Gold Price Holds $3,334 As Tariff Tensions Rise and Fed Minutes Loom Wednesday

Gold prices remained steady on Tuesday, trading near $3,334 per ounce, as investors weighed safe-haven demand sparked by renewed...

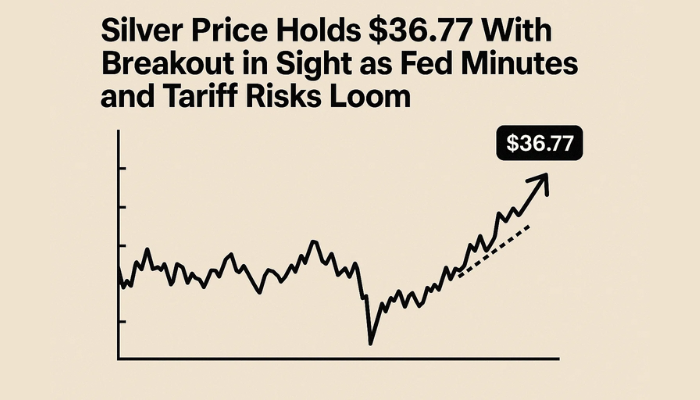

Quick overview

- Gold prices are steady around $3,334 per ounce as investors react to U.S. trade threats and rising Treasury yields.

- Former President Trump's proposed tariffs could complicate the inflation outlook and increase import prices.

- The market is currently consolidating, with a symmetrical triangle pattern indicating a potential breakout.

- Upcoming Federal Reserve minutes may provide crucial insights into future rate paths and impact gold's momentum.

Gold prices remained steady on Tuesday, trading near $3,334 per ounce, as investors weighed safe-haven demand sparked by renewed U.S. trade threats against rising U.S. Treasury yields. Spot gold dipped just 0.1% in early Asian trading, while U.S. gold futures held firm at $3,341.80.

The tug-of-war stems from former President Donald Trump’s fresh tariff push, with his administration preparing to raise import duties on countries like Japan and South Korea. Under his new “reciprocal tariffs” plan, goods from key U.S. trading partners face a 25% levy starting August 1. While deals have been reached with Britain and Vietnam, others remain in limbo ahead of the July 9 negotiation deadline.

“Markets aren’t panicking yet,” said Tim Waterer, Chief Market Analyst at KCM Trade. “Safe-haven flows are modest, and without a major geopolitical escalation, gold is simply consolidating—waiting for a decisive move.”

At the same time, rising U.S. 10-year bond yields—which hovered near a two-week high—are limiting gold’s upside. As yields climb, the opportunity cost of holding non-yielding bullion increases, making gold less attractive in the short term.

Fed Minutes and Inflation Risks Ahead

Adding another layer of uncertainty is the Federal Reserve’s upcoming June policy meeting minutes, due Wednesday. Investors are eyeing for clues about the Fed’s rate path, especially as inflation risks remain elevated.

Trump’s proposed tariffs could complicate the inflation outlook by pushing up import prices. China has already issued warnings, suggesting it may retaliate if the U.S. reintroduces tariffs next month. This sets the stage for renewed global trade friction, just as markets had begun to price in calmer macro conditions.

With rising bond yields, muted safe-haven demand, and mixed global signals, gold is holding its ground but lacks momentum. The Fed’s commentary could be the next major catalyst—especially if it tilts hawkish, reinforcing higher-for-longer rates that would weigh on bullion.

Triangle Pattern Points to Potential Breakout

From a technical perspective, gold (XAU/USD) is coiling within a symmetrical triangle pattern on the 4-hour chart—often a precursor to volatility. The current price sits around $3,334, neatly trapped between a downward sloping resistance near $3,344 and rising trendline support at $3,321.

- Key levels to watch:

- Breakout above $3,344 → Targets $3,366 and $3,390

- Breakdown below $3,321 → Opens room toward $3,297 and $3,275

- 50-SMA at $3,323 → Dynamic support

- RSI at 52.18 → Neutral-to-bullish zone

A clear break on either side, especially with volume, could define the next leg for gold traders. Until then, consolidation will likely continue as the market absorbs tariff developments and central bank signals.

Summary:

Gold (XAU/USD) is holding its ground near $3,334 as Trump’s tariff threats and rising bond yields offset each other. A symmetrical triangle on the chart signals a breakout may be on the horizon, with Fed minutes likely to tip the balance.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account