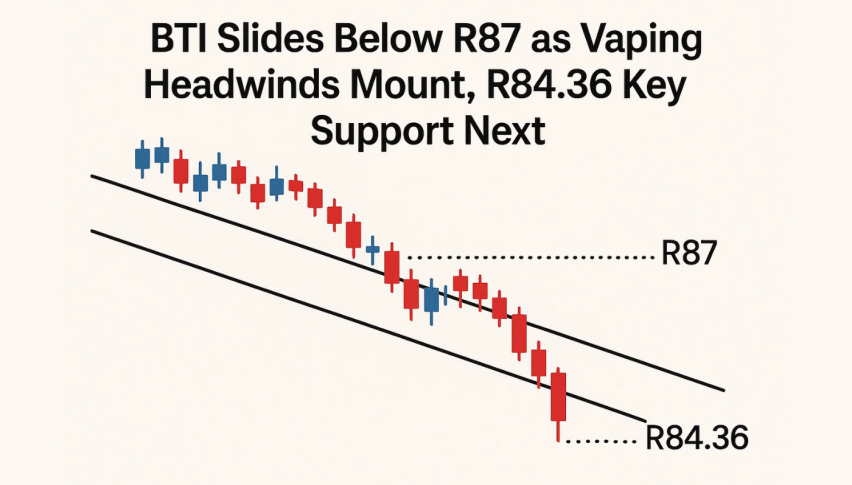

BTI Slides Below R87 as Vaping Headwinds Mount, R84.36 Key Support Next

British American Tobacco (JSE: BTI) is under pressure in its core growth segment. Vuse, its main vaping brand, is slowing...

Quick overview

- British American Tobacco is facing challenges in its core growth segment, particularly with its Vuse vaping brand due to increased regulatory scrutiny.

- A $5 million lawsuit in the US over alleged greenwashing could harm BAT's ESG reputation, which is important for institutional investors.

- Despite these issues, a weaker Rand is providing short-term support for BAT's JSE-listed shares by boosting foreign earnings.

- Technical indicators show early weakness for BTI's stock, with critical support levels around R85.49 that could lead to further declines if breached.

British American Tobacco (JSE: BTI) is under pressure in its core growth segment. Vuse, its main vaping brand, is slowing due to regulatory scrutiny. Governments worldwide are tightening approval processes and environmental requirements. This is squeezing margins and stalling growth, undermining BAT’s long-term shift from traditional cigarettes.

Adding to the woes, a $5 million lawsuit in the US is accusing the company of greenwashing Vuse with misleading “carbon-neutral” claims. If upheld, this could damage BAT’s ESG credentials, a growing priority for institutional investors.

Rand Weakness Helps Short-Term

Despite structural headwinds, macro is helping BTI’s JSE-listed shares in the short-term. SA inflation for May is 2.8% YoY and 0.3% MoM, with core inflation steady at 3%. This reduces the chances of a rate hike by the SARB, and is anchoring investor sentiment. April retail sales were subdued, and this could mean weaker domestic demand, and a weaker Rand. A weaker Rand helps BTI’s foreign earnings when converted to local currency, and is a cushion for the stock.

Technical Breakdown

BTI is showing early technical weakness after failing to hold above R87.03. The stock is heading back to the lower trendline of the ascending channel around R85.50, which is close to the 50-period EMA at R85.49. The MACD has gone negative, and the signal line is flattening, indicating fading momentum.

- Support: R85.49, R84.36, R83.26

- Resistance: R88.00, R89.08

- Bearish if R85.49 breaks

- Bullish if above R88.00

Final Thoughts

BTI’s stock is in a delicate balance between defensive and strategic uncertainty. While macro and dividend yield are attractive in the short-term, regulatory risks and technicals suggest caution. A break below R85.49 could open up R84.36 and R83.26, so the next few sessions are key.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM