Gold Price Rebounds to $3,332 as Dollar Weakens and Ceasefire Holds Firm

Gold edged higher midweek, climbing to $3,332 per ounce, as a weaker U.S. dollar and cooling Treasury yields reignited demand...

Quick overview

- Gold prices rose to $3,332 per ounce due to a weaker U.S. dollar and lower Treasury yields, boosting demand for the metal.

- A ceasefire between Israel and Iran has improved market sentiment, although geopolitical uncertainties remain.

- Central banks are expected to increase gold holdings, with one in three planning to do so over the next 1-2 years.

- Technical analysis indicates a bearish bias for gold, with key resistance and support levels identified for traders.

Gold edged higher midweek, climbing to $3,332 per ounce, as a weaker U.S. dollar and cooling Treasury yields reignited demand for the yellow metal. The U.S. Dollar Index (DXY) hovered near a one-week low, while benchmark 10-year Treasury yields remained subdued at their lowest in over a month. This combination helped restore appeal to non-yielding assets like gold, particularly for international buyers.

Geopolitical relief also contributed to gold’s mild rally. A U.S.-brokered ceasefire between Israel and Iran appeared to be holding, with no fresh cross-border escalations reported. Former President Donald Trump’s involvement in brokering the truce has offered markets a temporary calm, improving risk sentiment without fully eliminating uncertainty.

Adding to gold’s bullish undercurrent, U.S. consumer confidence weakened unexpectedly in June, with labor market anxiety rising amid the specter of trade-related inflation. Fed Chair Jerome Powell, in his congressional testimony, acknowledged that higher tariffs could fuel inflation this summer—an environment that often favors safe-haven assets.

Central Banks and Fed Policy Underpin Outlook

Global central banks continue to play a quiet but powerful role in shaping gold’s trajectory. A recent survey by the Official Monetary and Financial Institutions Forum revealed that one in three central banks managing $5 trillion in assets plans to increase gold holdings over the next 1–2 years—the highest ratio in at least five years.

Meanwhile, traders are increasingly pricing in U.S. rate cuts. Fed funds futures now reflect 60 basis points of easing expected in 2025, with the first cut likely arriving by September. Lower interest rates typically weaken the dollar and bolster gold.

Key drivers supporting gold sentiment:

- Israel-Iran ceasefire still holding

- U.S. dollar and yields remain under pressure

- Fed leaning dovish amid tariff-led inflation fears

- Central banks increasing gold allocations

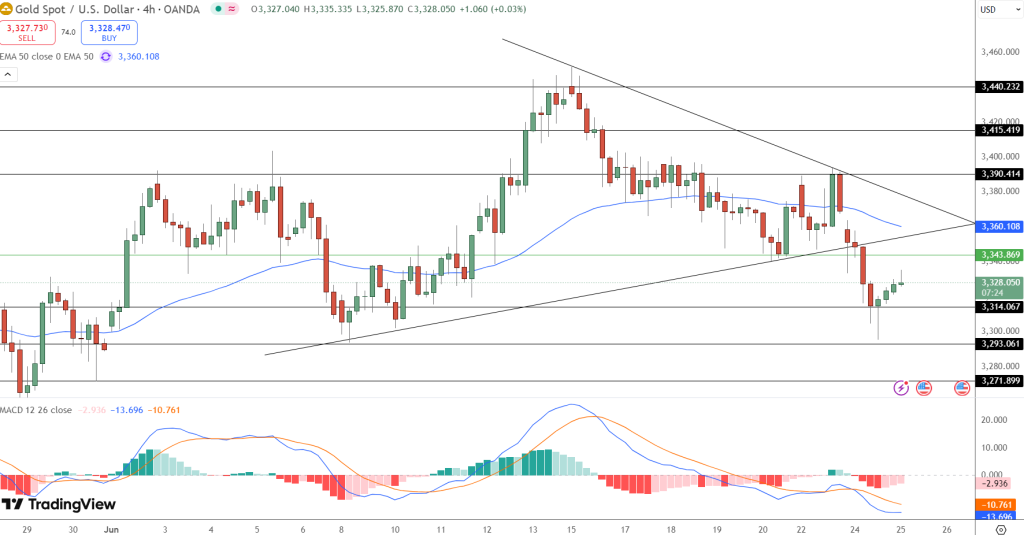

Gold Technical Picture: Bearish Bias but Cautious Rebound

On the 4-hour chart, gold recently broke down from a symmetrical triangle, slipping below the 50-period EMA ($3,358), which now acts as resistance. The bearish move was met with modest demand near $3,314—just above horizontal support at $3,293.

Although MACD remains in bearish territory, recent candles show long lower wicks, indicating buying pressure below $3,320. Still, no reversal patterns like a hammer or bullish engulfing have confirmed a change in trend.

Levels to watch:

- Resistance: $3,343, $3,358 (EMA), $3,390–$3,415

- Support: $3,314, $3,293, $3,271

Trade Setup Ideas:

- Bearish: Failure at $3,343 with bearish candle → Target $3,293–$3,271

- Bullish: Breakout above $3,358 with volume → Target $3,390–$3,415

- Stop-Loss Zones: Above $3,358 for shorts; below $3,293 for longs

Unless gold reclaims the 50-EMA, the broader bias leans bearish. Traders should await confirmation before taking sides, especially in this post-ceasefire but still fragile environment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account