Amazon Bets Big on Groceries: Same-Day Fresh Delivery Expansion Signals Ambitions in $940B Market

Amazon (NASDAQ: AMZN) expands same-day grocery delivery to 2,300+ cities, targeting Walmart in the $940B market while boosting Prime value

Quick overview

- Amazon is expanding its same-day fresh grocery delivery service for Prime members, aiming to capture a larger share of the $940 billion U.S. grocery market.

- The company plans to offer this service in over 2,300 cities by the end of 2025, leveraging its existing fulfillment network to reduce costs.

- Amazon's grocery initiative not only aims to increase revenue but also to enhance customer engagement and data collection for its advertising business.

- Despite facing stiff competition from Walmart and Instacart, Amazon's financial strength and operational capabilities position it well for growth in the grocery sector.

Amazon (NASDAQ: AMZN) is making a big move to get more of America’s grocery money by announcing that it will expand its same-day fresh grocery delivery service at no extra cost to Prime members. The move puts the e-commerce giant in direct rivalry with big stores like Walmart and aims to acquire a piece of the huge $940 billion U.S. grocery market.

By the end of 2025, the Seattle-based company intends to offer this service in more than 2,300 cities. This is one of Amazon’s biggest grocery projects to date. Amazon has 22% of the online grocery market, while Walmart has 25.7%. Amazon is trying to get more of a market where online sales only make up 13.4% of all grocery purchases, which means there is a lot of space for digital development.

Strategic Infrastructure Investment Drives Amazon’s Expansion

Amazon’s grocery push isn’t brand new. The business has promised $4 billion by 2025 to grow its rural delivery network to 4,000 areas, and by 2026, it wants to reach three times as many. This huge investment in infrastructure makes use of Amazon’s existing fulfillment network. Adding temperature-controlled zones to preexisting facilities is much cheaper than developing cold-chain operations from scratch.

The plan seems to be paying off early on. In some test areas, fresh strawberries have sold better than things that are usually popular, like AirPods. This shows that people are more interested in Amazon’s supermarket offers than expected. Early data shows that supermarket clients utilize the site twice as much as regular users, which could lead to greater overall transaction values.

Market analyst Stephen Ayers said, “We need to look at Amazon’s decision to add same-day delivery to groceries in context.” “Amazon has already paid for the expensive infrastructure needed to build a faster, more efficient fulfillment network for general merchandise. Now it can use those costs to attack the grocery market.”

Prime Ecosystem Integration Drives Long-Term Value

The grocery store’s growth has two purposes besides making money. Fresh foods lead to frequent, routine purchases that make Amazon a bigger part of people’s everyday lives and give the company useful information to further its high-margin advertising business. Already, Prime members spend an average of $1,400 a year, while non-Prime members only spend $600. Adding groceries could make it easier to raise membership prices in the future.

Amazon’s advertising revenue section has grown quickly, and grocery purchase data gives this business line even more ways to target customers. The organization is able to improve grocery operations and cross-selling prospects since it collects a lot of data, such as mouse movements and browsing behaviors.

Competitive Landscape in Grocery Delivery Intensifies

Amazon has a lot of tough competition in the grocery delivery business. Walmart stays at the top of the market by using more than 4,600 stores as fulfillment centers, which lets 90% of the U.S. population get their orders the same day. Instacart has a 21.6% market share since it works with 100,000 grocery stores in 14,000 locations. However, because it relies on gig workers, it is vulnerable to Amazon’s vertically integrated approach.

Kroger and Albertsons, two traditional grocery stores, have had trouble with online delivery because they rely on third-party services that make it harder to control pricing and the customer experience. Their prices are usually 5% to 13% more than Amazon’s, which shows how Amazon’s size can make it harder for other companies to compete.

Financial Strength Supports Ambitious Goals

Amazon is growing because it has a lot of money. The figures for the second quarter of 2025 showed that net sales rose 13% from the previous year to $167.7 billion. Operating income also rose from $14.7 billion to $19.2 billion. Over the past twelve months, operating cash flow hit $121.1 billion, which gave the capital-intensive grocery industry a lot of money to work with.

Amazon Web Services keeps making a lot of money, $30.9 billion in revenue in the second quarter alone, which lets them try new things in new areas. In the past, Amazon chose growth over profits, but now it increases both revenue and profits at the same time, showing excellent operating leverage.

Risks and Challenges Ahead

There are some big problems with the grocery delivery sector. McKinsey says that a $100 online grocery order can cost a company roughly $13, which is why many companies in this field have trouble making money. If grocery losses aren’t made up for fast, Amazon’s margins could be hurt, especially during the early adoption stages.

As Amazon grows, it challenges established players, which will make competition even stronger. Walmart probably won’t give up easy, which might lead to expensive price battles that could hurt already slim margins in the whole industry. Because Amazon is already the biggest player in the market and has a history of aggressive scaling techniques, regulatory scrutiny is also on the horizon.

Wall Street Remains Bullish on Amazon (AMZN) Stock

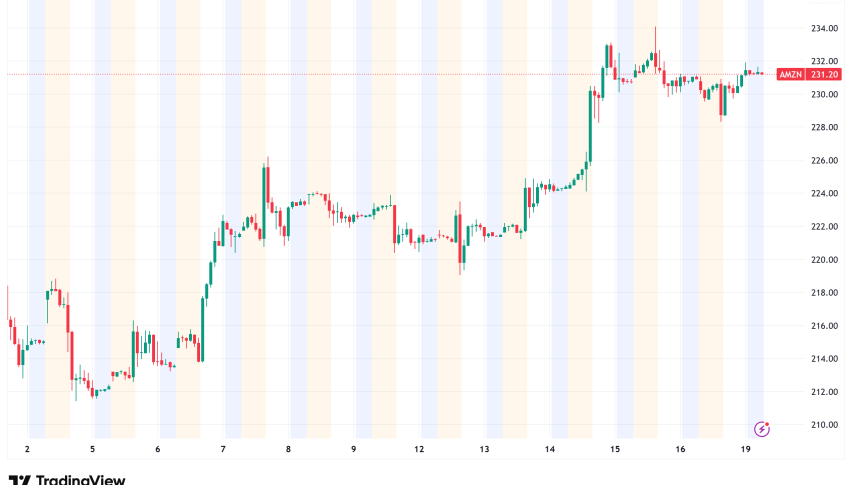

Wall Street still believes in Amazon’s plan, even though it has problems. Over the past three months, 44 people have said to Buy the stock, one person has said to Hold it, and no one has said to Sell it. This gives the stock a Strong Buy rating. Analysts say that the average price objective is $265.22, which means that the stock might go up 15% during the next year.

Three positive patterns and one cautionary signal in recent technical indicators point to bullish momentum. On the other hand, institutional inflows of 43.19% over five days suggest that large investors are cautiously optimistic.

Amazon’s grocery business is more than just a new way to make money; it’s also part of the company’s long-term plan to become the main utility for American commerce. The supermarket business is known for being hard, but Amazon’s size, financial strength, and operational skills might let it reshape retail while making Prime even more important as the doorway to modern consumer life.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account