s plans for crypto go beyond this most recent disclosure. In 2020, the bank released JPM Coin, a stablecoin pegged to the dollar. In 2024, it said it owned shares of different Bitcoin ETFs. The organization has slowly improved its digital asset skills while being careful in the unstable bitcoin market.

This change in policy puts JPMorgan in a better position to help clients who want to invest in digital assets while still following the rules and standards for risk management that are expected of traditional banks. As cryptocurrency becomes more widely accepted, JPMorgan’s action may lead other big banks to do the same, which might speed up the process of integrating digital assets into the larger financial system.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account