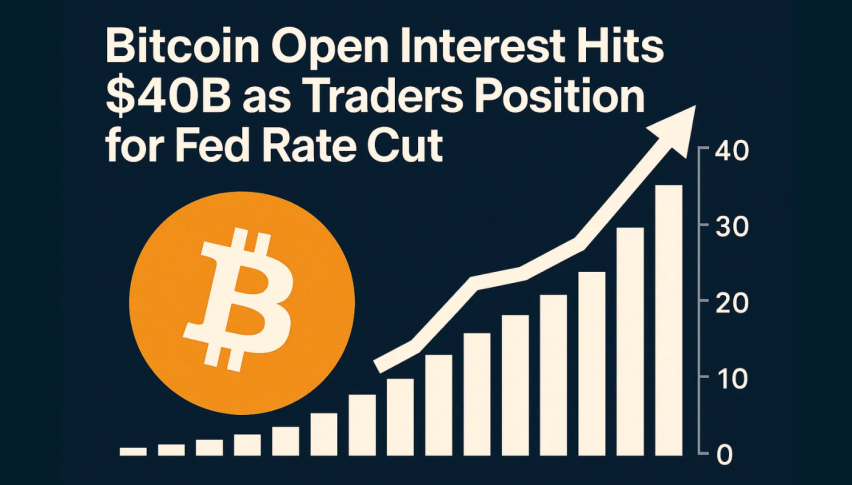

Bitcoin Open Interest Hits $40B as Traders Position for Fed Rate Cut

Bitcoin (BTC) climbed past $116,000 this week as traders ramped up leveraged positions ahead of the Federal Reserve’s policy meeting...

Quick overview

- Bitcoin (BTC) surpassed $116,000 this week as traders increased leveraged positions ahead of the Federal Reserve's anticipated rate cut.

- Open interest in Bitcoin derivatives rose to $37.6 billion, indicating a significant buildup in speculative leverage.

- Analysts attribute the bullish sentiment to slowing inflation and expectations of a gradual easing cycle from the Fed.

- While rising leverage reflects renewed confidence, it also poses risks of increased market volatility if Bitcoin fails to maintain key support levels.

Bitcoin (BTC) climbed past $116,000 this week as traders ramped up leveraged positions ahead of the Federal Reserve’s policy meeting on Wednesday, where officials are widely expected to cut rates by 25 basis points. The move could extend the rally in digital assets, which have surged amid renewed risk appetite and easing monetary expectations.

Open interest across Bitcoin derivatives markets — a measure of the total value of outstanding futures and options contracts — has jumped to $37.6 billion, up from $33 billion last week, according to CryptoQuant data. That surge underscores a buildup in speculative leverage as traders position for the Fed’s decision.

Analysts attribute the optimism to slowing inflation, a cooling labor market, and Fed Chair Jerome Powell’s remarks hinting at an end to quantitative tightening. The ongoing U.S. government shutdown, which has restricted access to new economic data, has further intensified focus on the Fed’s guidance for future policy moves.

Key indicators driving the rally:

- Open interest: up 14% week-over-week, nearing $40 billion.

- Prediction markets: Myriad users assign a 92.6% chance of a rate cut.

- Spot Bitcoin price: up 7.8% from $107,600 to $116,000.

🚨 Bitcoin Leverage Nears $40B Ahead of Fed Vote

BTC climbs toward $116K as traders price in a likely 25bps rate cut this Wednesday.

Open interest surges to $37.6B, signaling heavy positioning across derivatives.

💡 Prediction market Myriad: 92.6% chance of a quarter-point cut.…— ZC MINER (@zc_miner) October 28, 2025

Fed’s Rate Path Shapes Bitcoin Momentum

Data from Myriad, a blockchain-based prediction platform, shows market participants overwhelmingly expect a quarter-point reduction in the federal funds rate to the 4.00–4.25% range. Analysts say such a cut would increase liquidity and potentially reinforce the crypto sector’s momentum.

“Markets have already priced in a 25-basis-point cut,” said Gracy Chen, CEO of Bitget. “Despite the ongoing fiscal uncertainty from the government shutdown, monetary policy operates independently of Congress, and the Fed is likely to proceed as planned.”

Chen added that Powell may outline a gradual easing cycle, signaling a broader liquidity expansion that could sustain risk-asset gains.

The Fed’s tone will be critical: a more dovish stance could push Bitcoin toward $118,000 to $120,000, while any hint of policy hesitation may trigger short-term volatility.

Leverage Fuels Opportunity and Risk

While enthusiasm builds, analysts warn that excessive leverage could magnify market swings. Bitcoin’s current open interest remains below its October 6 peak of $47 billion, when prices hit an all-time high of $126,080 (CoinGecko). The gap suggests room for growth but also highlights the fragile balance between bullish momentum and potential liquidation pressure.

“Rising leverage signals renewed confidence,” Chen noted, “but it also introduces vulnerability. If Bitcoin fails to hold above $112,000, a correction toward $108,000 could follow.”

Still, with ETF inflows rising and trade tensions easing, investor sentiment appears resilient. Bitcoin’s positioning ahead of the Fed vote reinforces its role as a barometer of global liquidity — and a test case for risk appetite in a shifting macro landscape.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account