USD/JPY and Nikkei Shoot Higher After Dovish BOJ

Nikkei and the Yen are Seeing wild swings amid trade talks, safe haven flows, and policy steadiness from Bank of Japan.

Quick overview

- Japan's financial markets have experienced significant volatility in 2025, with the Nikkei 225 index dropping over 30% amid global risk aversion.

- The Japanese yen has strengthened as a safe haven asset, finding support below the 140 level against the USD despite fluctuations.

- Recent comments from US President Trump regarding trade negotiations have sparked optimism, contributing to a recovery in the Nikkei 225.

- The Bank of Japan maintained its interest rate at 0.50%, signaling a cautious approach amid ongoing economic uncertainties and subdued inflation forecasts.

Nikkei and the Yen are Seeing wild swings amid trade talks, safe haven flows, and policy steadiness from Bank of Japan.

Market Volatility Returns to Japan

The first four months of 2025 have extended the volatility that gripped global financial markets since mid-2024. Japan, in particular, has experienced dramatic fluctuations both in its stock market and currency. The Nikkei 225, Japan’s benchmark equity index, plunged by over 15,000 points from its summer highs—a drop exceeding 30%—as risk aversion intensified globally. Much of this shift stemmed from heightened geopolitical risks and persistent trade uncertainty, which drove investors into safer assets and away from equities.

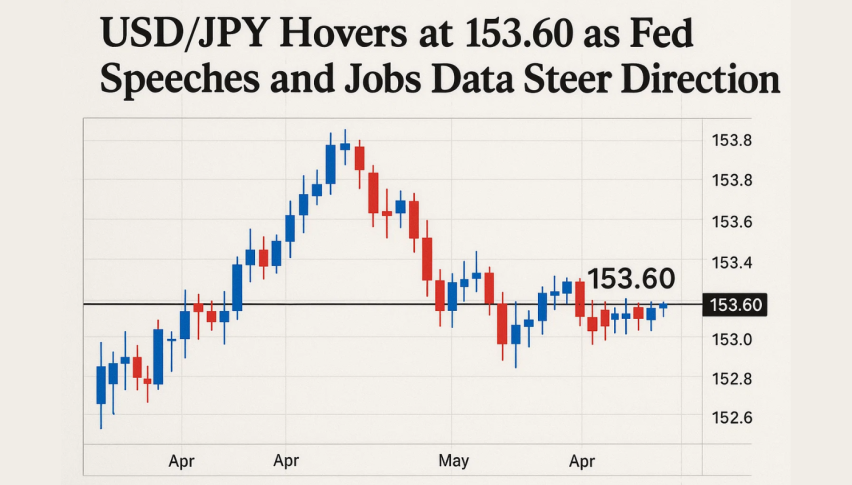

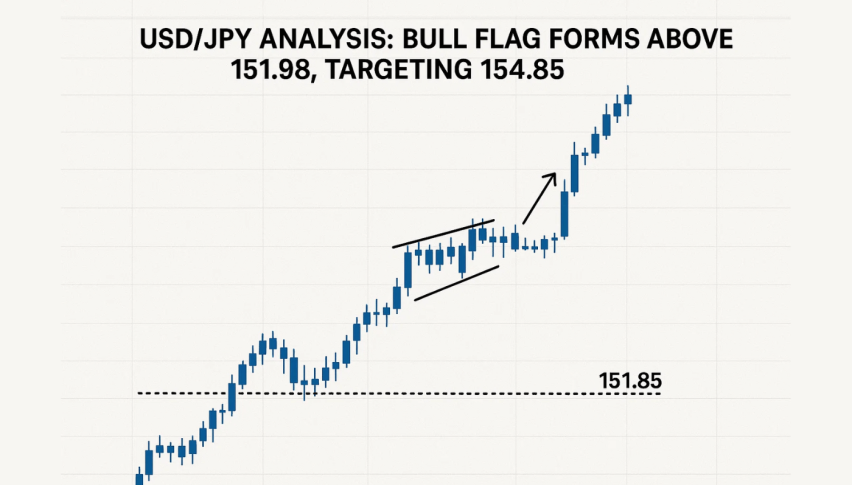

Yen Strengthens as Safe Haven but Support Below 140 Holds

In currency markets, the Japanese yen benefited from this defensive shift in sentiment. The USD/JPY pair initially fell below the 140 level by September 2024, a zone that has historically provided technical support. After rebounding more than 20 cents from that floor, the pair once again dipped below 140 earlier this year, reflecting renewed demand for the yen amid further USD softness and fragile risk sentiment. Last week, the pair found firm support around this same level, aided by the long-term 100-month simple moving average (SMA), before staging a rebound of nearly 4 cents.

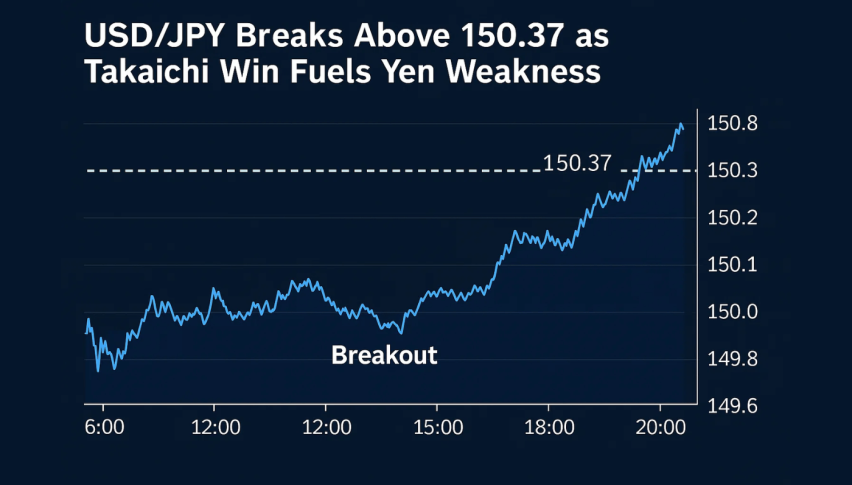

Trump Sparks Trade Optimism

A turning point in market sentiment came with US President Donald Trump’s recent remarks suggesting tangible progress in trade negotiations with Japan. Hints at a forthcoming trade deal have renewed optimism in financial markets, lifting both investor morale and asset prices in Tokyo. The Nikkei 225 responded to these developments by staging a strong recovery.

Nikkei Recovers on Policy Stability and Trade Hopes

After falling sharply in early February, the Nikkei 225 found solid support at the 200-week SMA around the 30,000-point threshold—a level that also acted as a floor during the August 2024 flash crash. Since then, the index has gained nearly 6,000 points, equivalent to a roughly 20% rise, buoyed by easing trade rhetoric and hopes for a more constructive US-Japan economic relationship.

BOJ Holds Steady

Earlier today, the Bank of Japan concluded its latest policy meeting with no surprises, holding interest rates at 0.50% as widely anticipated. The central bank’s cautious stance reflects ongoing uncertainty in the global economy, even as Japan continues to see stable growth and persistent inflation above the 2% target.

Bank of Japan May 1 Monetary Policy Meeting

- The Bank of Japan (BoJ) left its short-term policy interest rate unchanged at 0.50%, in line with market expectations during its May 1 monetary policy meeting.

- The BoJ emphasized it will raise rates further only if the economy and inflation evolve in line with projections.

- Core CPI forecast for fiscal 2025 was revised down to +2.2% (from +2.4% in January), and for 2026 to +1.7% (from +2.0%).

- Fiscal 2027 core CPI forecast came in at +1.9%.

- Core-core CPI (excluding fresh food and energy) showed a mixed revision:

- Fiscal 2025 was revised up to +2.3% (from +2.1%)

- Fiscal 2026 down to +1.8% (from +2.1%)

- Fiscal 2027 forecasted at +2.0%

- The BoJ report signals ongoing monetary support, noting that real interest rates remain deeply negative, and the economic recovery is moderate but uneven.

- Policymakers warned that risks to both the economic and inflation outlook remain tilted to the downside, with high levels of uncertainty.

- The bank reiterated its commitment to closely monitor FX and financial markets, considering their potential effects on the economy and price trends.

The Bank of Japan remains cautiously optimistic but non-committal on tightening, maintaining a wait-and-see stance amid subdued inflation projections and lingering economic uncertainties. While acknowledging potential for gradual tightening, the BoJ signaled it won’t act hastily unless data firmly supports a sustained 2% inflation path.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account