XRP Price Prediction: Eyes on $5 as Ripple Builds Banking-Style Model on RLUSD

Following a turbulent summer, XRP has recovered thanks to legal clarification, dovish Fed indications, and rekindled hope for possible ETF..

Quick overview

- XRP has regained momentum due to legal clarity, dovish signals from the Federal Reserve, and optimism over potential ETF approvals.

- The resolution of Ripple's legal battle with the SEC has boosted investor confidence and removed regulatory uncertainty.

- Ripple is strategically expanding its services, including a collaboration with Gemini to integrate its stablecoin into regulated financial systems.

- Upcoming ETF rulings could attract significant institutional investment, potentially elevating XRP's market capitalization and price.

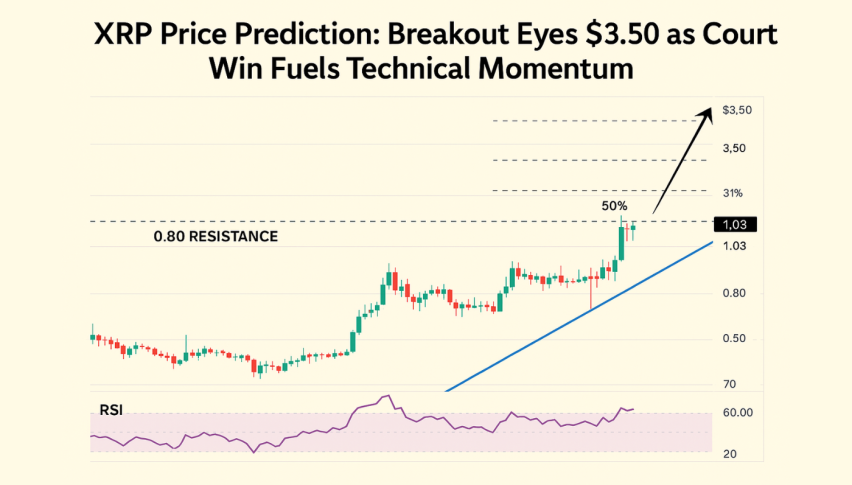

Live XRP/USD Chart

Following a turbulent summer, XRP has recovered thanks to legal clarification, dovish Fed indications, and rekindled hope for possible ETF approvals.

Market Performance and Technical Levels

Bitcoin and Ethereum’s record-setting runs have energized the broader crypto market, with XRP following suit. After Jerome Powell’s Jackson Hole speech, XRP surged 10% from below $2.80 to $3.10, briefly stalling at the 20-day simple moving average. Importantly, XRP managed to close last week above $3, reinforcing its resilience at this critical support level. Despite some setbacks in July, August has restored bullish sentiment, and analysts now eye the possibility of XRP climbing above $5 should positive catalysts align.

XRP/USD Chart Daily – Jump Stalled at the 20 SMA

Legal Settlement Brings Relief

A key driver of XRP’s rebound was the long-awaited resolution of Ripple’s legal battle with the U.S. Securities and Exchange Commission. On August 22, the Second Circuit Court of Appeals approved the joint dismissal, ending a lawsuit that had weighed on the token since 2020. The settlement not only removed regulatory uncertainty but also reignited investor confidence in XRP’s long-term prospects.

Ripple’s Strategic Expansion

Ripple has moved quickly to leverage its improved standing. Its collaboration with Gemini, revealed in the exchange’s IPO filing, includes a $75 million revolving credit facility that could expand to $150 million, available in Ripple’s RLUSD stablecoin. The arrangement highlights Ripple’s ambition to integrate RLUSD into regulated financial systems while positioning itself as a comprehensive financial services provider. With XRP at the core, Ripple aims to connect lending, payments, stablecoins, and settlement in a structure that resembles traditional financial institutions.

Policy Tailwinds

Momentum has also been bolstered by U.S. policy shifts. A recent executive order signed by President Donald Trump allows atypical assets, including cryptocurrencies, real estate, and private equity, to be held in 401(k) retirement funds. This unprecedented step provides digital assets with a level of mainstream acceptance that significantly broadens their appeal.

ETF Filings and Institutional Interest

At the same time, major asset managers including Grayscale, WisdomTree, Franklin Templeton, and 21Shares have updated filings for spot XRP ETFs. The SEC is expected to deliver rulings between October 18 and October 25, 2025, covering eight separate applications. Analysts estimate that approval could draw up to $8 billion in ETF inflows, potentially lifting XRP’s market capitalization toward $400 billion and pushing short-term prices into the $5–$6 range. Following the success of Bitcoin and Ethereum ETFs, institutional adoption of XRP through regulated funds would mark a significant step in its evolution from speculative asset to mainstream investment.

Conclusion: XRP’s climb back above $3 reflects a powerful mix of legal relief, policy support, and anticipation around ETF approvals. Ripple’s settlement with the SEC has cleared a multi-year overhang, while strategic partnerships and policy shifts are opening new pathways for adoption. With institutional players now positioning ahead of potential ETF rulings, XRP is on the verge of moving beyond retail-driven speculation and cementing itself as a core asset in the U.S. digital economy.

Ripple Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account