Bitcoin Poised for $120K Breakout as Fed Rate Decision and Technical Signals Align

Bitcoin (BTC) consolidates above $116,000 with multiple bullish catalysts converging ahead of Wednesday's FOMC meeting. What's next for it?

Quick overview

- Bitcoin is currently trading above $116,000, reflecting a 1.2% increase in the last 24 hours, with potential for a breakout toward $120,000 due to upcoming Federal Reserve decisions.

- Significant withdrawals from exchanges have tightened liquidity, reducing selling pressure and supporting price increases.

- Spot Bitcoin ETFs have driven substantial demand, with net inflows of $2.2 billion, creating a supply-demand imbalance favoring price growth.

- Despite cautious positioning in the derivatives market ahead of the Fed announcement, spot market demand remains strong, indicating a balanced market before potential price movements.

Bitcoin BTC/USD is trading above $116,000 right now, which is a 1.2% increase over the last 24 hours. The cryptocurrency is still trading in a limited range. With the Federal Reserve’s interest rate decision coming up on Wednesday, a number of technical and fundamental elements are coming together to support a possible breakout toward $120,000, even as derivatives traders are being careful.

Exchange Outflows and Supply Dynamics Create Bullish Foundation

A key reason why Bitcoin’s price is going up is because there is a lot less BTC owned by exchanges. Glassnode data shows that in September, 44,000 Bitcoin were withdrawn from centralized exchanges, which is the opposite of what happened in July when there were a lot of deposits. This pattern of withdrawals has made liquidity tighter right away and lowered the amount of selling pressure that is easy to find around the present $116,000 level.

Market watchers say that a large part of the 2.96 million BTC that is still on exchanges is not actively offered on order books. Many investors keep deposits in exchanges for the convenience of custody, the chance to earn interest, or lower trading fees instead of actively selling, which lowers the amount of liquid assets available to absorb buying pressure.

Spot Bitcoin ETF Flows Provide Persistent Buying Pressure

Spot listed in the US Bitcoin ETFs have become a strong driver of demand, bringing in a net of $2.2 billion between Wednesday and Monday. This institutional buying means that daily demand is more than ten times higher than the quantity of new Bitcoin created each day. This creates a big supply-demand imbalance that favors price increases.

After gold’s 11% rise since August, the ETF flows have helped investors trust the market again, making Bitcoin a more appealing alternative store of wealth. Eric Trump’s recent interview with CNBC added to this story. He called Bitcoin the “greatest asset of our time” and compared it to gold, especially as a way to protect yourself against weakness in the real estate market.

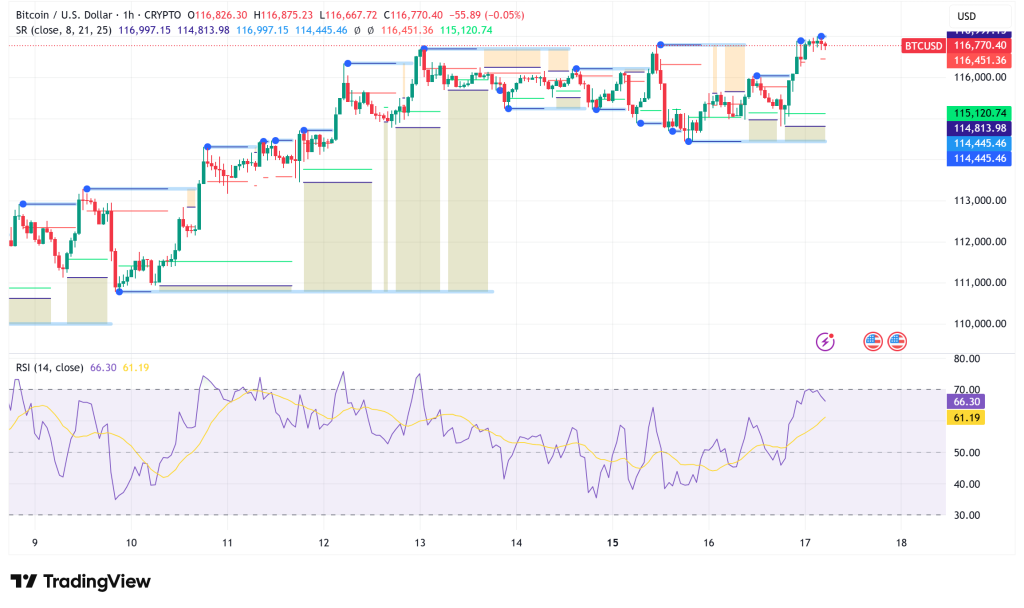

BTC/USD Technical Analysis Points to Major Breakout Potential

Bitcoin’s weekly stochastic RSI has given its ninth bullish signal of the current cycle from a technical point of view. If the pattern repeats, Bitcoin might reach the $155,000 mark because past crosses like this one have led to rallies of 35% on average.

Timothy Peterson, a crypto investor, says that Bitcoin might hit $200,000 in 170 days based on his cycle analysis. He gives this scenario better than even probability of happening. The cryptocurrency is now trading 8% below its all-time high, which puts it in a good position to break out over the important $117,000-$118,000 resistance zone.

Derivatives Market Shows Cautious Positioning Ahead of Fed Decision

Bitcoin futures traders are being careful ahead of Wednesday’s Federal Reserve announcement, even though the fundamentals are good. Open interest has dropped by $2 billion in five days, going from $42 billion to $40 billion. Aggregate futures volume, on the other hand, is still very low. This stance shows that traders are staying away from making big directional bets before the FOMC decision.

The funding rate for perpetual futures is going down, and the London session on Tuesday had the biggest hourly funding surge since August 14. Also, Binance’s hourly net taker volume has dropped below $50 million, which is far lower than the usual $150 million norm. This shows that the market is waiting for the Fed to make things clear.

Spot Market Demand Remains Robust Despite Derivatives Caution

Spot demand on Coinbase indicates a different story than the derivatives market, which is unsure. Since last Tuesday, the Coinbase premium has been slowly rising. This is because there is a lot of demand from US investors, and it is the strongest buying group since early August. This action shows that both institutional and retail buyers are working hard to protect the $115,000 support level.

The Bitcoin Bull Score has gone back up to a neutral 50 from a bearish 20 in the past four days. This means that selling pressure is receding and the market is in balance before the Fed announcement. At the same time, the Bitcoin Risk Index is at 23%, which is close to its cycle lows. This means that the market is “calmer” and there is less chance of quick liquidations.

Fed Decision Could Catalyze Next Major Move

The bond market thinks there is a 96% chance that the Federal Reserve will lower rates from 4.5% to 4.25%. However, what Chair Jerome Powell said at the press conference may be more important than the rate decision itself, especially when it comes to the Fed’s direction on inflation and future rate decreases.

Recent signs of financial stress, such as the Fed’s Standing Repo Facility providing $1.5 billion to banks and overnight lending rates rising to 4.42%, point to underlying market tensions that could make Bitcoin a good alternative store of value.

Bitcoin Price Prediction: Multiple Paths to $120K and Beyond

Bitcoin seems ready to break out toward $120,000 in the near future because of a combination of technical signs, supply and demand, and institutional interest. Based on past RSI patterns, a 35% rise may send BTC up to $155,000. Cycle analysis, on the other hand, refers to possible targets of $200,000 in six months.

Between $117,000 and $118,000, there is short-term resistance. If the price breaks over this level, it would likely cause algorithmic buying and momentum-driven rallies. The current consolidation over $115,000, which is supported by ETF flows and exchange withdrawals, gives a firm base for prices to go up once there is more certainty about the Fed.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM