Bitcoin Surges Past $89,000 as Trump Victory Catalyzes Historic Rally

Bitcoin (BTC) has rocketed to unprecedented heights, trading at $89,600 as cryptocurrency markets respond enthusiastically to Donald Trump's

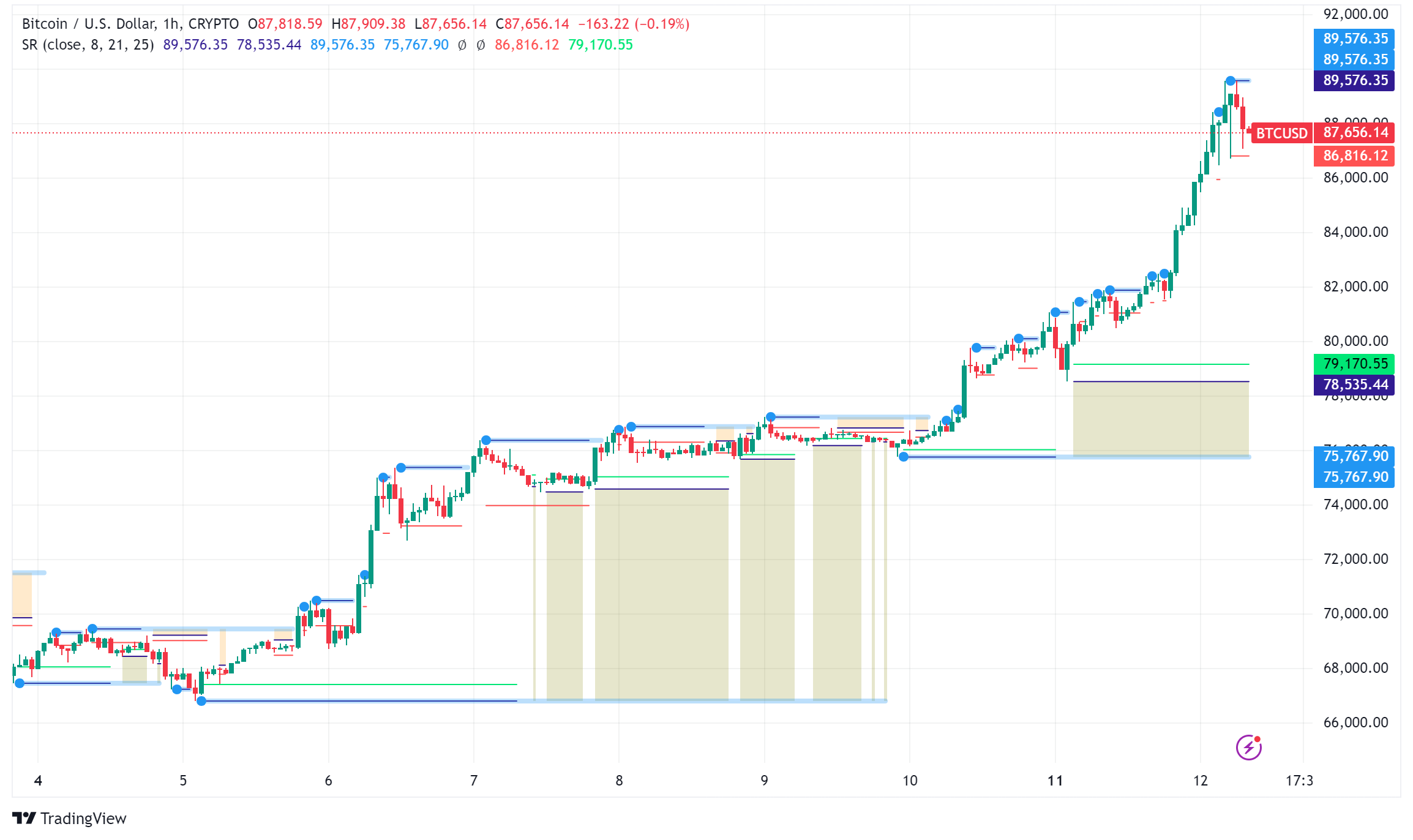

Bitcoin (BTC) has rocketed to unprecedented heights, trading at $89,600 as cryptocurrency markets respond enthusiastically to Donald Trump’s election victory. The flagship cryptocurrency has shattered previous records, gaining over 12% in a single day and pushing the total cryptocurrency market capitalization to a staggering $3.12 trillion.

Breaking New Ground

The dramatic rise has seen Bitcoin break through multiple psychological barriers, surging from $80,000 to nearly $90,000 in just 24 hours. This rapid ascent has been accompanied by extraordinary trading volumes, with Bitcoin-related securities seeing a combined daily trading volume of $38 billion – a phenomenon some analysts have dubbed “Volmageddon.”

“Bitcoin is now in price discovery mode after breaking through all-time highs early last Wednesday morning when it was officially declared that Trump won the election,” said Mike Colonnese, an analyst at H.C. Wainwright. “Strong positive sentiment is likely to persist through the balance of 2024 and [we] see bitcoin prices potentially reaching the six-figure mark by the end of this year.”

BTC/USD Technical Analysis and Price Predictions

Veteran trader Peter Brandt’s analysis, using Bayesian probability, suggests Bitcoin could reach $125,000 by New Year’s Eve 2024. This projection is based on historical patterns and the asset’s tendency to repeat bullish price action trends during markup phases. Other analysts, including Titan of Crypto, have set even more ambitious targets, pointing to a potential $158,000 based on a bullish pennant formation and the completion of a golden cross on weekly charts.

However, traders should note an open CME gap between $77,800 and $80,600, which could present a potential pullback zone. While such gaps often get filled, the current strong bullish momentum might delay any significant retracement.

MicroStrategy Buys More Bitcoin for $2B

In a significant move reflecting institutional confidence, MicroStrategy, led by Michael Saylor, has acquired an additional 27,200 BTC for approximately $2 billion. The company now holds 279,420 BTC, with current profits exceeding $11 billion on their total investment. This aggressive accumulation strategy has helped drive both Bitcoin’s price and MicroStrategy’s stock value, which has surged past its 25-year high.

Market Impact

The ripple effects of Bitcoin’s rally have been felt across the crypto ecosystem:

- Coinbase (COIN) shares surged 19% to trade above $300 for the first time since 2021

- Mining companies like Marathon Digital (MARA) and CleanSpark (CLSK) saw gains exceeding 29%

- The total cryptocurrency market cap is now approaching France’s GDP, making it equivalent to the world’s eighth-largest economy

- Ethereum and other major altcoins have also seen significant gains, with Dogecoin notably rising 38%

Regulatory Outlook

The market’s explosive growth comes amid expectations of a more crypto-friendly regulatory environment under the Trump administration. Matt Hougan, chief investment officer of Bitwise Asset Management, noted, “We’re now in a positive regulatory environment, we now have tailwinds from that, and that comes in the case of a market that was already in a bull market … that’s going to push us higher.”

Looking Ahead

As Bitcoin approaches the psychologically significant $90,000 level, many analysts believe this rally is just beginning. The combination of institutional buying, positive regulatory outlook, and technical momentum suggests continued strength in the market. However, investors should remain mindful of potential volatility and the historical tendency for sharp corrections following such dramatic price increases.

With Bitcoin’s market capitalization now exceeding $1.7 trillion – larger than Spain’s GDP – the cryptocurrency has cemented its position as a major financial asset class, drawing increased attention from both institutional and retail investors worldwide.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account