Saxo Bank Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Saxo Bank Account

- Safety and Security

- Affiliate Partnership

- Refer a Friend

- Reward Tiers

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Saxo Bank

- Employee Overview of Working for Saxo Bank

- Pros and Cons

- In Conclusion

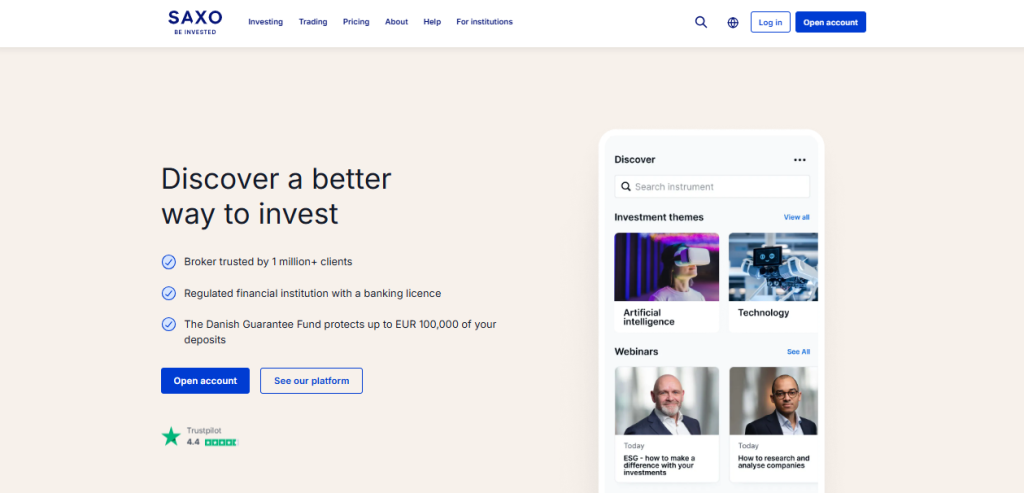

Saxo Bank is a respected and highly regulated broker with more than 30 years of experience in the industry. It is supervised by the UK’s Financial Conduct Authority (FCA) and the FSA. Saxo Bank has earned a strong trust score of 99 out of 100.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Overview

Saxo Bank continues to impress global investors with its advanced platforms, access to over 71,000 financial instruments, and a legacy of trust since 1992. Based in 🇩🇰 Denmark, the bank remains a secure and transparent option for both individuals and institutions seeking a robust trading experience.

Frequently Asked Questions

Is Saxo Bank safe and trustworthy for new traders?

Yes, Saxo Bank is a fully regulated institution licensed by global regulators, including 🇬🇧 FCA. Its strong emphasis on transparency and client protection makes it a reliable choice for new and experienced traders alike.

What sets Saxo Bank apart from other brokers?

Saxo offers an expansive product range, professional-grade platforms like SaxoTraderPRO, and superior research tools. Combined with exceptional client service and tight spreads, it positions itself as a premium broker for serious investors.

Our Insights

Saxo Bank offers a premium trading experience backed by global regulation, advanced technology, and market diversity. Although it may not suit budget-conscious beginners, the platform excels in reliability and depth, making it ideal for active traders and professionals seeking serious tools and security.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

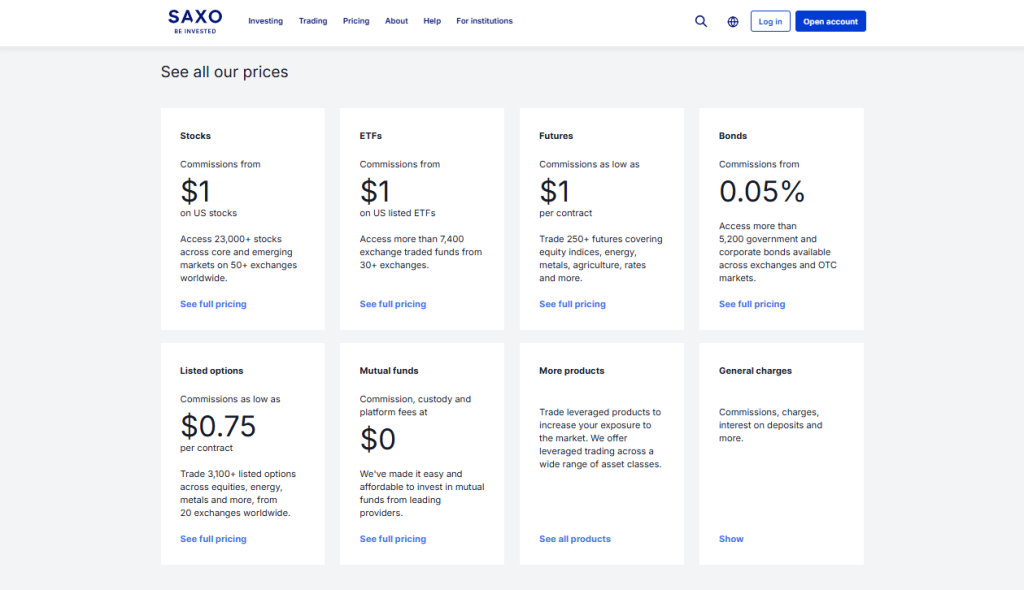

Fees, Spreads, and Commissions

Saxo Bank offers a highly competitive and transparent pricing model across asset classes such as stocks, ETFs, futures, options, and mutual funds. Traders benefit from low commissions starting at just $1 and even better rates for higher volumes, making it a cost-effective choice for serious investors.

| Asset Class | Commission (Starting) | Fee Notes |

| US Stocks | $1 per trade | Lower rates for higher volume |

| ETFs | Similar to stocks | Competitive, market-based |

| Futures | $1 per contract | Applies to major global markets |

| Mutual Funds | $0 | No custody or platform fees |

Frequently Asked Questions

How much does it cost to trade US stocks with Saxo Bank?

Saxo Bank charges as little as $1 per trade for US stocks. This competitive pricing appeals to both casual investors and high-volume traders aiming to maximize their returns.

Does Saxo Bank charge any fees for mutual funds?

No, Saxo Bank waives commission, custody, and platform fees on mutual funds. This allows investors to access top-tier funds without incurring extra costs, boosting long-term portfolio growth.

Our Insights

Saxo Bank delivers exceptional value through its low commissions, volume-based discounts, and zero-fee mutual funds. It’s transparent pricing model ensures traders always know what they’re paying, while the bank’s premium service and robust trading infrastructure elevate the overall experience.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

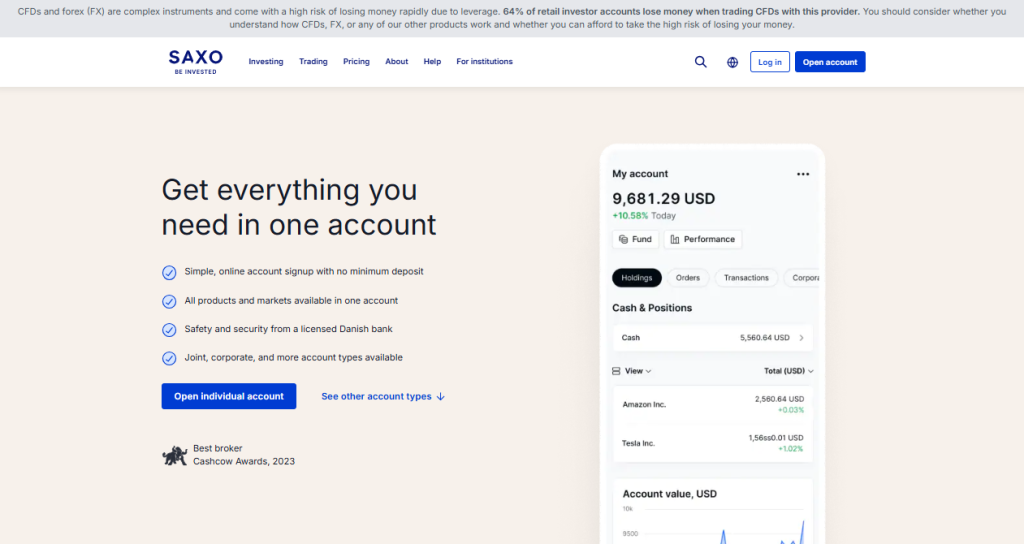

Minimum Deposit and Account Types

Saxo Bank offers accessible trading with no minimum deposit for standard accounts, opening the door for new investors. At the same time, it rewards larger deposits with enhanced services and lower fees. Multiple account types support everyone from casual traders to institutional clients.

| Feature | Standard Account | Premium Account |

| Minimum Deposit | None | Required for upgrade |

| Account Types | Individual Joint Corporate Professional | N/A |

| Multi-Currency Support | Yes | Yes |

| Regulatory Status | 🇩🇰 Danish Licensed Bank | 🇩🇰 Danish Licensed Bank |

Frequently Asked Questions

Is a minimum deposit required to open an account with Saxo Bank?

No, Saxo Bank does not require a minimum deposit for its standard account. However, clients who want access to lower fees and premium features can qualify for higher-tier accounts by depositing a set minimum amount.

What types of accounts does Saxo Bank offer?

Saxo provides a broad range of account types: individual, joint, corporate, and professional. This makes the platform suitable for personal investors, companies, and experienced traders looking for tailored financial solutions.

Our Insights

Saxo Bank offers flexibility and accessibility by not requiring an initial deposit, making it ideal for beginners. Yet, it also caters to experienced traders with premium-tier accounts. This dual-approach, backed by regulatory strength and decades of expertise, makes Saxo a trustworthy and dynamic broker.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

How to Open a Saxo Bank Account

Opening a Saxo Bank account is a straightforward process that can be completed in a few simple steps. Here’s a guide to help you get started:

1. Step 1: Visit Saxo’s Website

Go to the Saxo Bank website and click on the “Open Account” button. This will direct you to the registration page.

2. Step 2: Choose Your Account Type

Saxo offers various account types, such as Individual, Joint, Corporate, and Professional accounts. Select the account type that best suits your needs.

3. Step 3: Fill in Your Details

You’ll be asked to provide basic personal information such as:

- Name

- Date of birth

- Contact details (email, phone number)

- Residential address

- Employment details (profession, source of income)

You’ll also need to create a username and password for secure login.

4. Step 4: Verify Your Identity:

Saxo Bank requires identification documents to verify your identity and ensure compliance with regulatory requirements. This may include:

- A valid government-issued ID (passport or national ID card)

- Proof of address (e.g., a utility bill or bank statement)

- Upload the documents directly through the secure platform.

- Complete a Risk Profile Questionnaire

Saxo will ask you to fill out a brief questionnaire about your trading experience, risk tolerance, and investment goals. This helps the bank assess whether its services are suitable for you.

5. Step 5: Fund Your Account:

Once your account is verified, you’ll need to deposit funds to start trading. There is no minimum deposit requirement, though different tiers may be available depending on the amount you deposit. Saxo accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets.

After funding your account, you can access Saxo’s SaxoTraderGO or SaxoTraderPRO platform to begin trading in a wide range of financial instruments such as stocks, ETFs, forex, bonds, and more.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Safety and Security

Saxo Bank stands out as a secure trading platform regulated by top-tier authorities, including 🇬🇧FCA and 🇩🇰FSA. With over 30 years of experience, a solid banking foundation, and investor protections like negative balance protection, it prioritizes client safety across its global reach.

| Regulated By | 🇬🇧FCA 🇩🇰FSA Swiss Authorities |

| Years in Operation | 30+ Years |

| Negative Balance Protection | Yes (Retail Clients in EU, Some MENA) |

| Listed on Stock Exchange | None |

Frequently Asked Questions

Is Saxo Bank a regulated and trustworthy broker?

Yes, Saxo Bank is heavily regulated by high-trust authorities such as 🇬🇧FCA and 🇩🇰FSA. This, combined with its banking background and transparent financial practices, reinforces its credibility as a secure platform for both new and experienced traders.

Does Saxo Bank protect me if I lose more than my balance?

Yes, Saxo Bank offers negative balance protection for retail clients within the 🇪🇺EU and selected MENA countries. However, this protection does not apply to professional accounts or users from regions like 🇦🇺Australia, 🇸🇬Singapore, and 🇯🇵Japan.

Our Insights

Saxo Bank is a strong, security-focused broker backed by regulatory excellence, a banking legacy, and key investor protections. It provides traders peace of mind through compliance, transparency, and tailored safety features that support long-term trading confidence – even if it is not publicly listed.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Affiliate Partnership

Saxo Bank combines 30+ years of industry experience with innovative trading technology and global regulatory oversight. Through its affiliate program, partners such as marketers and educators can earn commissions by referring clients to a reputable broker offering access to over 70,000 financial instruments.

| Feature | Details |

| Instruments Available | 70,000+ |

| Platforms | SaxoTraderGO SaxoTraderPRO SaxoInvestor |

| Affiliate Program | Yes – Commission or Fixed-Fee Options |

| Global Clients | Over 1 million across 26 countries |

Frequently Asked Questions

What can affiliates earn by partnering with Saxo?

Saxo’s affiliate program allows partners to earn commissions based on either funded client referrals or a fixed-fee arrangement. This structure supports various partnership types, from content creators to institutional partners seeking monetization opportunities.

Which financial products are offered through Saxo Bank?

Saxo offers access to more than 70,000 instruments, including global stocks, ETFs, bonds, and mutual funds. These products are accessible via advanced platforms like SaxoTraderGO and SaxoTraderPRO, supporting both retail and professional trading needs.

Our Insights

Saxo Bank offers an attractive affiliate program backed by the strength of a global, fully regulated financial institution. With robust technology, a diverse product suite, and long-standing credibility, Saxo provides a valuable opportunity for both traders and affiliate partners seeking reliable earnings potential.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

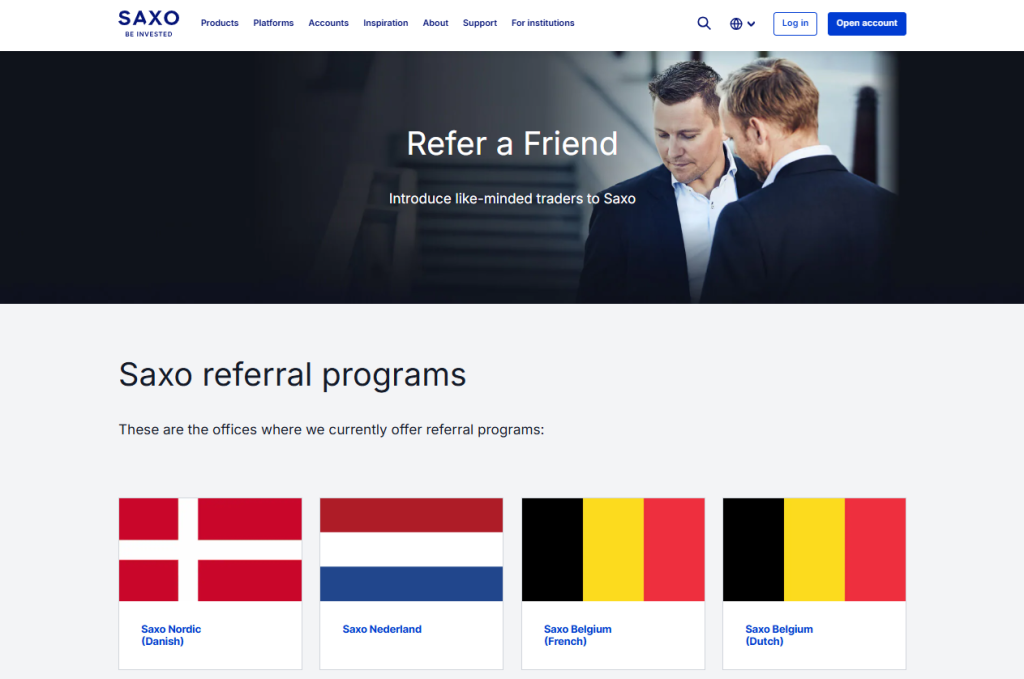

Refer a Friend

Saxo Bank empowers users to grow its trading community through a rewarding referral program available in multiple countries and languages. With a strong global presence, trusted platforms, and secure trading environments, Saxo makes it easy to share the experience and earn along the way.

| Feature | Details |

| Program Type | Refer-a-Friend |

| Platforms Included | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor |

| Reward Model | Regional reward incentives for successful referrals |

Frequently Asked Questions

What is Saxo’s refer-a-friend program?

The referral program allows Saxo users to invite friends and fellow traders to the platform. If a referral leads to a new account being opened and funded, the original user earns a reward, with availability depending on region and language.

Where is the Saxo referral program available?

🇩🇰 Denmark, 🇬🇧 the United Kingdom, 🇸🇬 Singapore, 🇦🇺 Australia, 🇧🇪 Belgium, and 🇨🇿 the Czech Republic are just some of the supported countries. The program is region-specific, with variations in availability and reward structure based on local offices.

Our Insights

Saxo Bank’s referral program offers a seamless way to earn while promoting a trusted trading platform. With availability in multiple languages and countries, it caters to a global user base. Backed by Saxo’s credibility and advanced platforms, this program is both practical and rewarding.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

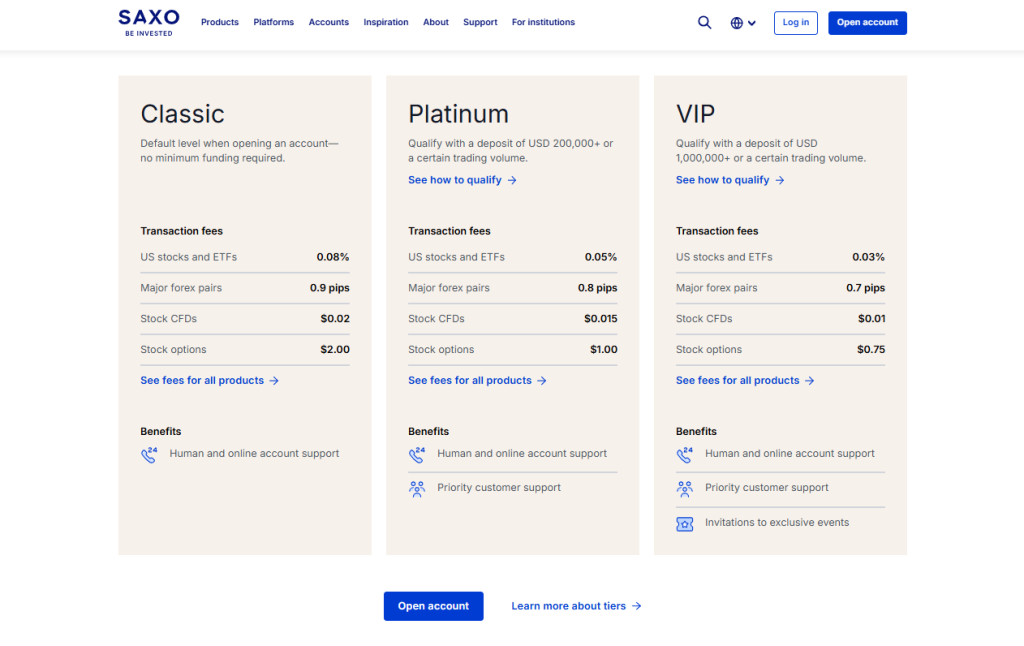

Reward Tiers

Saxo Bank’s Saxo Rewards loyalty program allows clients to earn points for every qualifying trade. These points unlock account upgrades to Classic, Platinum, or VIP tiers, each offering enhanced benefits like better pricing, tailored support, and expert insights. It’s a smart way to reward active traders with real, tangible perks.

| Tier | Entry Requirement | Benefits |

| Classic | Default tier | Standard pricing and support |

| Platinum | Moderate trading volume | Lower commissions, enhanced service |

| VIP | High trading volume | Personalized support, expert insights, top pricing |

Frequently Asked Questions

How do I join Saxo Rewards?

You’re automatically enrolled once you open a Saxo Bank account. As you begin trading, you start collecting reward points that help you move up tiers and unlock benefits.

How do I move to a higher account tier?

Earn points through qualified trading activity and deposits. As your points grow, you’ll automatically be upgraded to Platinum or VIP levels, offering better conditions and personalized services.

Our Insights

Saxo Rewards adds value to every trade you make, creating a clear path to improved trading conditions without requiring an upfront investment. Its transparent point system and tier-based benefits make it an appealing feature for both casual and high-volume traders.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

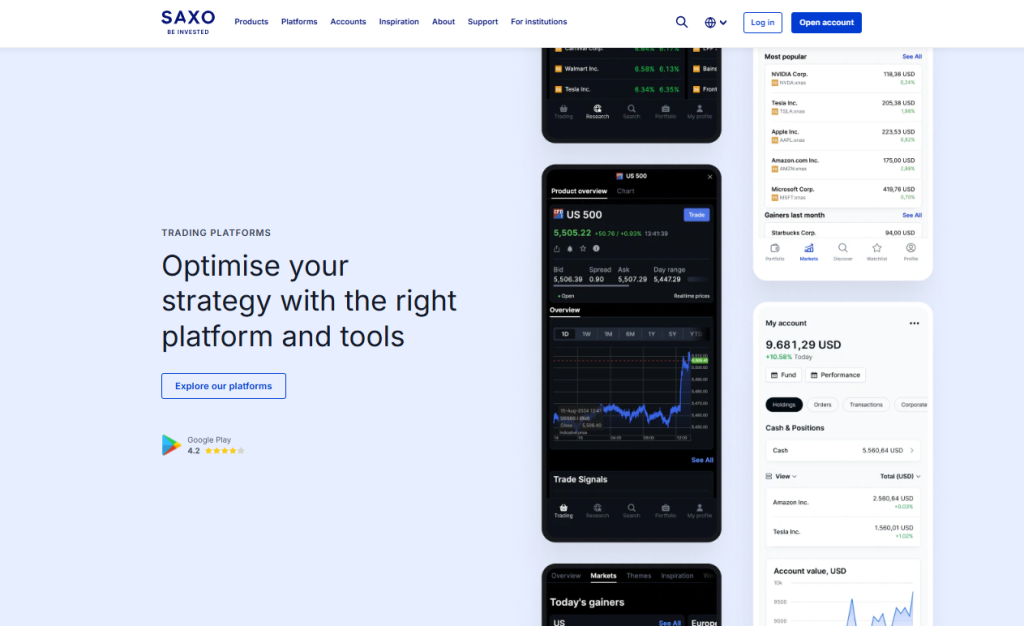

Trading Platforms and Tools

Saxo Bank delivers award-winning trading platforms tailored for all trader levels—from beginners to professionals. With support across web, desktop, and mobile, Saxo ensures secure, flexible, and high-performance access to a wide range of financial instruments globally, backed by top-tier technology and insightful tools.

| Feature | Details |

| Platform Types | Web Desktop Mobile |

| Products Supported | Stocks ETFs Forex Bonds CFDs |

| Award | Best Trading Platform (BrokerChooser 2025) |

| Demo Account | Yes (Limited-time simulated trading experience) |

Frequently Asked Questions

How can I access Saxo’s trading platforms?

You can access Saxo’s trading platforms by signing up on the Saxo Bank website or downloading the mobile apps from the Google Play Store or Apple App Store. Once registered, log in to start trading across multiple supported devices.

Are Saxo platforms free to use?

Yes, Saxo’s platforms are free for registered users. Some advanced tools or premium features may be available only through specific account tiers, like the Platinum or VIP levels, but the core trading platforms remain accessible to all account holders.

Our Insights

Saxo Bank provides one of the most complete and responsive platform experiences in the market. With robust tools, wide instrument coverage, and award-winning design, these platforms empower traders across all levels. Saxo’s flexibility and technology cement its place as a leader in online trading.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Markets Available for Trade

Saxo Bank delivers one of the most comprehensive market offerings in the trading industry, giving clients access to over 70,000 financial instruments. From stocks and ETFs to forex, crypto, CFDs, and structured products, Saxo supports virtually every trader’s strategy – whether short-term or long-term.

| Market Type | Example Instruments | Notes |

| Stocks ETFs | Apple Tesla Vanguard ETFs | Global exchanges supported |

| Forex | EUR/USD GBP/JPY | 180+ currency pairs |

| Commodities | Gold Oil Silver | Spot and CFD trading available |

| Cryptocurrencies | Bitcoin Ethereum Litecoin | Via ETPs or regulated products |

| Options Futures | Index options FX futures | For experienced traders |

| Mutual Funds | Global and regional fund access | Includes low-fee and actively managed |

| CFDs | Indices shares commodities | Long/short trading flexibility |

Frequently Asked Questions

What asset classes can I trade with Saxo Bank?

You can trade a vast selection of instruments, including global stocks, ETFs, bonds, forex pairs, CFDs, commodities, options, futures, mutual funds, and cryptocurrencies like Bitcoin and Ethereum.

Is global market access available on Saxo?

Yes, Saxo Bank connects you to top-tier exchanges worldwide, including the NYSE, NASDAQ, LSE, HKEX, and others – ensuring broad exposure to international opportunities.

Our Insights

Saxo Bank stands out for its market diversity and global reach. Whether you’re a casual investor or a professional trader, you’ll find tools and instruments tailored to your trading goals. With Saxo, you gain access to a powerhouse of trading possibilities – secure, regulated, and versatile.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Deposit and Withdrawal

Saxo Bank offers traders a smooth and reliable experience when it comes to funding and withdrawing from their accounts. With free bank transfers, instant card deposits, and trusted processing, Saxo ensures your money moves when and how you need it to – safely and efficiently.

| Method | Type | Processing Time | Fees |

| Bank Transfer | Deposit/Withdraw | 2–3 business days | None (bank fees may apply) |

| Credit Card | Deposit only | Instant | Varies by provider |

| Debit Card | Deposit only | Instant | Varies by provider |

| E-wallets (varies) | Deposit only | Instant or near-instant | Not always supported regionally |

Frequently Asked Questions

Are there any fees for depositing money with Saxo Bank?

Saxo Bank does not charge fees for bank transfer deposits. However, your bank or payment provider may apply third-party fees depending on your location or currency.

How long does a bank transfer take to process?

Bank transfers typically take 2–3 business days to reflect in your Saxo account. Processing times can vary slightly based on your bank’s policies.

Our Insights

Saxo Bank provides a streamlined and efficient funding experience, with instant card deposits and zero-fee bank transfers. While withdrawal methods are limited to bank transfers, the process is highly secure and dependable. Saxo prioritizes both speed and safety – essential qualities for any serious trader.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Insights from Real Traders

🥇 Reliable and Professional Trading Experience

I’ve been using Saxo Bank for several months now, and the overall experience has been fantastic. The platform is intuitive and easy to navigate, making it simple for both beginners and seasoned traders. Deposits are quick, and withdrawals are smooth without any hidden fees. – Gaby

⭐⭐⭐⭐

🥈 Top-Notch Service and Features

Saxo Bank has been a game-changer for my trading. Their platforms are among the best in the industry -whether you’re on mobile or desktop, everything runs smoothly and efficiently. The asset variety is impressive, and I’ve found the spreads and commissions to be competitive. – Tony

⭐⭐⭐⭐⭐

🥉 Great Platform with Strong Customer Support

Saxo Bank stands out with its comprehensive trading features and exceptional customer service. The platforms, especially SaxoTraderGO, are easy to use, and I appreciate how everything is in one place. Trading across various asset classes is a breeze, and the tools they offer are invaluable for making informed decisions. – Amy

⭐⭐⭐⭐

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Customer Reviews and Trust Scores

Third-party review platforms show a mixed sentiment toward Saxo Bank. While around 43 percent of Trustpilot ratings are positive, a significant portion is negative, with users frequently citing complaints about customer service responsiveness. Overall, feedback reflects both satisfaction and frustration among clients.

| Platform | Summary Rating/ Feedback |

| Trustpilot | ~43 percent positive reviews; many complaints about support |

| Reddit threads | Mixed: reliable bank but customer service often criticized |

The review data suggests potential clients should weigh Saxo’s strengths in products against reports of inconsistent service quality.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Discussions and Forums about Saxo Bank

Forums highlight a split perception: traders enjoy Saxo’s global platform access and product breadth, yet platforms and support issues generate frustration. Reports include delayed market data, high currency fees, and slow problem resolution.

| Topic | Community Feedback Summary |

| Fee Transparency | High forex conversion costs; custody and withdrawal fees questioned |

| Support Experience | Mixed service responses; some users comment on long delays or poor clarity |

| Interface and Usability | Interface preferred over competitors by some, though others find it clunky |

Thus, community sentiment underscores value but highlights drawbacks in support and cost clarity.

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Employee Overview of Working for Saxo Bank

Employee reviews on various platforms present a nuanced picture. Workers praise the opportunity to learn in a fast-paced fintech environment, but report issues with management, job security, and frequent reorganization. Ratings hover near 3.2 to 3.5 out of 5.

| Workplace Area | Employee Feedback Highlights |

| Culture | High learning potential but fast-paced and politically charged |

| Job Security | Frequent turnover and layoffs reported by former staff |

| Management | Leadership often seen as disorganized or dismissive |

| Compensation Benefits | Moderate pay, decent perks, but inconsistent salary growth |

★★★★ | Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| User-friendly platforms | Limited educational resources |

| Wide range of assets | High minimum funding for some tiers |

| Competitive spreads | No demo account for all platforms |

| Excellent customer support | Fees can be complex |

References:

In Conclusion

Saxo Bank maintains physical offices in major financial hubs around the world, offering in-region support and sales teams for clients. These local offices serve as touchpoints for client questions, onboarding assistance, and regional compliance.

- 🇩🇰 Denmark

- 🇬🇧 United Kingdom

- 🇫🇷 France

- 🇧🇪 Belgium

- 🇨🇿 Czech Republic

- 🇮🇹 Italy

- 🇳🇱 Netherlands

- 🇨🇭 Switzerland

- 🇦🇺 Australia

- 🇸🇬 Singapore

- 🇯🇵 Japan

- 🇦🇪 United Arab Emirates

These countries represent locations where Saxo has established office presence and offers local support services. Saxo Bank delivers localized client support through its international offices, making it easier for traders and investors in these regions to access assistance and services through a regional point of contact.

Faq

The minimum deposit requirement varies depending on the account type, and you can find more details during the registration process.

Yes, Saxo provides comprehensive customer support, including live chat, phone, and email assistance, to ensure a smooth trading experience.

Yes, Saxo’s trading platforms are available on both desktop and mobile devices, making it easy to trade on the go.

Saxo offers a variety of market insights, tutorials, and resources to help traders stay informed and make better investment decisions.

Saxo Bank operates with high levels of security, adhering to strict regulatory standards to ensure that clients’ investments are well-protected.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Saxo Bank Account

- Safety and Security

- Affiliate Partnership

- Refer a Friend

- Reward Tiers

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about Saxo Bank

- Employee Overview of Working for Saxo Bank

- Pros and Cons

- In Conclusion