Stocks Rally Ahead Of FOMC Minutes

As we talked about yesterday, the forthcoming FOMC Minutes release is going to be one of the most-watched in recent history.

Today has brought a strong Wall Street open, just hours ahead of this afternoon’s FOMC Minutes. All three leading indices were firmly in the green when trade kicked off, with the DJIA DOW (+215), S&P 500 SPX (+22), and the NASDAQ (+60) setting the pace. At least in the early going, equities players are anticipating an overtly dovish FOMC Minutes release at 2:00 PM EST.

During the U.S. pre-market, some startling news came in from the real estate sector. MBA Mortgage Applications (August 16) plummeted to -0.9% from a previous figure of 21.7%. This runs counterintuitive to last month’s FED rate cuts and an increased availability of home loans to qualified buyers. With more than a 22% plunge, it appears that the prime summer months for U.S. home buyers and sellers have drawn to an early close.

S&P 500 On The Bull Ahead Of FOMC Minutes

As we talked about yesterday, the forthcoming FOMC Minutes release is going to be one of the most-watched in recent history. At the 31 July meeting, the FED cut interest rates for the first time since 2008. Since then, the markets have been anxious to see the dialogue behind the move. At 2:00 PM EST, we will all finally get that chance.

++8_21_2019.jpg)

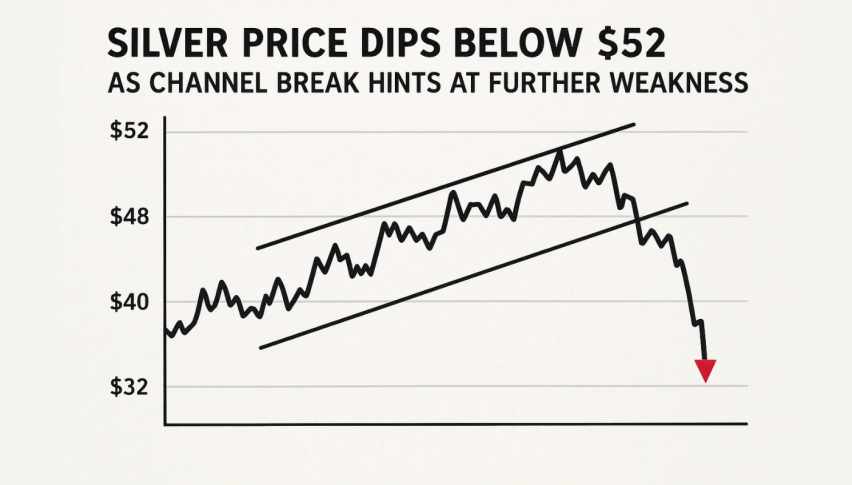

For the past three sessions, the September E-mini S&P 500 has been in heavy consolidation near 2900.00. Perhaps today’s FOMC Minutes release will move the needle. Here are the levels to watch for the remainder of the session:

- Resistance(1): Bollinger MP, 2922.00

- Resistance(2): Daily SMA, 2952.00

Bottom Line: If the bids keep hitting the September E-mini S&Ps, then scalping the Daily SMA to the short is likely a profitable play. For the remainder of the session, I will have sell orders in the queue from 2949.75. With an initial stop at 2953.25, this trade produces a quick 8 ticks on a sub-1:1 risk vs reward management plan.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account