XRP Price Surges 20% in 7 Days as Open Interest Hits $3.42B: What’s Driving It?

XRP jumps 20% with open interest soaring to $3.42B. Explore what’s powering this rally—from ETF inflows to bullish momentum.

Quick overview

XRP has had an impressive week. The price has surged by 20% over the past seven days, climbing to around $2.60. That’s a strong move even in crypto terms.

For comparison, the broader cryptocurrency market rose 13% during the same period. What’s behind XRP’s breakout? A combination of rising futures market activity, strong technical signals, and growing excitement around an XRP exchange-traded fund (ETF).

Open Interest Tells the Real Story

Open interest in XRP futures—basically, the total amount of open contracts in the market—has grown by $1 billion in a single week. According to Glassnode data from May 13, it jumped from $2.42 billion to $3.42 billion, up 41.6%.

When price and open interest both go up, it usually means new money is entering the market—a bullish sign. That tells us traders are betting on more gains ahead, not just closing old positions.

ETF Inflows Fuel Confidence

Another big driver is institutional demand. The XXRP ETF, which gives big investors exposure to XRP, brought in $14 million last week. That’s up from $10 million the week before. Now the fund holds over $99 million in assets. Even with a relatively high 1.89% management fee, investors are buying in.

Some believe this trend is building toward the launch of a fully approved spot XRP ETF. In fact, prediction markets like Polymarket now estimate an 80% chance of that happening.

JPMorgan even projects that a spot XRP ETF could attract $8 billion in its first year.

XRP/USD Technical Analysis; Key Levels to Watch

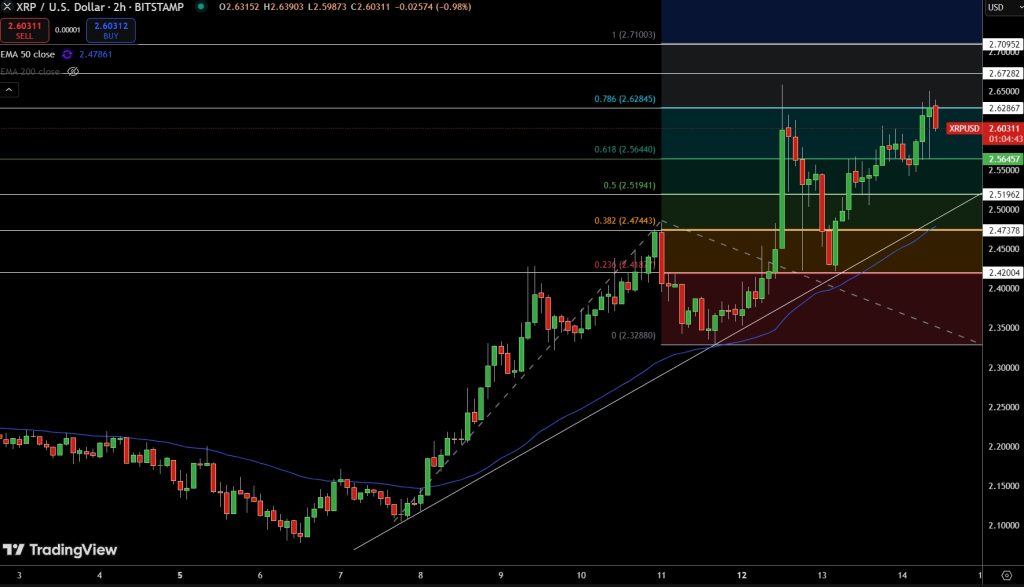

From a chart perspective, XRP/USD is holding up well. After bouncing off support around $2.42, it’s back above the 50-period exponential moving average (EMA), currently at $2.47. That’s a key sign that buyers are in control.

The price also reclaimed the 61.8% Fibonacci retracement level at $2.56, another bullish signal. Now, if XRP breaks above $2.63, it could make a run toward $2.71.

However, if the price drops below $2.56 again, it might revisit the $2.47 or even $2.42 support levels. Momentum, measured by the MACD indicator, is still positive but starting to flatten. That could mean we see a pause before another move higher.

Trade Idea

- Buy Zone: $2.55 to $2.58

- Target 1: $2.63

- Target 2: $2.71

- Stop Loss: Below $2.47

This setup gives you a chance to ride the trend without taking too much risk. Just make sure to set your stop-loss and watch for volume and momentum to confirm your entry. If XRP breaks past $2.63 with strong buying, it could be the start of another leg up.

Conclusion

Between the $1 billion spike in futures, rising ETF interest, and a strong technical setup, XRP is gaining attention for good reason. Whether you’re new to crypto or just watching for a smart entry, this rally might offer a solid opportunity—as long as you manage risk carefully.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account