Intel Stock (INTC) Slides 7% as Restructuring Hits Earnings—Can Support Hold?

Following an unexpected loss in its Q2 earnings announcement, which overshadowed higher-than-expected sales and continued growth in its...

Quick overview

- Intel shares fell sharply after reporting an unexpected loss in its Q2 earnings, despite stronger-than-expected revenue.

- The company's foundry business grew 3% year-over-year, contributing to a revenue of $12.86 billion, which exceeded analyst expectations.

- The earnings miss was primarily due to $800 million in impairment charges and $200 million in one-time costs.

- Intel's Q3 guidance suggests a breakeven EPS and revenue projections that align closely with analyst estimates, indicating cautious optimism.

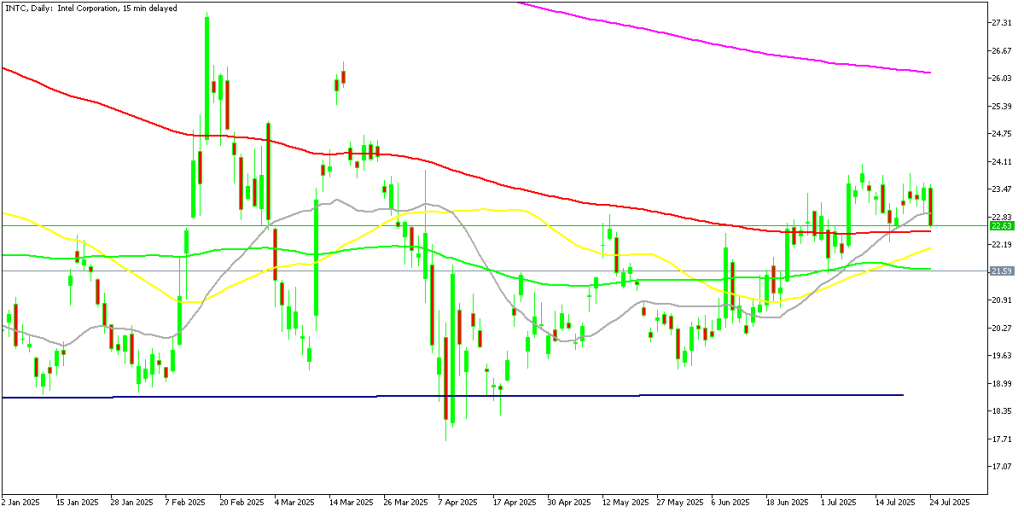

Live INTC Chart

[[INTC-graph]]Following an unexpected loss in its Q2 earnings announcement, which overshadowed higher-than-expected sales and continued growth in its foundry sector, Intel shares fell precipitously.

Intel Slides After Q2 Miss

Intel Corporation (NASDAQ: INTC) saw its stock fall sharply during Thursday’s U.S. session and continued to drop below $22.50 in after-hours trading following the release of its second-quarter earnings. The stock had closed at $23.49 the previous day but ended the session 0.86 cents down or about -4%, while slipping another $1 post-market to accumulate losses to -7% so far.

INTC Chart Daily – Difficult to Hold Gains

The company’s ambitious chip-manufacturing strategy and reorganization plans under the new CEO have given us new hope during the summer, but it will take some time for the financial reports to reflect the impact of the new policies.

Q2 Results: Strong Revenue, But Unexpected Loss

The company’s earnings report revealed an unexpected adjusted loss, surprising many investors. Although revenue came in higher than Wall Street had expected—thanks largely to ongoing strength in Intel’s foundry business—the loss was driven by $800 million in impairment charges and $200 million in one-time costs.

Intel’s foundry segment, a central piece of its long-term strategy, grew 3% year-over-year to $4.4 billion, providing some optimism amid the otherwise disappointing bottom line.

Intel Q2 2025 Earnings – Key Highlights

Adjusted EPS:

- Reported a loss of $0.10 per diluted share, missing expectations.

- Analysts had forecast a small profit of $0.01 per share.

Revenue:

- Came in at $12.86 billion, flat year-over-year.

- Beat expectations of $11.95 billion, primarily due to stronger-than-expected foundry performance.

Foundry Business:

- Grew 3% in Q2 to $4.4 billion, surpassing analyst estimates.

- Continues to be a bright spot in Intel’s transformation strategy.

EPS Drag:

- The earnings miss was largely driven by $800 million in impairment charges.

- An additional $200 million in one-time costs further reduced EPS by $0.20 total impact.

Q3 2025 Guidance

EPS Forecast:

- Intel expects adjusted EPS to breakeven in Q3.

- Analysts were expecting $0.04 per share.

Revenue Forecast:

- Projected between $12.6 billion to $13.6 billion.

- The midpoint slightly exceeds the Street estimate of $12.66 billion.

Strategic Adjustments Weigh on Sentiment

Part of the earnings pressure stems from Intel’s broader reorganization efforts under its ongoing turnaround plan. The company is scaling back or postponing several high-cost manufacturing projects to improve capital efficiency. Intel has canceled plans to build semiconductor facilities in Germany and Poland, and will delay the development of its chip plant in Ohio. These moves are designed to better align spending with market conditions and help stabilize the balance sheet.

Looking Ahead: A Mixed Road Forward

Intel’s guidance for the third quarter calls for flat EPS and revenue between $12.6 billion and $13.6 billion, a range that brackets analyst expectations. While the company’s leadership has sparked renewed optimism with its ambitious manufacturing overhaul, it may take several quarters before that vision is reflected in improved profitability.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM