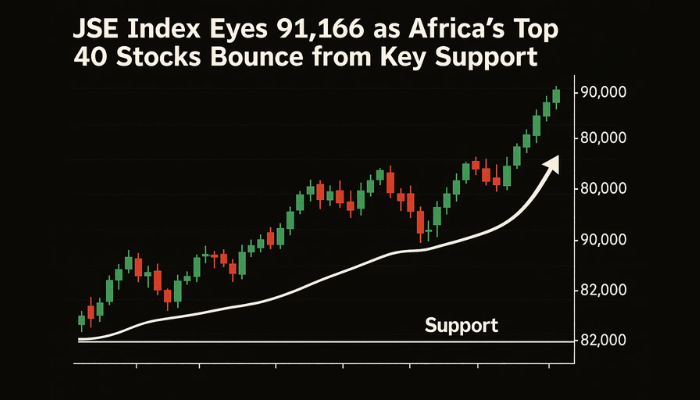

JSE Index Eyes 91,166 as Africa’s Top 40 Stocks Bounce from Key Support

The JSE Top 40 Index is showing some life, bouncing off support at 89,061 and closing at 89,571 on Wednesday. The broader All Share Index...

Quick overview

- The JSE Top 40 Index has shown resilience, bouncing off support at 89,061 and closing at 89,571.

- Despite a lackluster broader market, technical indicators suggest potential for further upside in the JSE Top 40.

- South Africa's economic growth remains stagnant with a GDP increase of only 0.1% in Q1 2025 and high unemployment rates.

- Traders should monitor key support and resistance levels in the JSE Top 40 for potential trading opportunities.

The JSE Top 40 Index is showing some life, bouncing off support at 89,061 and closing at 89,571 on Wednesday. The broader All Share Index gained 226.51 points (0.23%) to 97,482.25 ZAR on Tuesday as investors cautiously dip their toes back into local equities despite global trade tensions.

The broader market has been lacklustre – especially in mining and manufacturing – but the technicals of the JSE Top 40 tell a different story. Bulls defended the mid-channel zone at 89,276, which is also the 50-SMA and previous breakouts. This is now acting as a base for further upside.

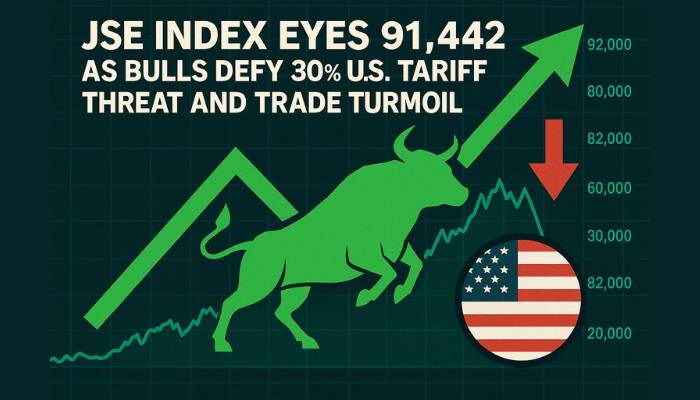

US Tariffs Cloud Export Outlook

The commodity-linked rand is vulnerable especially after President Trump’s announcement of a 50% tariff on copper imports from BRICS countries. Copper is key to EVs and defence tech so this could impact South African exports.

More pressure could come if a new trade deal isn’t finalised before the US deadline of August 1, and an additional 30% tariff kicks in. The rand has held steady but the pressure is building.

Bond markets are cautiously optimistic with the 2035 yield slipping to 9.89%. But volatility could return quickly if trade talks fail or if gold and platinum spot prices continue to decline.

Economic Growth Stagnates Despite Policy Adjustments

Beneath the technical rally is a tough macro environment. South Africa’s GDP grew just 0.1% in Q1 2025 and unemployment is still high at 32.9%. The Reserve Bank cut interest rates to 7.25% to support growth but structural issues remain:

- Mining contracted 4.5% in Q1

- Manufacturing output fell 2.3% due to logistics constraints

- Youth unemployment is above 40%

- Public debt is approaching 80% of GDP

Reform momentum in energy and logistics exists but implementation has been patchy. Until decisive action is taken long term investor confidence will remain fragile.

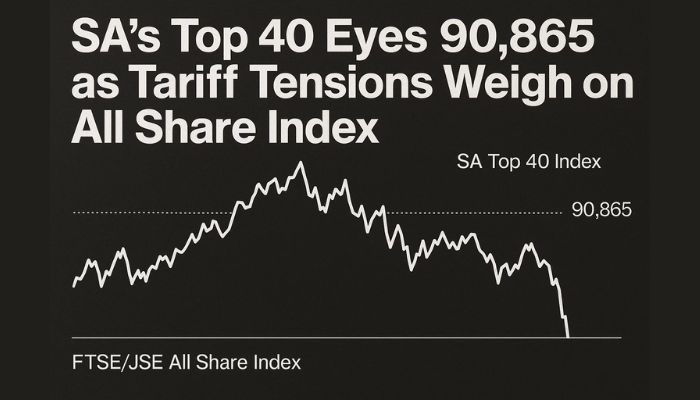

Technical Outlook: Stock Trading Opportunity on JSE

From a trading perspective the JSE Top 40 is still inside a rising channel with bullish structure intact.

- Support: 89,061 (50-SMA), 88,706

- Resistance: 90,168, 90,681

- Target: 91,166

If price bounces above 89,300 traders can look to get long. Watch for bullish engulfing or increased volume for confirmation. Only a close below 88,706 would kill the trade.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account