1-Cent Gain for CAD to USD Rate After BOC Inflation Comments

Yesterday bank of Canada held its meeting, which sent the CAD to USD rate 1 cent higher, as USD/CAD fell from 1.35 to 1.35.

Yesterday bank of Canada held its meeting, which sent the CAD to USD rate 1 cent higher, as USD/CAD fell from 1.35 to 1.35. They have stopped raising interest rates, but they’re not announcing the start of the monetary policy easing process yet. They’re basing this decision on underlying inflation, which remains sticky according to them.

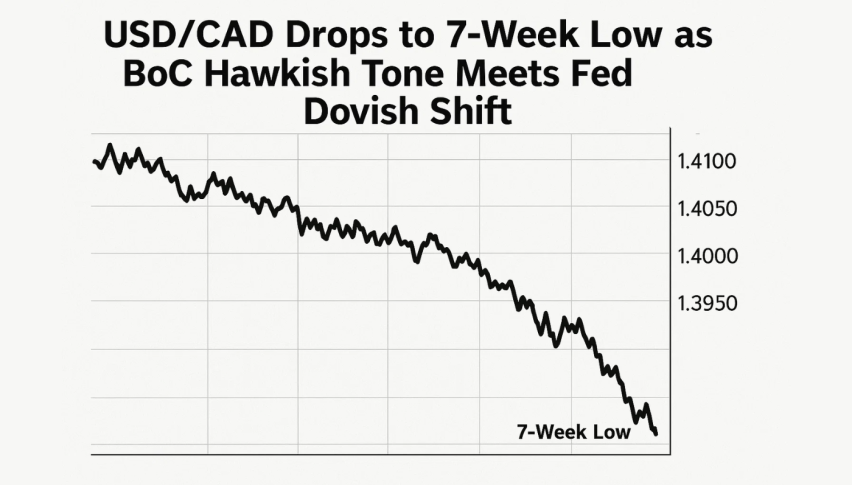

USD/CAD H4 Chart – Moving Averages Acting As Support

The Bank of Canada’s remarks yesterday indicated the significance of shelter price inflation in their decision-making process. They acknowledge that while shelter inflation is a prominent factor that has helped lower inflation, there are additional underlying inflationary pressures beyond this category, which was seen as slightly dovish by the market.

The central bank is closely monitoring the broader spectrum of inflation indicators and is awaiting further evidence of sustained downward pressure in underlying inflation before making decisions. These comments sent USD/CAD diving lower, however the decline stopped right at the 100 SMA (green) on the H4 chart.

Bank of Canada Monetary Policy Decision

- The BOC remains concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation.

- The central bank wants to observe further and sustained easing in core inflation.

- While global economic growth slowed in the fourth quarter, the US economy remained surprisingly robust.

- In Canada, the economy expanded in the fourth quarter by more than anticipated.

- There are indications that wage pressures may be easing.

- Year-over-year and three-month measures of core inflation are in the 3% to 3.5% range.

- The BOC anticipates inflation to remain close to 3% during the first half of this year before gradually moderating.

Highlights from the BOC’s opening statement include:

- Over the six weeks since the previous decision in January, there have been no significant surprises.

- The BOC emphasizes the need to give higher rates more time to have their intended effect.

- It is deemed premature to consider lowering the policy interest rate at this time.

- Future progress on inflation is expected to be gradual and uneven, with upside risks to inflation persisting.

- The BOC aims to avoid maintaining monetary policy in its current restrictive stance for longer than necessary.

- Shelter price inflation is certainly weighing on our decisions

- If we look beyond shelter, we’re seeing underlying inflation persist

- There are other underlying inflationary pressure beyond shelter

- We’re looking for further evidence of sustained downward pressure in underlying inflation

- We will take our April decision in April

- We most likely won’t get 2% inflation this year

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account