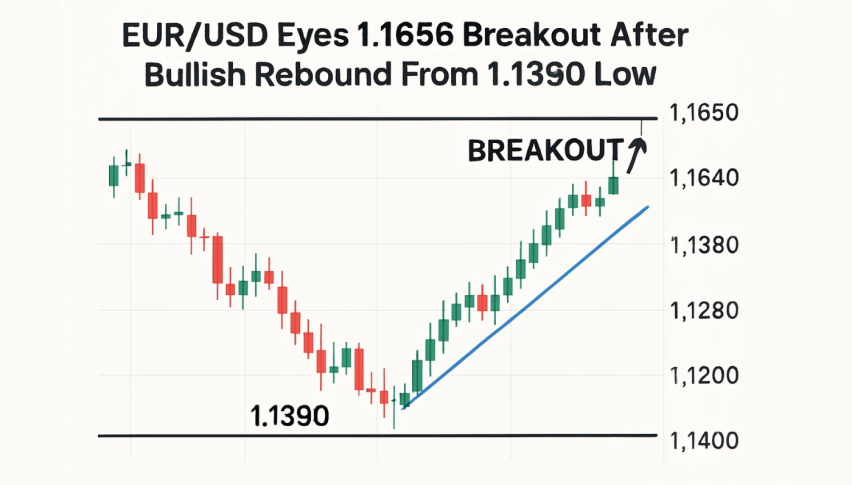

EUR/USD Eyes 1.1656 Breakout After Bullish Rebound From 1.1390 Low

EUR/USD fell back slightly on Monday but remains above Friday’s jump, thanks to weak US jobs and factory data...

Quick overview

- EUR/USD experienced a slight decline on Monday but remains above Friday's gains due to weak US jobs and factory data.

- July's Nonfarm Payrolls reported only 73K job additions, significantly missing expectations, while the unemployment rate rose to 4.2%.

- The technical outlook shows EUR/USD forming a symmetrical triangle, with potential breakout points at 1.1593 and 1.1656.

- Traders are advised to look for bullish setups, with conservative and aggressive entry options based on price movements.

EUR/USD fell back slightly on Monday but remains above Friday’s jump, thanks to weak US jobs and factory data. July’s Nonfarm Payrolls showed only 73K job additions—a big miss from 110K—and revisions wiped out gains from prior months. The unemployment rate rose to 4.2% and now markets are pricing in around 80% chance of a September Fed rate cut—up from below 40% just days ago on CME’s FedWatch data.

EUR/USD Technical Outlook: Triangle Setup Suggests Breakout

EUR/USD bounced sharply from 1.1390 on Friday with a beautiful bullish engulfing candle. Since then price has made higher lows and formed a small symmetrical triangle just below the descending trendline from the July 25 high. Price is consolidating near resistance at 1.1593. The 50-EMA at 1.1496 is now support, with RSI near 60—not overbought yet. A clean break above 1.1593 and the upper trendline could be towards 1.1656 and the horizontal wall above.

Trade Setup: Conservative and Aggressive Options

Look for bullish setups while waiting for technical triggers:

- Conservative Entry: Close above 1.1595.

- Target: 1.1655

- Stop-loss: Below 1.1515

- Aggressive Entry: Enter mid-triangle once price confirms higher lows with volume.

Why It Matters:

EUR/USD looks poised for breakout with dovish Fed expectations clearing the path. A clean technical rally could test resistance near 1.1656. A sharper dive—below 1.1515—may reopen downside risk. Monitoring macro cues and candlestick confirmation will be key.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account