Crypto Strategy: Cryptocurrency Trading: Price Action

Cryptocurrency trading offers both rapid growth and high volatility, making strategy essential. Crypto price action trading stands out by analyzing past price movements to interpret market direction without relying on technical indicators.

This approach is effective across markets, including crypto, where historical data is limited but price patterns often echo traditional assets.

By focusing on clear price signals, traders gain insights into support and resistance levels, market momentum, and likely price shifts.

For crypto traders, price action provides a straightforward, responsive method to make well-timed decisions in a fast-moving environment.

Solid price action trading strategies produce good yields across different markets.

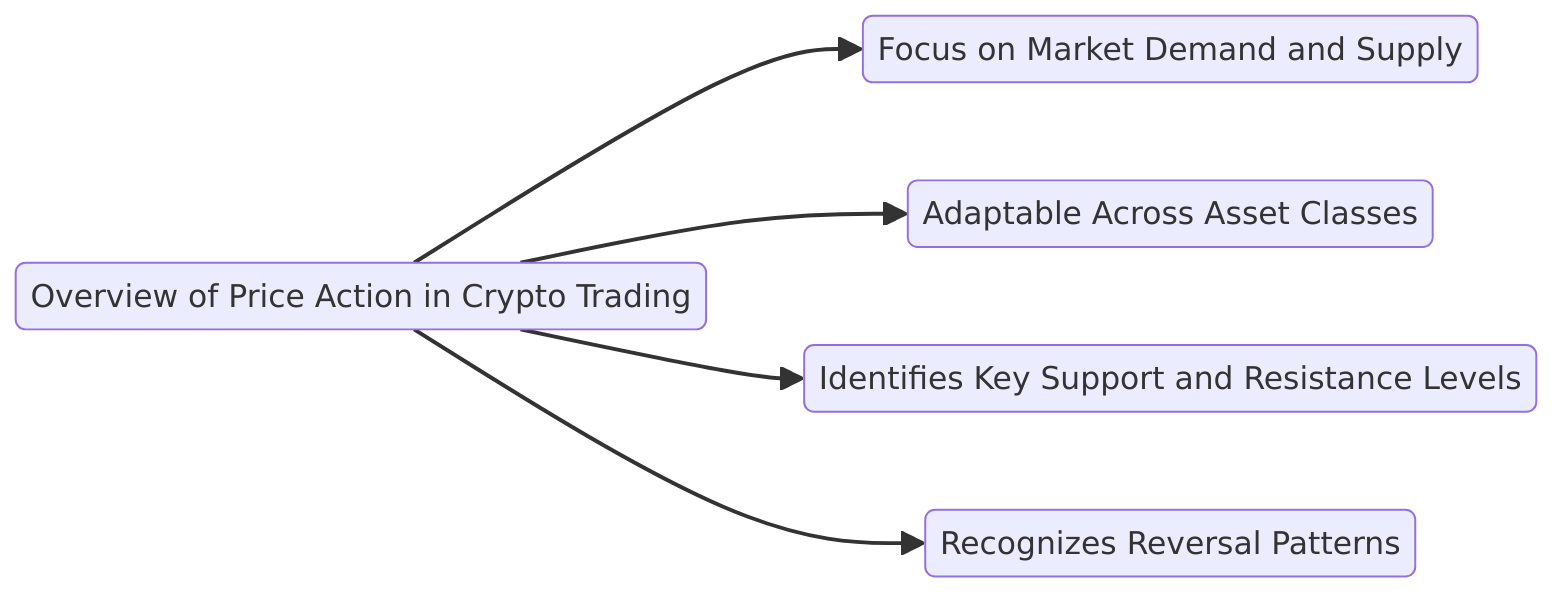

Overview of Price Action in Crypto Trading

In cryptocurrency trading, price action is a straightforward yet powerful method of interpreting market direction by focusing on the actual price movements.

Price action traders prioritize analyzing historical price movements and patterns over traditional indicators, making subjective decisions based on their interpretations of price behavior, psychological factors, and market sentiment.

Unlike strategies that rely on technical indicators or complex data, price action zeroes in on visible price behavior. This approach is particularly valuable in crypto markets, where prices can swing drastically, and fundamental data is often limited.

Here’s why price action is essential in crypto trading:

- Focus on Market Demand and Supply: Price action reveals immediate changes in demand and supply by analyzing historical price points like daily highs and lows, or open and close levels. In a market as volatile as crypto, this real-time insight is key.

- Adaptable Across Asset Classes: Price action works in any market where assets are freely traded. For example, cryptocurrencies often display the same price patterns found in traditional markets—such as support, resistance, and trendlines—allowing crypto traders to apply the same principles used in forex or stocks.

- Identifies Key Support and Resistance Levels:

- Traders can observe levels where prices “bounce” or hit resistance repeatedly. For instance, if Bitcoin frequently bounces at $28,000 (support) and faces selling pressure around $30,000 (resistance), traders can anticipate future movements based on these levels.

- Support and resistance levels provide clear, actionable signals that help traders decide where to enter or exit trades without relying on lagging indicators.

- Recognizes Reversal Patterns: Common price action signals like bullish engulfing candlesticks or doji formations suggest shifts in momentum.

- For example, a bullish engulfing pattern, where a large green candle fully covers a previous red one, might indicate the end of a downtrend and a shift toward buying interest.

- These patterns are easy to spot and interpret in real-time, allowing traders to stay responsive in volatile markets.

By focusing solely on the price, crypto traders can make informed, quick decisions without needing extensive historical or fundamental data. This adaptable approach is particularly suited to the fast-paced and unpredictable nature of the cryptocurrency market, allowing traders to respond directly to the forces driving price movement.

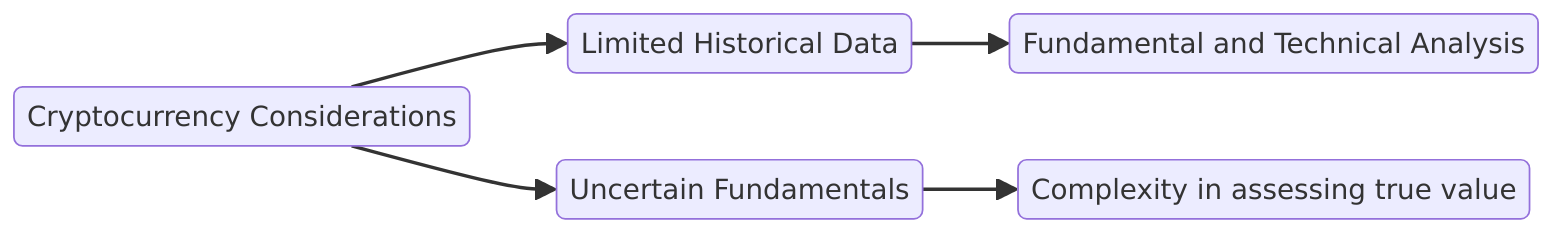

Cryptocurrency Considerations

Limited Historical Data (Fundamental and Technical)

Cryptocurrencies have not been with us for a very long time. While other asset classes like forex and stocks have plenty of historical data (both fundamental and technical) to draw valuable information from, most of the cryptocurrency market is uncharted territory.

The first and most prominent cryptocurrency, bitcoin, has only been around since 2009.

With this in mind, statistical modeling and strategy backtesting on cryptocurrencies have limited significance because results derived from small data samples are often misleading and unreliable.

The limited price history in the cryptocurrency market makes it challenging for traders to identify long-term trends, emphasizing the importance of understanding past price action as a tool for technical analysis.

However, interpretations of this data can vary among traders, leading to differing strategies based on recent price history.

Tricky and Uncertain Fundamentals

With fundamentals revolving around concepts which are generally difficult to understand, cryptocurrencies’ price behavior is often difficult to deduce or predict from fundamental aspects. Should traders, therefore, stand aside from this phenomenal market just because its fundamentals may be tricky to master? Definitely not!

The Power of Price Action Trading

There is a powerful ‘truth’ in global financial markets. Traders often expect certain fundamental catalysts to have specific effects on the price of an asset. These biases are often thwarted when the price does either nothing or exactly the opposite of what was expected.

Fundamental triggers are often ‘priced in’ by informed market players long before it is officially made public, rendering it largely ineffective by the time it is published.

Learn how to use price action and technical trading strategies.

Although fundamental data can play an important role in the valuation of assets, the price action of an asset is the final and most important consideration to be taken into account when making trading decisions.

When all has been factored in and everything is taken into account, the price is the final barometer and most reliable guide to what’s really going on with an asset. Even when fundamentals override price action ‘expectations’, the price action itself will quickly adapt to the fundamental shift. The price of an asset is often ‘ahead’ of its fundamentals.

Price action – the great market barometer.

Universal Price Behaviour Across Different Asset Classes

Market Psychology

Why does price action across many different assets and asset classes often resemble similar patterns? Most markets generally function in the same way because of the common characteristics and thought processes of the individuals who participate in these markets. Over time, different market participants react to certain market conditions in very much the same way. This gives price movements a repetitive nature because of the market psychology involved.

Supply, Demand, and Common Market Mechanics

Another reason for the uniformity between different markets is the way supply and demand shape markets. A simple example is the following: in strong uptrends, there is a shortage of sellers. Large investors and speculators who trade with-trend often have problems with getting large buy orders filled at reasonable prices.

Consequently, when these large market participants encounter pullbacks against the uptrend, it offers them opportunities to get their large orders filled at relatively good prices.

Also, when the price pulls back, it is a visible indication that more selling liquidity is entering the market, which may move the ‘big boys’ to continue accumulating long positions because a greater supply of that asset is entering the market.

This, and other market factors, often cause trending price action across most freely tradable financial instruments to move in impulsive followed by corrective Elliot wave sequences (impulsive, corrective, impulsive, corrective, etc.). Of course, the impulsive/corrective pattern is only one of the many common characteristic patterns caused by regular market functioning.

All freely tradable assets have some core price action functions in common (supply, demand, liquidity, human psychology, etc.).

Key Concepts and Terminology

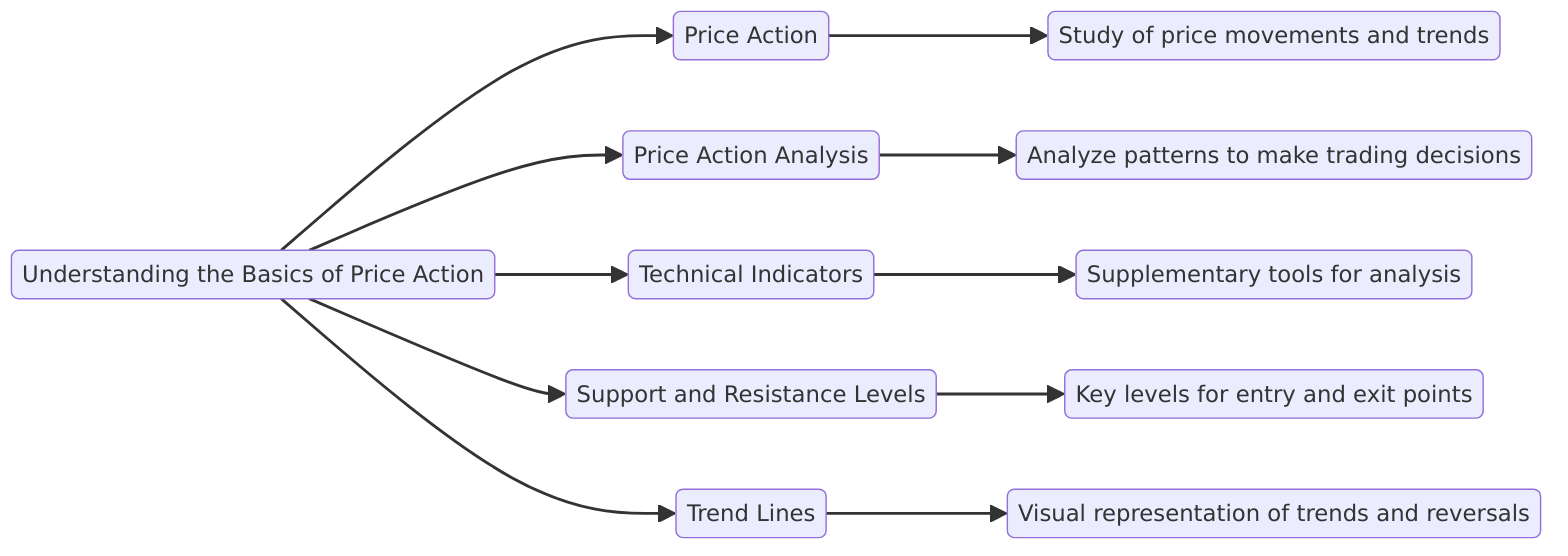

Understanding the Basics of Price Action

Price action trading is a technique used to analyze financial markets by focusing on price movements and patterns. It involves studying historical price data, typically represented in the form of charts, to identify trends, patterns, and potential indicators of future price movement.

Unlike traditional analysis, price action focuses solely on the price itself, making it a favored strategy among traders looking for direct insights into market sentiment.

Key concepts in price action trading include:

- Price action: The study of price movements and trends in the market. By observing how prices move, traders can gain insights into market psychology and sentiment.

- Price action analysis: The process of analyzing price movements and trends to make informed trading decisions. This involves interpreting various price patterns and signals to predict future price movements.

- Technical indicators: While price action trading primarily focuses on price itself, some traders may use technical indicators as supplementary tools to analyze price movements and trends.

- Support and resistance levels: Key price levels where the market has historically shown a tendency to reverse or stall. Identifying these levels helps traders make decisions about entry and exit points.

- Trend lines: Used to identify potential upward or downward trends in the market by connecting highs and lows on a chart. Trend lines provide a visual representation of the market’s direction and can signal potential reversals or continuations.

By mastering these concepts, traders can develop a robust price action trading strategy that leverages the natural movements of the market to make informed and timely trading decisions.

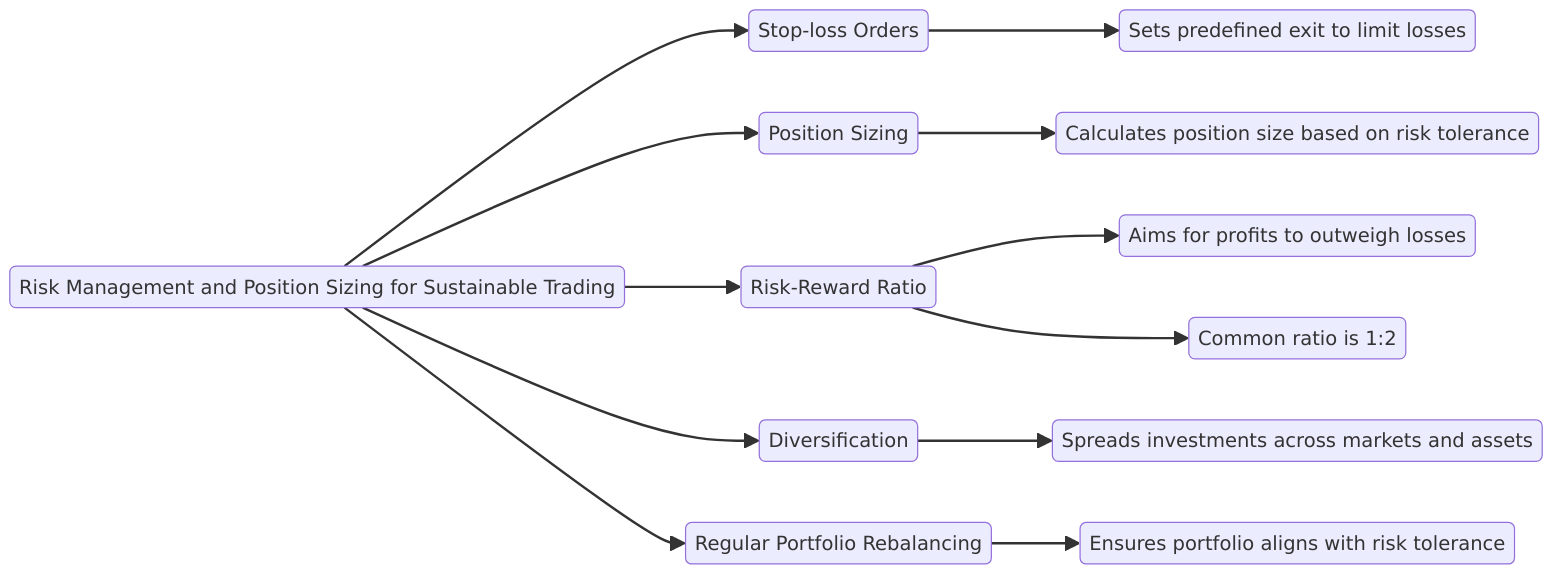

Risk Management and Position Sizing

Strategies for Sustainable Trading

Risk management and position sizing are crucial components of a successful price action trading strategy. Here are some strategies for sustainable trading:

- Stop-loss orders: Setting a stop-loss order is essential to limit potential losses if the trade does not go in the expected direction. This predefined exit point helps protect your capital and ensures that losses are kept within manageable limits.

- Position sizing: Determining the optimal position size based on your risk tolerance and account size is vital. By calculating the appropriate amount to invest in each trade, you can avoid overexposure and manage your risk effectively.

- Risk-reward ratio: Establishing a risk-reward ratio ensures that potential profits outweigh potential losses. A common ratio is 1:2, meaning you aim to make twice as much profit as the amount you are willing to risk.

- Diversification: Diversifying your trades across different markets and assets can minimize risk. By spreading your investments, you reduce the impact of a poor-performing trade on your overall portfolio.

- Regular portfolio rebalancing: Regularly rebalancing your portfolio ensures that it remains aligned with your risk tolerance and investment objectives. This practice helps maintain a balanced and diversified portfolio, reducing the risk of significant losses.

Implementing these risk management and position sizing strategies can help traders maintain a sustainable trading approach, protecting their capital while maximizing potential returns.

Common Mistakes in Price Action Trading

Avoiding Pitfalls and Improving Strategies

Price action trading can be a powerful tool for traders, but it is not without its pitfalls. Here are some common mistakes to avoid:

- Over-reliance on technical indicators: Relying too heavily on technical indicators can lead to false signals and poor trading decisions. While indicators can be useful, they should not replace the core principles of price action analysis.

- Failure to adapt to changing market conditions: Markets are dynamic and constantly evolving. Failing to adapt to changing market conditions can lead to poor trading decisions and significant losses. Stay flexible and adjust your strategies as needed.

- Insufficient risk management: Failing to implement adequate risk management strategies can lead to significant losses and even account blowouts. Always prioritize risk management to protect your capital.

- Lack of discipline: Sticking to a trading plan and maintaining discipline is crucial. Impulsive decisions and emotional trading can result in poor outcomes. Develop a solid trading plan and adhere to it consistently.

- Inadequate market analysis: Thorough market analysis is essential for making informed trading decisions. Failing to conduct proper analysis can lead to poor trades and significant losses. Take the time to analyze the market and understand the factors driving price movements.

By avoiding these common mistakes and implementing effective risk management and position sizing strategies, traders can improve their chances of success in price action trading.

Current and Future Similarities (Cryptos vs. More Established Markets)

While there is much more to be said about how traders generally think and act when it comes to trading, the important point is that the cryptocurrency market has already displayed the same ‘core’ price action characteristics that are commonly found throughout other financial markets.

The cryptocurrency market is also expected to continue making moves that will resemble the predominant characteristics of traditional financial instruments’ price behavior.

Therefore, we can trade cryptocurrencies with ‘traditional’ technical analysis/price action techniques, especially because the cryptocurrency market’s limited technical and fundamental data offer traders little substance to build cryptocurrency-specific strategies with.

Try ‘buy-and-hold’ cryptocurrency trading

These traditional price action trading techniques will have to be customized to the individual cryptocurrencies, of course, but the great underlying strength of proper price action methods combined with prudent risk management is virtually guaranteed to bring success.

In Conclusion

Price action is very responsive and reveals an incredible amount of information about any financial instrument. Cunning price action techniques and technical analysis are destined to perform well in the cryptocurrency market, like in any other market.

Even in the absence of extensive historical cryptocurrency data, price action trading offers a high probability of success due to the universal characteristics of financial markets.

Start with cryptocurrency trading today!