Buy USD/CHF Signal, as Sentiment gets CHF to USD Rate Moving

The rate of CHF to USD is starting to display volatility again, as markets try to find a balance between a risk-on and risk-off sentiment.

The rate of CHF to USD is starting to display volatility again, as markets try to find a balance between a risk-on and risk-off sentiment today. Early this morning the price climbed above 0.85 despite a weakening dollar, as risk sentiment remained positive in financial markets, however, we’re seeing a pullback in the US session, which we decided to use as an opportunity to open a buy USD/CHF signal.

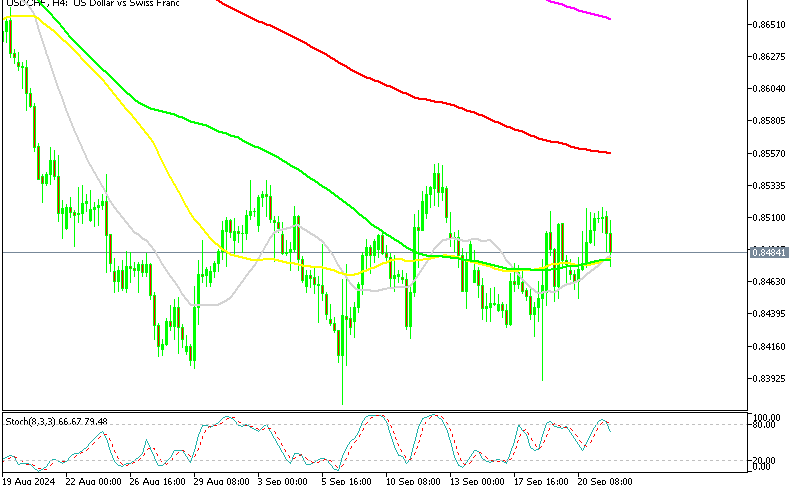

USD/CHF Chart H4 – Bullish Signal as MAs Turn Into Support

As investor confidence in financial markets deteriorated, safe-haven currencies like the Swiss Franc (CHF) saw gains, leading USD/CHF to dip below 0.84. However, as sentiment improved, reflected by a strong rebound in stock markets, USD/CHF started making higher lows since early September. Despite this, the pair has been fluctuating within a narrow one-cent range, keeping the trend unclear. Currently, moving averages are providing support for USD/CHF, suggesting a potential shift toward a bullish trend. Based on this technical setup, we opted to buy the pair at the 100 SMA on the 4-hour chart. Buyers, however, will need to push the price higher to break above the 0.87 handle in order to reinforce the bullish outlook.

Federal Reserve’s Easing Cycle

Last week, the Federal Reserve kicked off its much-anticipated easing cycle, cutting interest rates by 50 basis points. This move was widely expected by the market, so it came as no surprise. The larger rate cut was framed as a precautionary measure, with the Fed’s dot plot suggesting two more 25-bps cuts by the end of the year. This projection was slightly less aggressive than market expectations for 2025. Now that the Fed’s decision has been made, attention will turn to upcoming economic data. If we see signs of economic improvement, Treasury yields could rise, providing further upside momentum for USD/CHF. On the other hand, if economic data deteriorates, concerns over a potential recession could weigh on the dollar, pushing USD/CHF lower.

Swiss National Bank and CHF Outlook

For the Swiss Franc, the Swiss National Bank (SNB) is expected to cut rates by 25 basis points this week, bringing its policy rate down to 1.00%. This decision is likely due to inflation surprising to the downside, with the latest reading showing a drop to 1.1%, well below the SNB’s Q3 forecast of 1.5%. SNB Chairman Thomas Jordan has expressed concern that the Swiss Franc’s appreciation has been hurting the Swiss industrial sector. As a result, there is a high likelihood of a dovish rate cut from the SNB, which could further weaken the CHF and increase the risk of market intervention.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account