Aussie CPI Beats Expectations

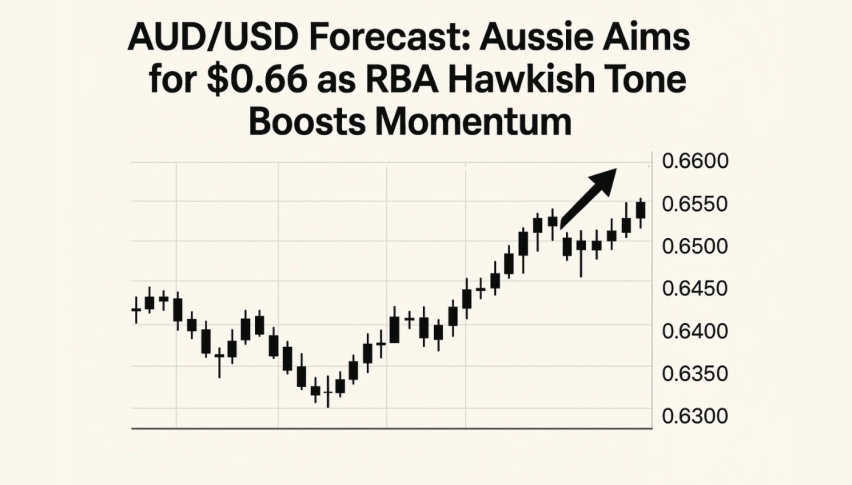

Australian CPI was out this morning and the result was better than expected.

Australian CPI was out this morning and the result was better than expected.

After the first negative reading in more than 70 years, CPI bounced back to come in at 1.6% vs 1.5% exp. While the YoY data is still well off the 2-3% inflation target the RBA is looking for, the good news is that the economy is turning things around.

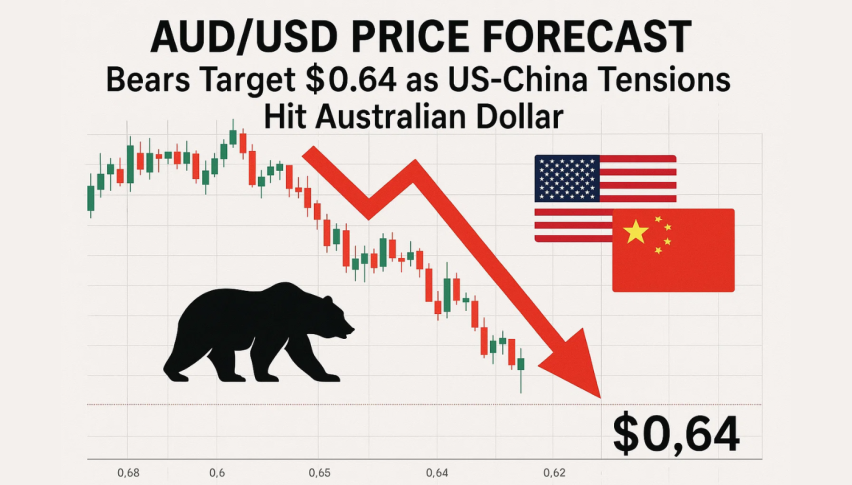

That said, the AUD/USD is still looking weak in early Asian trade. One of the key reasons for this appears to be the fact that there are growing rumours that more countries across Europe will be going back into various states of lockdown, in what is a big blow. European countries have had various response levels, but if the likes of Germany is impacted, then that doesn’t bode well for the Eurozone.

The Aussie and also the NZD/USD have been quite range bound of recent days. Yesterday, the Kiwi was the strongest performer on the session and broke out above the 0.6700 level which likely added to the buying interest. However, it has given back those gains and once again dropped that level on the increasingly negative sentiment.

The AUD/USD is still holding above the 0.7100 level despite the likelihood of the RBA slashing rates to 0.1% next week at their monthly meeting.

If the risk-off sentiment, which is also linked to the US election, continues to grow, then both pairs will be in danger of taking out those lower support levels. 0.6675 for the Kiwi and 0.7100 for the Aussie.

For the time being, we are still just waiting to see how the day plays out, but at the moment, it looks like we are slowing starting to build up the risk-off tone early on in the day.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account