Silver Price Prediction: XAG Tightens in Triangle, Breakout Looms at $36.65

Silver (XAG/USD) held steady on Thursday as gold remained resilient in the face of fresh trade tensions and a weakening U.S. dollar.

Quick overview

- Silver (XAG/USD) remained stable as gold showed resilience amid trade tensions and a weakening U.S. dollar.

- The U.S. dollar index fell 0.2%, making silver more attractive due to lower yields, despite it lagging behind gold's performance.

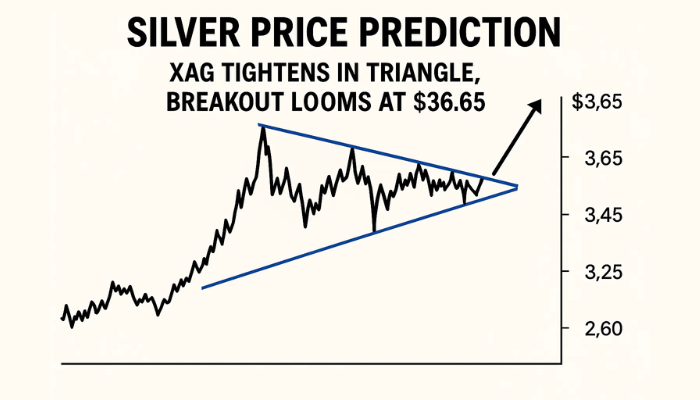

- Silver is currently within a symmetrical triangle pattern, with key resistance at $36.65 and support at $36.29.

- Traders are advised to watch for breakout opportunities, with bullish setups above $36.65 and bearish setups below $36.29.

Silver (XAG/USD) held steady on Thursday as gold remained resilient in the face of fresh trade tensions and a weakening U.S. dollar. As President Trump ups the ante on tariffs across multiple trade partners, including a 50% duty on U.S. copper imports and broader tariffs on Brazil, traders are reevaluating safe-haven assets. While gold is leading the charge, silver’s ties to both precious metals and industrial demand put it at a crossroads.

Adding fuel to the fire, the U.S. dollar index (DXY) fell 0.2% and 10-year Treasury yields backed off recent highs. Lower yields make silver, like gold, a more attractive option since it doesn’t yield interest. The Fed’s June meeting minutes showed only “a couple” of officials supported near-term rate cuts, with most waiting for clearer inflation data—largely driven by tariff uncertainty.

This combination of geopolitical risk, dollar weakness and falling yields has historically favored silver. But while the macro drivers are in place, silver hasn’t followed gold’s full move—creating an asymmetric opportunity.

Symmetrical Triangle Hints at Breakout Setup

Silver is still contained within a symmetrical triangle on the 1-hour chart. Price is testing the top of the triangle near $36.65, while the 50-SMA is short-term resistance at $36.57. RSI is 49, neutral but with room to go bullish.

The ascending trendline support at $36.29 has held multiple times and is a level to watch. A strong close above $36.65 could see price move up to $37.07, while a break below $36.29 could see a move down to $35.81.

Trade Levels and Forecast

- Support: $36.29, $36.15, $35.99

- Resistance: $36.65, $36.86, $37.07

- Breakout Target (Upside): $37.07

- Breakout Target (Downside): $35.81

Trade Idea: Breakout Anticipation Play

- Bullish Setup: Entry above $36.65 with volume confirmation

- Stop: Below $36.29

- Target: $36.86, $37.07

- Bearish Setup: Entry below $36.29 with strong selling momentum* Stop: $36.57

- Target: $36.15, $35.81

Silver Playing Catch-Up

Gold has reacted quickly to Trump’s tariff escalation and Fed indecision, but silver is lagging behind—but often does. With technical compression and fundamental factors building, silver may be gearing up for a breakout that matches gold’s move. Watch for price confirmation as Fed speak and trade headlines continue to whip up volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account