Forex Signals Brief July 9: Interest Rates, Tariffs and Record Copper Rally Shape Markets

Markets were busy yesterday with the RBA decision to hold rates steady and RBNZ following the same path today, despite soring prices for...

Quick overview

- The RBA held its cash rate steady, surprising traders who expected a cut, leading to volatility in the AUDUSD currency pair.

- President Trump announced new tariffs, including a surprising 50% tariff on copper imports, causing copper prices to surge to record highs.

- US stock indices closed mixed amid trade tensions, with the Dow and S&P 500 declining while the Russell 2000 showed resilience.

- Cryptocurrency markets experienced significant volatility, with Bitcoin rebounding after dipping below $100,000, while Ethereum outperformed due to strong institutional support.

Markets were busy yesterday with the RBA decision to hold rates steady and RBNZ following the same path today, despite soring prices for consumers.

Currency Market Moves React to RBA Decision

The AUDUSD was the standout mover in FX trading after the Reserve Bank of Australia surprised markets by holding its cash rate steady. Traders had largely priced in a 25 basis point cut, which would have supported the Australian dollar. Instead, the hold left the currency volatile as markets reassessed the policy outlook.

Meanwhile, the EURUSD climbed earlier in the day but reversed during the US session as it ran into firm selling interest at its 100-hour moving average.

Tariff Announcements Spark Commodity Chaos

Tariff news dominated headlines as President Trump announced plans to send letters over the coming days to an additional 15 to 20 countries detailing new tariff levels. Among sector-specific moves, pharmaceuticals will face tariff increases of up to 100% or more over time.

Perhaps most dramatically, Trump declared a 50% tariff on copper imports—a surprise policy shift that sent ripples through the commodities market. Intraday copper prices rocketed to their highest since 1989, with front-month contracts closing up 13.3% at $5.645 a pound, breaking the all-time record. This marks the largest single-day percentage gain ever recorded for the metal, highlighting just how sensitive supply projections have become to trade policy headlines.

US Stock Indices Close Mixed Amid Trade Tensions

US equity markets ended the day with limited direction overall. The Dow Jones Industrial Average slipped -0.37%, reflecting concerns over the new tariff threats and their impact on corporate costs. The S&P 500 also edged lower by -0.7%, while the NASDAQ managed a small gain of +0.03%. Notably, the Russell 2000 outperformed with a +0.66% rise, suggesting some underlying appetite for riskier small-cap names even amid trade uncertainty.

Today’s Market Events

Monetary Policy Updates from the RBNZ

At its meeting today, the Reserve Bank of New Zealand held its official cash rate steady at 3.25%, maintaining its cautious, data-dependent stance. Westpac analysts noted the central bank is unlikely to give clear guidance on the timing of future rate cuts, leaving market expectations hinged on upcoming economic data ahead of the August meeting.

Markets remain split on whether the RBNZ will reduce rates to 3.00% as early as August or hold out longer given inflation risks and global growth concerns.

US Labor Market: Slow Cooling Signals

Jobless claims data in the United States continue to show a labor market cooling at a measured pace. Initial claims remain historically low, with a four-week average of 242,000—still tight but up 2% year-over-year. However, the median duration of unemployment has ticked up to 10 weeks, signaling it’s taking longer for jobseekers to find new positions.

Wells Fargo analysts warn that while layoffs remain modest for now, any sharp increase in claims would be an early signal of deeper economic troubles ahead, particularly as rising trade costs could hit corporate margins and demand.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD jumping above 1.18 but returned back below it, while S&P and Nasdaq retreated yesterday, but Dow Jones kept pushing higher. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

Gold Breaks Below the 50 SMA

Gold remains in a precarious technical position despite its spectacular April run to record highs around $3,500 per ounce. After breaking decisively below its 50-day simple moving average—a support level for nearly a year—traders have shifted their focus to the 100-day SMA near $3,150 as the next key floor. Buying interest has thinned out this week, underscoring the risk of further declines.

Yen Slides as Yield Chasing Intensifies

Meanwhile, USD/JPY volatility persisted earlier this week, with the pair surging from 143.40 to 148 as yield differentials and capital outflows from Japan weighed on the yen. However, the rally ran into stiff resistance near its 100-week simple moving average, reinforcing that a sustained breakout may require a more significant shift in investor risk appetite or monetary policy outlook.

USD/JPY – Weekly Chart

Cryptocurrency Update

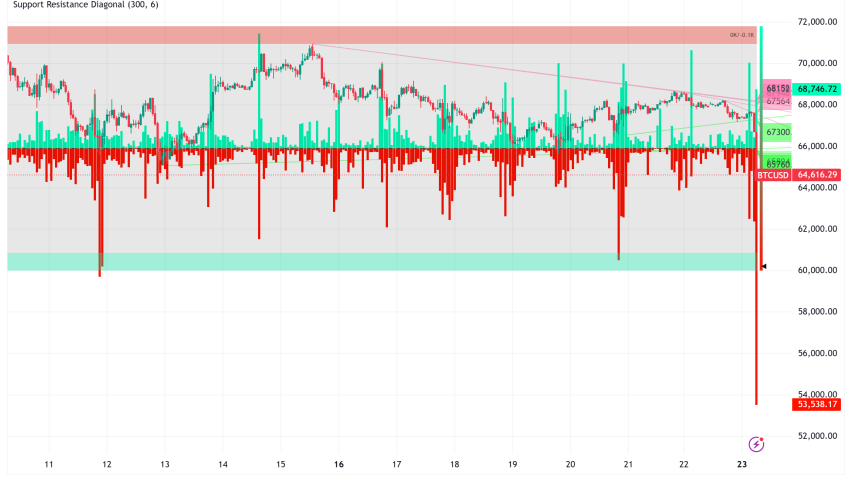

Crypto Markets See Wild Swings

Cryptocurrency markets mirrored broader financial volatility. Bitcoin faced selling pressure earlier in the week, breaking below its 50-day moving average and briefly plunging below the $100,000 mark for the first time since early May. Yet longer-term investors quickly stepped in around the 20-week simple moving average, sparking a sharp $10,000 rebound that by week’s end had Bitcoin trading back toward $108,000. This critical support zone once again proved vital in maintaining confidence among dedicated holders.

BTC/USD – Weekly chart

Ethereum Outpaces Bitcoin on Institutional Support

Ethereum, meanwhile, has been even stronger. It is up more than 20% since April, consistently outperforming Bitcoin in recent weeks. Much of that momentum has been driven by a resurgence of institutional buying and mounting anticipation for its next Pectra upgrade, which is expected to further strengthen Ethereum’s role in the blockchain ecosystem.

Technically, ETH is now testing its 200-day moving average, a crucial level for traders. A decisive break above this threshold would open the door to the $4,000 zone, potentially cementing Ethereum’s lead over Bitcoin through the summer and reinforcing its appeal to investors seeking blockchain exposure.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM