Intel Faces Perfect Storm as Trade Tensions and Layoffs Weigh on INTC Stock Performance

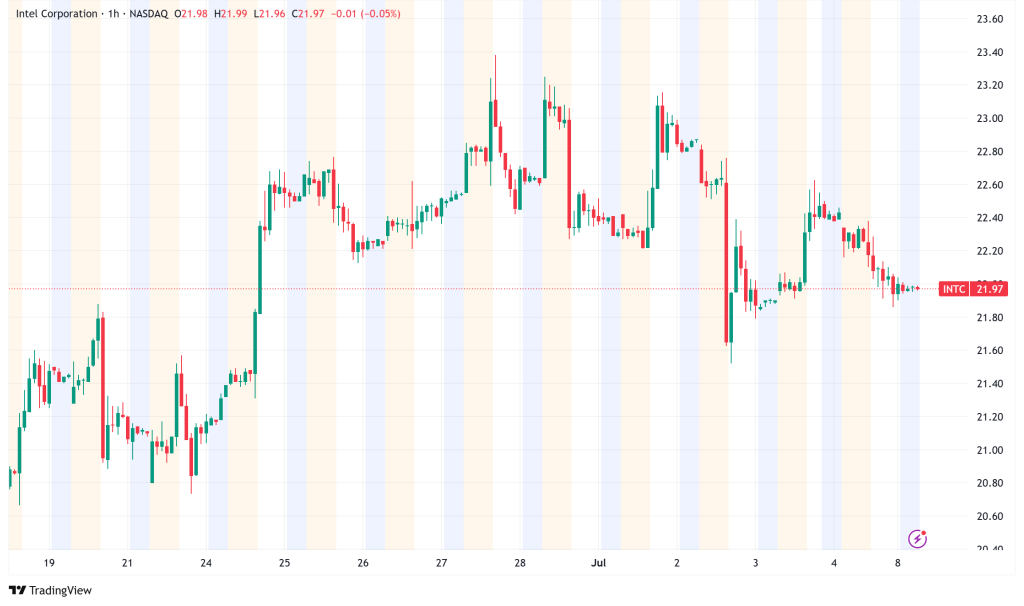

Shares of Intel Corporation (NASDAQ: INTC) fell 2.18% on Monday, ending the day at $22.00. Investors are rethinking the company's short-term

Quick overview

- Intel Corporation's shares fell 2.18% to $22.00 amid concerns over trade tensions and restructuring efforts.

- The U.S. announced 25% tariffs on imports from Japan and South Korea, complicating Intel's global supply chains.

- Controversial layoffs in Israel have sparked internal tensions, with affected workers facing difficult choices regarding severance.

- Analysts maintain a cautious outlook on Intel, with a consensus rating of 'Hold' and a wide range of price targets reflecting uncertainty.

Shares of Intel Corporation (NASDAQ: INTC) fell 2.18% on Monday, ending the day at $22.00. Investors are rethinking the company’s short-term outlook because it is facing a number of problems at the same time. The stock’s performance shows that the market is worried about rising trade tensions and the company’s ongoing restructuring efforts under new management.

Trade War Escalation Hits Semiconductor Sector

The White House’s announcement of broad 25% tariffs on all imports coming from Japan and South Korea, starting August 1, was the main reason for Monday’s drop. After 90 days of negotiations that didn’t lead to a solution, President Donald Trump’s administration called these duties a “moderate” approach to fix “unsustainable trade deficits.”

These tariffs are a big problem for Intel since it has to deal with complicated worldwide supply chains that cross numerous countries. The company relies on parts and materials from Asian suppliers for a lot of its manufacturing and assembly work, which makes it quite sensitive to trade problems.

The administration is apparently getting ready to stop shipments of advanced AI chips to Malaysia and Thailand to keep technology from going to China. This is a worry for the whole sector. These possible export restrictions on high-performance semiconductors make Intel’s data center and AI-focused business areas even less solid.

Controversial Layoffs Spark Internal Tensions

Intel’s efforts to minimize costs have caused a lot of problems in Israel, where the corporation recently let off hundreds of workers. The problematic part of these cuts is that workers who were affected were given an ultimatum: either accept instant termination with a large severance package of up to 19 months’ salary, or contest the decision through a hearing process and risk losing the extra pay.

This method, which is said to be in line with Israeli labor laws, has come under fire for putting workers in an uncomfortable situation. If someone who wants to fight their firing loses, they may only get the legally required severance, which is a big financial risk.

Leadership Transition Draws Mixed Reviews

Jim Cramer and other well-known market observers have talked about Intel’s leadership change. Cramer called incoming CEO Lip Bu-Tan “monster good.” Tan took over on March 18, 2025, and Intel will benefit from his extensive experience in the business during this important time.

Cramer, on the other hand, moderated his excitement by saying that it would take “another six months to a year” for any real change to happen. This timetable shows that investors may need to be patient while Intel’s new management puts its plans into action.

INTC Technical Analysis and Price Targets

Wall Street analysts are still wary about Intel. The consensus rating is still “Hold,” with one Buy, 26 Holds, and four Sells among recent recommendations. This distribution shows that there is a lot of doubt about the company’s future, rather than strong belief in either direction.

Citigroup just boosted its price objective for Intel from $21.00 to $24.00, which is a 14.29% rise, but kept its “Neutral” rating. The average price objective for analysts is $21.24, but some say it may go as high as $28.30 or as low as $14.00. This large range shows how uncertain Intel’s future performance is.

Some other projections provide a more positive outlook, with a fair value estimate of $23.86, which is an 8.88% increase from where we are now. This value takes into account past trading multiples and predictions for how the business will do in the future.

Outlook and Strategic Considerations

Intel’s current dilemma shows how hard it is for established semiconductor businesses to do business in a world that is getting more complicated. The new leadership team has a lot on their plate because of trade concerns, competition in the AI and data center businesses, and the need to run the business more efficiently.

The company’s high value score means that patient investors can see an opportunity in Intel’s current valuation, especially if management can deal with the trade problems and carry out its strategic plans. But the sluggish momentum and growth numbers show that any rebound may take time instead of happening right away.

As CEO Tan leads Intel into the future, it will be very important for the corporation to find a balance between cutting costs and investing in new ideas. Whether Intel can take advantage of its current attractive valuation or keep facing pressure from competition and the economy will largely depend on how well it can balance these two things.

Intel shares ended the day on Monday at $22.00, which is 2.18% lower than the previous session.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account