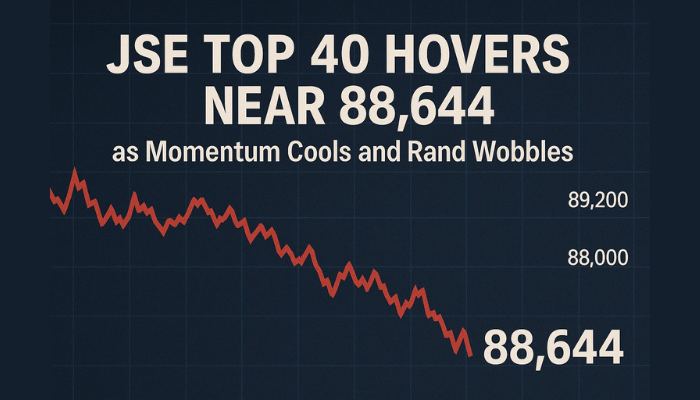

JSE Top 40 Hovers Near 88,644 as Momentum Cools and Rand Wobbles

The JSE Top 40 Index (SA40) is holding near 88,644, bouncing from trendline support within a rising channel that’s been in place since...

Quick overview

- The JSE Top 40 Index is currently near 88,644, supported by a rising channel but facing limited upside due to mixed pressures.

- The South African rand has weakened to R17.65/USD as markets await crucial inflation and labor data.

- Technical indicators show signs of bearish divergence in the SA40, suggesting fading momentum despite recent price increases.

- Several macroeconomic risks, including U.S.-SA trade talks and local disruptions, may further limit the SA40's upside potential.

The JSE Top 40 Index (SA40) is holding near 88,644, bouncing from trendline support within a rising channel that’s been in place since mid-June. Despite staying above the 50-period EMA at 88,372, the upside remains limited as traders digest a mix of local and global pressures.

The South African rand weakened by 0.3%, sliding to R17.65/USD, as markets await local inflation expectations data and key U.S. labor figures. The Bureau for Economic Research’s inflation survey, due shortly, is expected to guide the South African Reserve Bank’s (SARB) next policy move, especially with SARB’s mandate under review.

Bond markets reflect cautious optimism. The 2035 government bond yield eased 1.5 basis points to 9.84%, but risk sentiment remains fragile ahead of the July 9 trade deadline with the U.S. South Africa is pushing for revised tariff terms after the U.S. slapped a 31% duty on select imports in April.

SA40 Technical Outlook: Bearish Divergence Emerges

Technically, the SA40 remains in an upward channel, but signs of fatigue are surfacing. The MACD histogram has turned negative, and the signal lines have crossed bearishly—suggesting momentum is fading. Despite recent higher highs in price, the MACD failed to confirm, creating a bearish divergence.

Recent candles near the 89,500 level feature long upper wicks—hinting at profit-taking or supply pressure. The 88,350–88,400 zone is now the key line in the sand. A sustained hold above this area is needed to preserve the bullish structure.

Key Technical Levels:

- Support: 88,372 (EMA), 88,347 (horizontal), 87,692

- Resistance: 89,573 → 90,246 → 90,865

- Bias: Bullish above 88,350, but momentum is weakening

Trade Setups:

Bullish:

- Entry: Above 88,350 on strong bullish candles

- Targets: 89,573 and 90,246

- Stop: Below 88,000

Bearish:

- Entry: Below 88,000 with MACD confirmation

- Targets: 87,692 and 87,053

- Stop: Above 88,500

Economic Risks May Limit SA40 Upside

Several macro and geopolitical risks are creating headwinds:

- U.S.–SA Trade Talks: The July 9 deadline could trigger new tariffs if negotiations stall.

- Monetary Policy Uncertainty: SARB’s inflation target review and the Fed’s rate path remain key drivers.

- Global Data: U.S. ADP and NFP reports this week could shift capital flows and risk appetite.

- Local Disruptions: Recent delays at OR Tambo International Airport are impacting logistics and pressuring the tourism and retail sectors.

Conclusion:

While the SA40 index remains technically constructive, the loss of momentum and external risks are starting to weigh. Traders should watch for a confirmed break above 89,573 for renewed bullish conviction—or a fall below 88,000 to trigger a possible trend reversal. Agility and clear risk levels are key in this environment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account