Windtree Therapeutics Faces Nasdaq Delisting After Bold BNB Crypto Treasury Strategy Backfires

Windtree Therapeutics (WINT), a biotech business that made news last month for using an unusual cryptocurrency treasury approach, got some

Quick overview

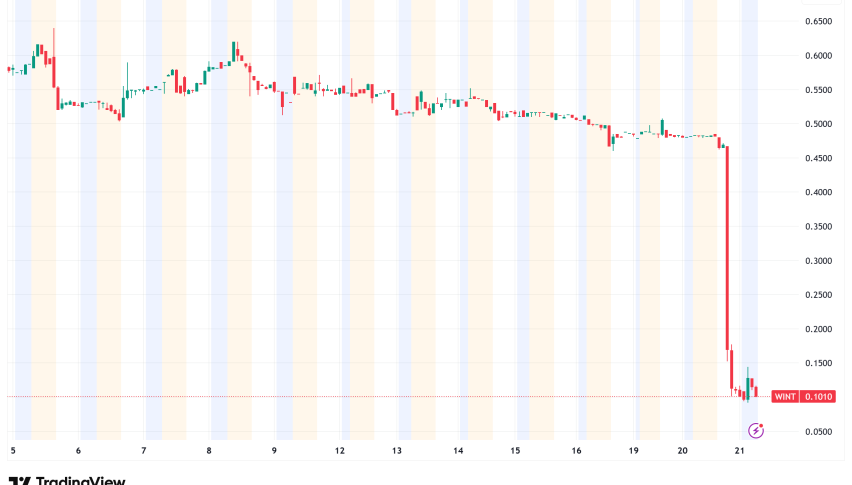

- Windtree Therapeutics has been delisted from Nasdaq due to failing to meet minimum compliance criteria, resulting in a 77% drop in stock price.

- The company's controversial move to use Binance Coin as a treasury asset has raised concerns among investors and industry experts about its long-term viability.

- Despite Windtree's struggles, the cryptocurrency market, particularly BNB, continues to perform well, highlighting the risks associated with crypto treasury strategies for companies lacking strong fundamentals.

- Windtree plans to transition to over-the-counter markets while maintaining its ticker symbol, but faces challenges related to liquidity and future fundraising.

Windtree Therapeutics (WINT), a biotech business that made news last month for using an unusual cryptocurrency treasury approach, got some bad news on Wednesday when Nasdaq said it will delist the company’s stock because it didn’t meet minimum compliance criteria.

After the company was delisted, its stock price dropped 77% to $0.11. After-hours trading showed an additional 14% drop. The significant drop ends a rough time that started when Windtree switched from traditional biotech work to using Binance Coin BNB/USD as a treasury asset.

Compliance Failure Triggers Windtree’s Nasdaq Delisting

Windtree broke Listing Rule 5550(a)(2), which says that corporations must keep a minimum bid price of $1.00 per share for 30 working days in a row. Nasdaq sent out the official delisting letter. The business told the Securities and Exchange Commission in a Form 8-K filing that trading would stop on Thursday, August 21.

“The company will keep reporting even though it has been delisted,” CEO Jed Latkin said in the regulatory filing. Windtree wants to move its shares to over-the-counter (OTC) markets while keeping its WINT ticker symbol. However, the business admitted that it is not guaranteed that its application for an OTCQB tier listing will be approved.

Risky Crypto Strategy of BNB Treasury Raises Eyebrows

The company’s decision to delist comes only weeks after it shocked everyone by announcing that it would be moving into bitcoin treasury management. The company said on July 16 that it has signed a $60 million deal with Build and Build Corp to buy BNB tokens, with the possibility to invest a further $140 million. After the announcement, there was an even bigger commitment: a $500 million equity line of credit from an unnamed investor. This brought the total possible BNB exposure to over $520 million.

At first, the crypto plan looked good, as WINT shares rose 32% in the two days after the July 16 release. But the gains didn’t last long; since then, the stock has dropped more than 90% from its peak on July 18.

Industry experts were unsure about Windtree’s strategic emphasis because of the timing and size of the company’s bitcoin investment. Critics said that such a big change away from the company’s main biotech activities could make investors doubt its scientific goal and long-term survival.

BNB Market Disconnect Highlights Volatility

Ironically, BNB did very well even though Windtree’s shares fell. On Wednesday, the cryptocurrency jumped 5.6% to a new all-time high of $876.26. This shows how the company’s financial problems are not affecting the overall performance of the crypto market. BNB is one of just a few major cryptocurrencies, like XRP and Solana, that have reached new highs during the current bull cycle.

This disparity shows how risky crypto treasury tactics may be, especially for organizations that don’t have good fundamentals. Some publicly traded companies have been able to successfully use cryptocurrency reserves, but Windtree’s story is a warning about the problems that might come up with these kinds of plans.

Impact on Operations and Future Outlook

Windtree says that its business will go on as usual even though it has been delisted. The company stressed its dedication to openness and its ongoing compliance with SEC reporting rules. However, moving to OTC markets usually means less liquidity, less visibility, and even problems with getting into capital markets for future fundraising or collaborations.

The corporation has not said anything about how many BNB it now holds or whether it plans to keep using its bitcoin treasury strategy. We have not been able to get in touch with Windtree to get their thoughts on these important issues.

Broader Implications for Biotech-Crypto Integration

Windtree’s big drop shows how hard it is for established businesses to include bitcoin strategies without good risk management systems. The case shows that strategic alliances, like Windtree’s arrangement with Kraken for custody and trading, can’t make up for serious financial and regulatory compliance problems.

People who watch the industry say that for crypto treasury to succeed, it needs strong compliance standards, good liquidity management, and a clear long-term strategic integration plan instead of just positioning for short-term gains. Companies that are thinking about doing something similar may need to rethink how they do things based on what Windtree has learned.

Windtree’s future is still unclear as it moves to OTC trading. The company will only be able to bounce back from this setback if it can stabilize its operations, efficiently manage its cryptocurrency risk, and maybe even work its way back to being listed on a major exchange. For now, the biotech company is a clear example of the dangers of adopting cryptocurrencies too quickly without a solid financial base and following the rules.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM