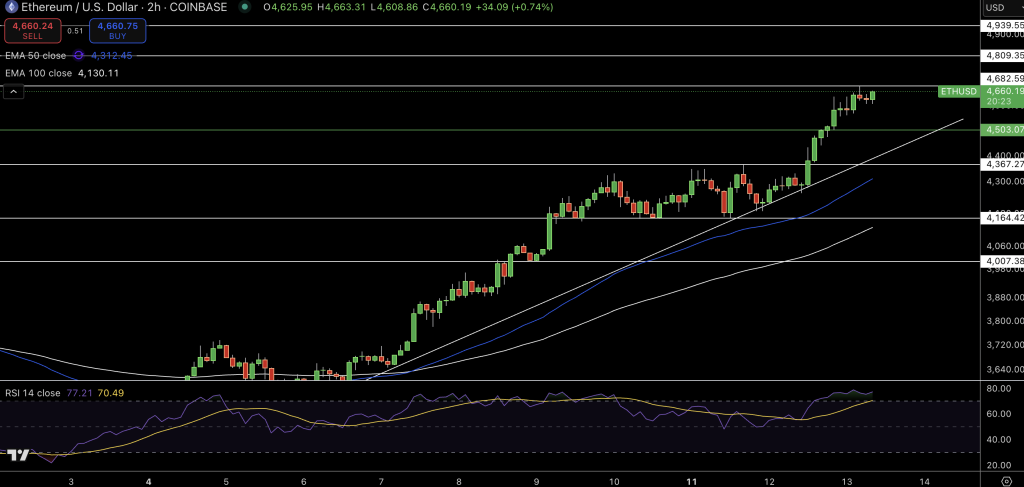

Ethereum Rallies 8.5% to $4,666, Analysts Eye $5,241 as Next Target

Ethereum (ETH) is leading the market, up 8.5% in the last 24 hours to $4,666, a 4 year high. It’s now less than 5%...

Quick overview

- Ethereum (ETH) has surged 8.5% in the last 24 hours, reaching $4,666, just under 5% from its all-time high.

- The broader crypto market is also experiencing gains, with notable increases in Solana, Dogecoin, Cardano, and Chainlink.

- Institutional demand, particularly through Ether ETFs, is significantly driving Ethereum's price momentum, with ETFs buying over 52 times the daily newly issued ETH.

- Analysts predict that Ethereum could reach a resistance level of $5,241, while retail traders are selling as ETH approaches its all-time highs, historically a bullish sign.

Ethereum (ETH) is leading the market, up 8.5% in the last 24 hours to $4,666, a 4 year high. It’s now less than 5% from the all time high of $4,891. Analysts and institutional investors are optimistic.

The rest of the crypto market is joining the party:

Analysts attribute Ethereum’s momentum to a combination of structural factors. Key drivers are the ETH treasury accumulation race, inflows into Ether ETFs and institutional participation. The current strength is market confidence and demand from corporate and high net worth investors vs retail investors who are cautious.

MVRV Bands Suggest $5,241

Technical models suggest Ethereum can go higher. According to crypto analyst Ali Martinez, ETH MVRV bands suggest the next resistance is at $5,241.

Santiment observed that retail traders are selling ETH as it approaches all time highs. Historically this is a bullish sign as retail sentiment goes against the market.

Institutional and corporate buyers are supporting Ethereum’s rise. On August 12, ETH treasury firm Bitmine Technologies announced a $25 billion stock sale to increase its ETH holdings. This reduces selling pressure on the market and allows Ethereum to break past previous highs.

- Spot Ether ETF inflows: $500 million (Aug 12)

- Total BlackRock ETHA holdings: $10.5 billion

- Daily ETH issuance: 2,428 ETH vs 127,403 ETH bought by ETFs

ETFs are buying over 52 times the daily newly issued ETH. That’s how intense the institutional demand is and how much it’s impacting price. Ethereum is leading the crypto rally. Despite other altcoins performing well, ETH is outperforming them, hence the “ETH season”. Analyst Benjamin Cowen noted that TOTAL3 market cap excluding BTC and ETH has gone down relative to ETH, meaning ETH is still in the lead.

Cowen said:

- ALT/ETH pairs will likely underperform in the short term

- ETH/USD will test prior all time highs before a potential September pullback

- Altcoins will gain against USD but lag behind ETH’s dominance

Technical momentum, ETF inflows and strategic corporate acquisitions are all lining up for Ethereum to go higher. Investors and analysts are watching closely to see if ETH will break all time high and trigger renewed interest in both retail and institutional markets.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account