South African Rand Forecast: USD/ZAR Eyes R17 as R18 Barrier Holds Firm Despite Global Headwinds

After showing signs of fatigue earlier in July, the South African rand is back on the powerful Q2 run, and might will head to R17 if...

Quick overview

- The South African rand has shown signs of recovery in Q2 but faces potential downward pressure if support levels break.

- Despite a strong performance earlier in the quarter, political tensions and tariff announcements have capped the rand's momentum.

- Traders are cautious as they monitor the USD/ZAR pair, particularly with upcoming economic data releases that could influence the rand's direction.

- The rand's value remains closely tied to commodity prices, with potential tariffs on exports posing additional risks.

After showing signs of fatigue earlier in July, the South African rand is back on the powerful Q2 run, and might will head to R17 if the support breaks.

Support Holds, But Momentum Slows

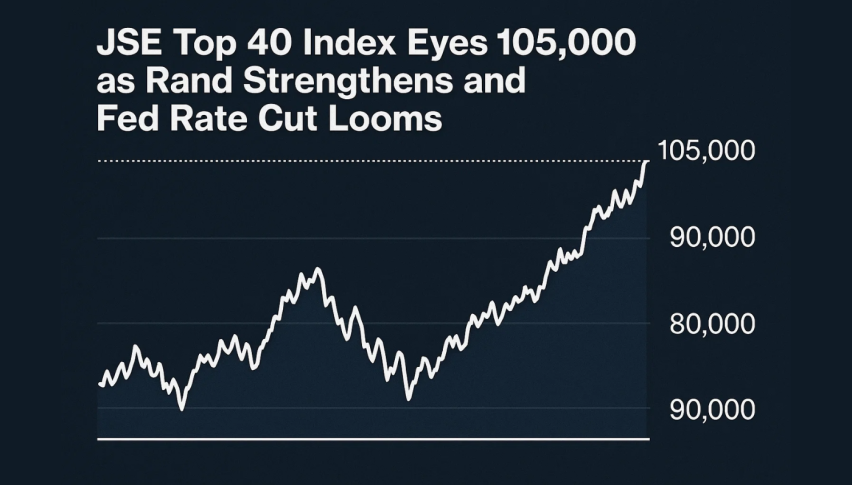

The South African rand (ZAR) found support at the 200-week Simple Moving Average (SMA) earlier this month but struggled to regain upward momentum amid a broader rebound in the US dollar. The USD/ZAR pair, which had dropped sharply from R20 to under R17.50 between April and early July, saw a mild reversal last week, briefly approaching the R18.00 resistance level before retreating once more.

Despite dovish comments from several Federal Reserve members hinting at possible US rate cuts later in 2025, the dollar strengthened, putting pressure on the rand. The bounce in USD/ZAR was particularly visible during Monday and Friday’s trading sessions, signaling caution among traders heading into a politically tense weekend in South Africa.

Q2 Performance: A Stellar But Vulnerable Run

The rand had been one of the standout performers among emerging-market currencies in the second quarter. The 12% gain in USD/ZAR over three months marked an impressive stretch, driven largely by broad-based US dollar weakness, rising commodity prices, and South Africa’s trade balance improvements.

However, the mood shifted after President Donald Trump announced a 30% tariff on South African goods, effective August 1st. While the market remains skeptical about the enforcement of this measure, the announcement alone was enough to cap the rand’s momentum and invite profit-taking. Traders are now watching to see if the R18.00 level turns into a firm ceiling or a launchpad for another leg higher.

Political Tensions Add Currency Risk

South African politics added further strain on the currency as President Cyril Ramaphosa abruptly dismissed the DA’s deputy trade minister, a move seen as escalating friction within the ANC-led coalition government. The lack of explanation has fueled speculation of deeper disagreements within the fragile political alliance, which could impact investor confidence.

The G20 finance ministers’ meeting, held last week in Durban, yielded little of substance. Traders had hoped for clarity on trade policies and fiscal direction, but the lack of meaningful announcements caused the USD/ZAR pair to drift back toward R17.70 by Friday’s close.

Trade Data and Commodity Focus

Beyond political noise, fundamentals remain in focus. As South Africa is a major exporter of industrial commodities, Trump’s parallel proposal of a 50% tariff on copper imports could have broader ramifications. If implemented, such tariffs could disrupt export volumes and affect the rand’s value given its high correlation with commodity prices.

Markets will also be watching today’s release of May credit extension, M3 money supply, trade balance, and budget balance data, which may further define the rand’s short-term direction. If the local macro data surprises to the upside and global trade risks recede, USD/ZAR could break below R17.50 again—and even test the psychologically important R17.00 mark.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account