Saxo Bank Review

- Overview

- Detailed Summary

- Safety and Security

- Affiliate Partnership

- Refer a Friend

- Minimum Deposit and Account Types

- Reward Tiers

- How to Open a Saxo Bank Account

- Trading Platforms and Tools

- Markets Available for Trade

- Fees, Spreads, and, Commissions

- Deposit and Withdrawal

- Customer Reviews

- Pros and Cons

- In Conclusion

Saxo Bank is a respected and highly regulated broker with more than 30 years of experience in the industry. It is supervised by the UK’s Financial Conduct Authority (FCA) and the FSA. Saxo Bank has earned a strong trust score of 99 out of 100.

🛡️Regulated and trusted by the FCA and the FSA

🛡️2700 new traders chose this broker in the last 90 days.

🛡️Available for global Traders.

| 🔎 Broker | 🥇 Saxo Bank |

| 📌 Year Founded | 1992 |

| 👤 Amount of staff | Approximately 2,000 |

| 👥 Amount of active traders | Over 800,000 |

| 📍 Publicly Traded | ✅Yes |

| ⭐ Regulation and Security | Very High |

| 🛡️ Regulation | FSA FCA |

| 📈 Account Segregation | ✅Yes |

| 📉 Negative balance protection | ✅Yes |

| 📊 Investor Protection Schemes | ✅Yes |

| 💹 Account Types and Features | SaxoTraderGO, SaxoTraderPRO |

| 🅰️ Institutional Accounts | Available |

| 🅱️ Managed Accounts | Available |

| 💴 Minor account currencies | ✅Yes |

| 💶 Minimum Deposit | Varies by account type and region |

| ⏰ Avg. deposit processing time | Typically 1-2 business days |

| ⏱️ Avg. Withdrawal processing time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | No standard fee, may vary depending on method |

| 💷 Spreads from | 0.4 pips (varies by instrument and market conditions) |

| 💳 Commissions | Variable, depending on account type and trading volume |

| 💸 Number of base currencies | Over 40 |

| 💲 Swap Fees | Varies depending on account type and instrument |

| ▶️ Leverage | Up to 1:200 (varies by asset class and jurisdiction) |

| ⏹️ Margin requirements | Varies by asset class |

| ☪️ Islamic account | Available |

| 🆓 Demo Account | ✅Yes |

| ⌚ Order Execution Time | Typically milliseconds to seconds |

| 🖥️ VPS Hosting | Available |

| 📊 CFDs Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📈 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit cards, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit cards, e-wallets |

| 💻 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 🖱️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex trading tools | Advanced charting, research tools, trading signals |

| 🥰 Customer Support | Very Responsive |

| 🗯️ Live chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact | Varies by Region |

| 🐦 Social media | Facebook, Twitter, |

| 🔖 Languages | Multiple languages including English, Danish, German, etc. |

| 🏷️ Forex course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📔 Educational Resources | Yes (includes articles, videos, and courses) |

| 🫰🏻 Affiliate program | ✅Yes |

| 🫶 Amount of partners | Numerous |

| 🤝 IB Program | ✅Yes |

| 🌟 Sponsor notable events/teams | Various |

| 💰 Rebate program | ✅Yes |

| 😊 Suited to Beginners | ✅Yes |

| 😎 Suited to Professionals | ✅Yes |

| ♒ Suited to Active Traders | ✅Yes |

| 💡 Suited to Scalpers | ✅Yes |

| 🌞 Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Overview

Saxo Bank is an award-winning financial institution that has been a trusted partner for over 1,200,000 clients worldwide. Founded in Copenhagen, Denmark in 1992, Saxo has grown into a fully regulated and licensed provider of online trading platforms. Offering access to over 71,000 financial instruments, Saxo connects investors and traders to global markets.

The bank is known for its commitment to transparency, security, and client satisfaction, ensuring reliable access to various financial products across multiple platforms. Saxo serves individual traders and institutional clients, helping them make the most of their investments.

Frequently Asked Questions

What is Saxo Bank?

Saxo Bank is an award-winning financial institution that provides online trading platforms to investors and traders globally, offering access to a wide range of financial instruments.

Is Saxo Bank regulated?

Yes, Saxo Bank is a fully regulated financial institution with licenses from regulatory authorities like the UK Financial Conduct Authority (FCA) and other international bodies.

What products can I trade with Saxo?

Saxo offers over 71,000 financial instruments including stocks, ETFs, bonds, mutual funds, and more.

What platforms does Saxo provide?

Saxo offers several trading platforms including SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor for different levels of experience and investment needs.

Our Insights

Saxo Bank is a trusted, highly regulated financial institution that offers a broad range of investment options on its intuitive trading platforms. Whether you’re an individual investor or part of an institution, Saxo delivers a reliable, secure, and dynamic environment for trading.

Detailed Summary

| 🔎 Broker | 🥇 Saxo Bank |

| 📌 Year Founded | 1992 |

| 👤 Amount of staff | Approximately 2,000 |

| 👥 Amount of active traders | Over 800,000 |

| 📍 Publicly Traded | ✅Yes |

| ⭐ Regulation and Security | Very High |

| 🛡️ Regulation | FSA FCA |

| 📈 Account Segregation | ✅Yes |

| 📉 Negative balance protection | ✅Yes |

| 📊 Investor Protection Schemes | ✅Yes |

| 💹 Account Types and Features | SaxoTraderGO, SaxoTraderPRO |

| 🅰️ Institutional Accounts | Available |

| 🅱️ Managed Accounts | Available |

| 💴 Minor account currencies | ✅Yes |

| 💶 Minimum Deposit | Varies by account type and region |

| ⏰ Avg. deposit processing time | Typically 1-2 business days |

| ⏱️ Avg. Withdrawal processing time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | No standard fee, may vary depending on method |

| 💷 Spreads from | 0.4 pips (varies by instrument and market conditions) |

| 💳 Commissions | Variable, depending on account type and trading volume |

| 💸 Number of base currencies | Over 40 |

| 💲 Swap Fees | Varies depending on account type and instrument |

| ▶️ Leverage | Up to 1:200 (varies by asset class and jurisdiction) |

| ⏹️ Margin requirements | Varies by asset class |

| ☪️ Islamic account | Available |

| 🆓 Demo Account | ✅Yes |

| ⌚ Order Execution Time | Typically milliseconds to seconds |

| 🖥️ VPS Hosting | Available |

| 📊 CFDs Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📈 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit cards, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit cards, e-wallets |

| 💻 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 🖱️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex trading tools | Advanced charting, research tools, trading signals |

| 🥰 Customer Support | Very Responsive |

| 🗯️ Live chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact | Varies by Region |

| 🐦 Social media | Facebook, Twitter, |

| 🔖 Languages | Multiple languages including English, Danish, German, etc. |

| 🏷️ Forex course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📔 Educational Resources | Yes (includes articles, videos, and courses) |

| 🫰🏻 Affiliate program | ✅Yes |

| 🫶 Amount of partners | Numerous |

| 🤝 IB Program | ✅Yes |

| 🌟 Sponsor notable events/teams | Various |

| 💰 Rebate program | ✅Yes |

| 😊 Suited to Beginners | ✅Yes |

| 😎 Suited to Professionals | ✅Yes |

| ♒ Suited to Active Traders | ✅Yes |

| 💡 Suited to Scalpers | ✅Yes |

| 🌞 Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Frequently Asked Questions

How do I open an account with Saxo?

You can open an account by visiting Saxo’s website and following the registration process, which involves providing necessary personal and financial information.

What are the fees for trading with Saxo?

Saxo’s pricing is competitive and varies based on the product and platform used. You can find specific pricing details on their website.

Can Saxo be used by institutions?

Yes, Saxo provides trading solutions for institutions, banks, brokers, and financial intermediaries through advanced technology and APIs.

Is Saxo available in my country?

Saxo Bank is available globally and operates in over 15 countries, offering tailored services based on local regulations.

Our Insights

Saxo Bank is a global leader in online trading, known for its award-winning platforms, strong regulation, and vast selection of financial instruments. It’s an excellent choice for serious traders looking to access international markets securely and efficiently.

Safety and Security

Saxo Bank is a well-established and reputable brokerage that has been operating for over 30 years. It is regulated by several top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA) and the Danish Financial Services Agency (FSA).

With a banking background and a strong focus on transparency, Saxo Bank offers a high level of protection to its clients, including negative balance protection for retail clients in the EU and some MENA countries. Although it is not listed on the stock exchange, Saxo’s solid regulatory oversight and commitment to security make it a trustworthy option for investors.

Frequently Asked Questions

Is Saxo Bank regulated?

Yes, Saxo Bank is regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Danish Financial Services Agency (FSA), and the Swiss Federal Banking Commission, among others.

Is Saxo safe to use for trading?

Yes, Saxo Bank is considered safe due to its strong regulatory status, banking background, transparency in financial reporting, and the provision of investor protection measures like negative balance protection for eligible retail clients.

What kind of protection does Saxo offer for my funds?

Saxo provides varying levels of protection depending on the country of residence. For most European clients, it offers up to €100,000 for cash and €20,000 for securities. However, there is no protection for clients in some countries such as Australia, Singapore, and Japan.

Does Saxo provide negative balance protection?

Yes, Saxo offers negative balance protection for retail clients in the EU and some MENA regions, but this protection does not apply to professional clients or clients from certain other regions.

Our Insights

Saxo Bank is a highly secure and reliable brokerage with strong regulatory oversight from top-tier authorities, a banking background, and a transparent approach to financial data. It offers protection measures like negative balance protection for retail clients in certain regions, enhancing its safety profile. While not listed on the stock exchange, Saxo’s reputation, longevity, and commitment to security make it a trustworthy choice for investors seeking a safe and regulated trading environment.

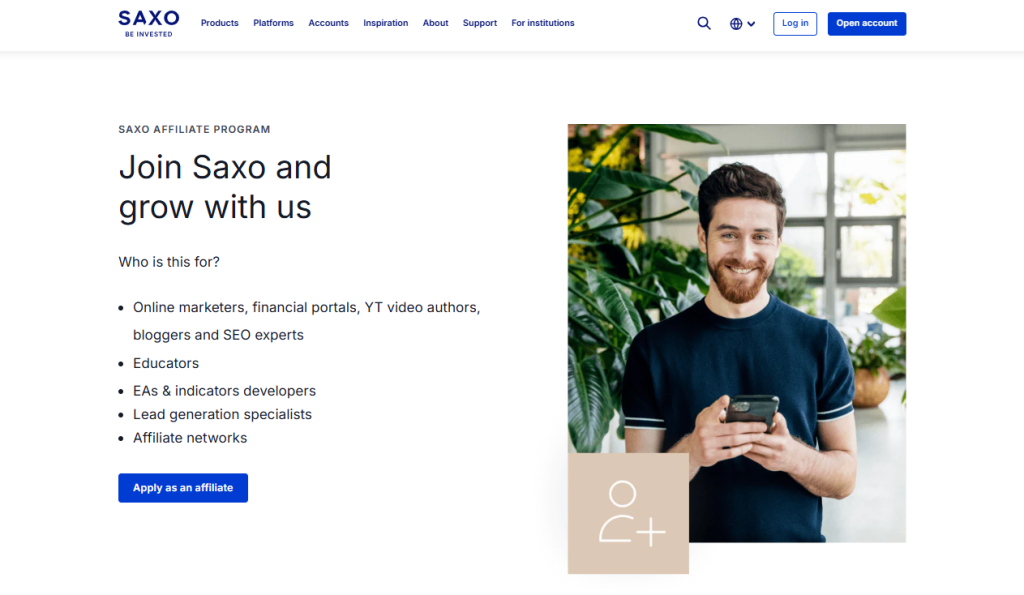

Affiliate Partnership

Saxo Bank is a globally recognized, fully regulated financial institution with over 30 years of experience. Serving more than 1 million clients across 26 countries, Saxo offers access to over 70,000 financial instruments, including stocks, ETFs, bonds, and mutual funds. Through its cutting-edge platforms like SaxoTraderGO and SaxoTraderPRO, Saxo provides an intuitive trading experience for both retail and institutional clients.

The bank also features an affiliate program, enabling marketers, bloggers, educators, and financial experts to earn commissions by referring clients to Saxo. Saxo’s reputation is built on its long-standing industry presence, transparent business practices, and commitment to delivering high-quality investment solutions.

Frequently Asked Questions

What types of products does Saxo offer?

Saxo provides a wide variety of financial products, including stocks, ETFs, bonds, mutual funds, and other investment instruments. Clients have access to more than 70,000 financial products across global markets.

What platforms are available for trading with Saxo?

Saxo offers several trading platforms, such as SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor, each catering to different trading needs and experience levels.

How does Saxo’s affiliate program work?

Saxo’s affiliate program allows marketers, financial portals, and other partners to earn commissions by referring new clients to Saxo. Affiliates can earn based on the number of funded clients or via a fixed-fee cooperation arrangement.

What benefits do Saxo clients get?

Saxo clients enjoy access to over 70,000 financial instruments, cutting-edge platforms for trading, and the security of working with a well-regulated financial institution headquartered in Denmark. The bank also offers various account types tailored to individual and institutional needs.

Our Insights

Saxo Bank stands out as a trustworthy and reliable financial institution with a vast range of products and powerful trading platforms. Its long history of successful operations, paired with its transparent business practices and strong regulatory backing, make it an excellent choice for traders and investors. The opportunity to participate in Saxo’s affiliate program provides an additional avenue for earning commissions, making Saxo a versatile platform for both clients and business partners.

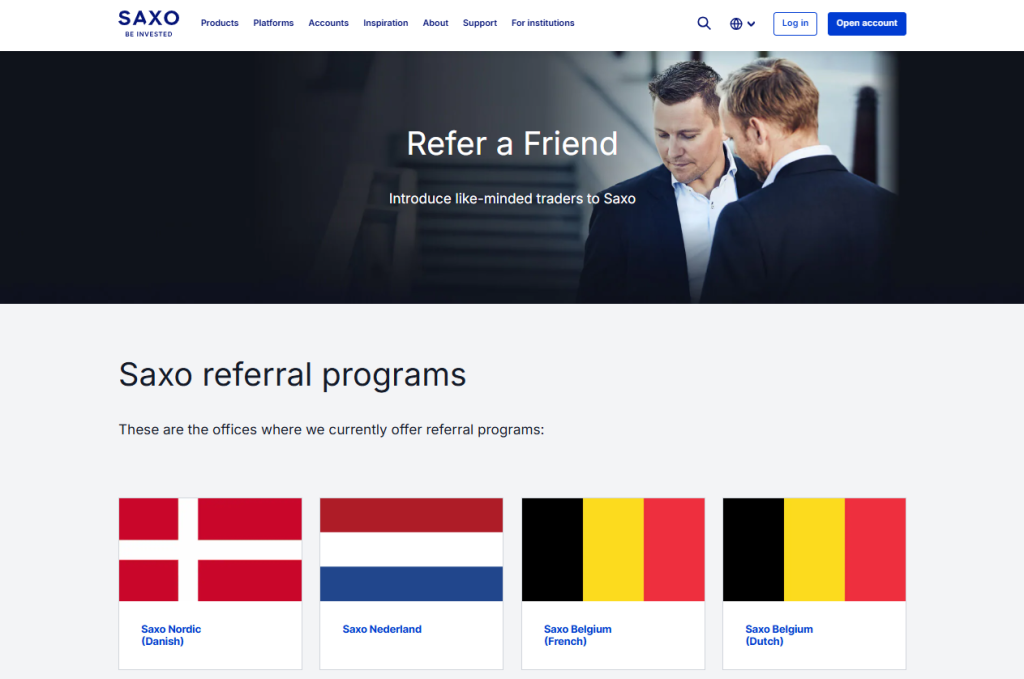

Refer a Friend

Saxo Bank offers a comprehensive referral program that allows users to introduce like-minded traders to the platform and earn rewards. Available in multiple regions, the program is designed to reward individuals who help grow the Saxo community. This program is available in several languages and regions, including Denmark, the UK, Singapore, Australia, and more.

With access to a broad range of financial products and services, Saxo provides a secure and transparent environment for both experienced and novice traders. The platform offers multiple trading options through its advanced platforms like SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor.

Frequently Asked Questions

What is the Saxo referral program?

The Saxo referral program allows users to introduce new traders to the platform and earn rewards for successful referrals. The program is available in various countries and languages, including the UK, Denmark, Singapore, and Australia.

Which regions are eligible for the Saxo referral program?

Saxo’s referral program is available in several countries, including Denmark, the UK, Singapore, Australia, Belgium, the Czech Republic, and more. The specific locations vary based on the language and office availability.

How do I participate in the referral program?

To participate, simply sign up for the referral program on the Saxo website, receive a unique tracking link, and start referring potential traders to the platform. If your referral results in a successful account opening and funding, you will earn rewards.

What rewards can I earn from the Saxo referral program?

The exact rewards depend on the specific terms and conditions of the program in your region, but Saxo typically offers monetary incentives based on the number of successful referrals who open and fund accounts.

Our Insights

Saxo Bank’s referral program is a great way to earn rewards while introducing others to the platform. It’s easy to participate, with multiple regions and languages covered, making it accessible to a global audience. Saxo’s reputation as a well-established, secure, and regulated financial institution adds to the appeal of its referral program, offering a reliable platform to share with potential traders.

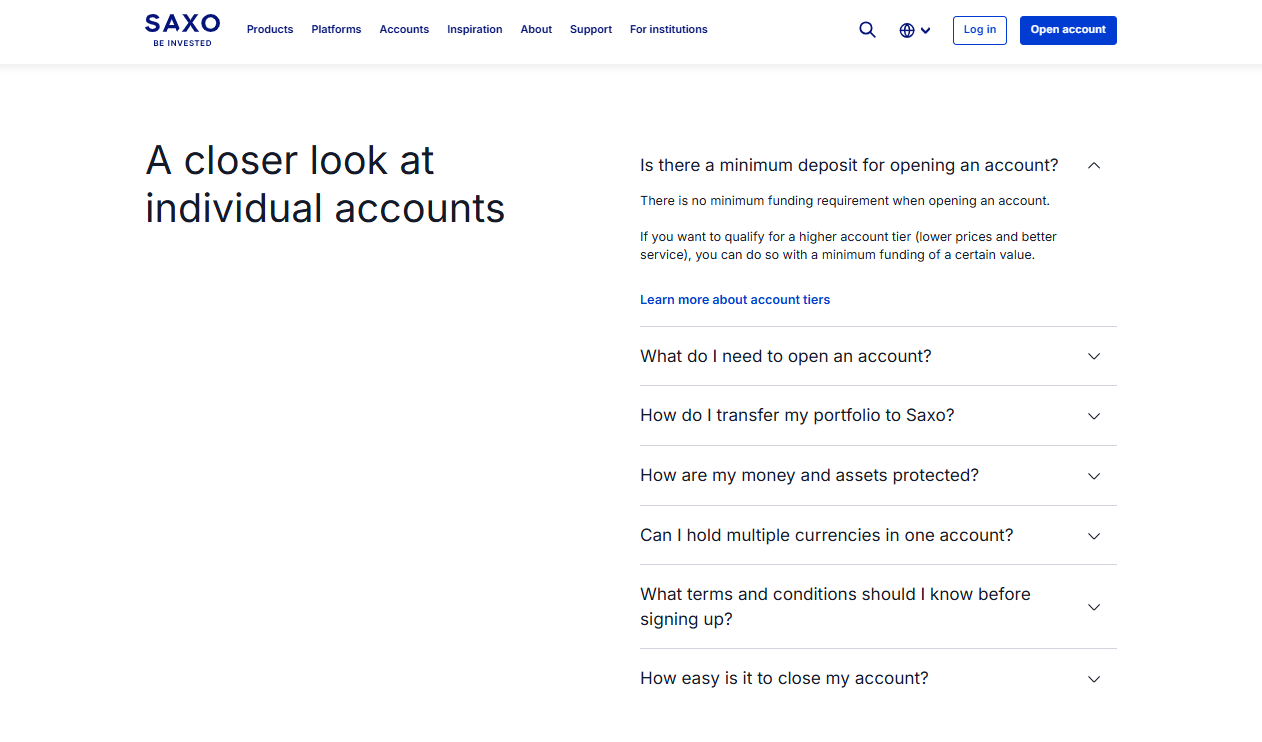

Minimum Deposit and Account Types

Saxo Bank offers a variety of account types with no minimum deposit required for opening an account. This allows for easy access for new traders who wish to start investing. While there is no initial deposit requirement, those looking for better service and lower fees can qualify for higher account tiers by depositing a minimum amount.

Saxo provides flexibility by offering individual, joint, corporate, and professional accounts, catering to a wide range of investment needs. Clients also benefit from the security of a licensed Danish bank, with an S&P credit rating and 30+ years of experience in the industry.

Frequently Asked Questions

Is there a minimum deposit required to open an account?

No, there is no minimum deposit required to open a standard account with Saxo. However, to qualify for higher account tiers with reduced prices and enhanced services, a minimum deposit may be necessary.

What account types does Saxo offer?

Saxo offers several account types, including individual accounts, joint accounts, corporate accounts, and professional accounts. Each is designed to meet the needs of different types of investors, from individuals to companies and professional traders.

How do I qualify for a higher account tier?

To qualify for a higher account tier, you need to make a minimum deposit that varies depending on the tier you want to access. This grants you benefits such as lower fees and enhanced services.

Can I hold multiple currencies in my Saxo account?

Yes, Saxo allows clients to hold multiple currencies in one account, offering flexibility for global trading and investments.

Our Insights

Saxo Bank offers a user-friendly platform with no minimum deposit requirement to open an account, making it accessible to new traders. For those looking for premium services and lower fees, higher account tiers are available with a minimum deposit.

With options ranging from individual to professional accounts, Saxo is a versatile broker suitable for a variety of investment styles. The security and transparency provided by the licensed Danish bank add credibility to its offerings, making it a reliable choice for traders globally.

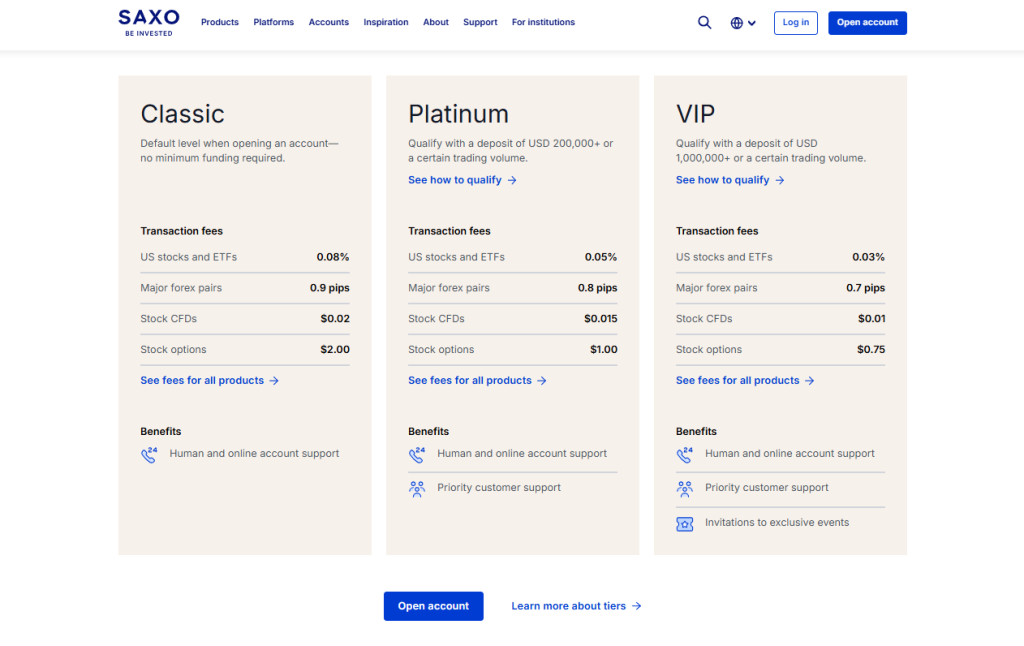

Reward Tiers

Saxo Bank offers a unique loyalty program, Saxo Rewards, where clients can earn reward points for each qualifying trade. These points can be accumulated to unlock better account tiers with upgraded services, lower prices, and priority support. The program includes three account tiers: Classic, Platinum, and VIP, each offering a range of benefits such as tighter entry prices, personalized customer support, and access to trading experts.

Saxo also offers transparency in the points system, allowing clients to track their rewards in real-time, with no minimum initial funding required to join the program.

Frequently Asked Questions

How do I join Saxo Rewards?

To join Saxo Rewards, simply open an account with Saxo Bank. Once your account is set up, you can start earning points every time you place a qualifying trade. Based on your trading activity and account funding, you can qualify for higher tiers.

How do I upgrade my account tier?

To upgrade your account tier, you need to accumulate enough reward points. Points can be earned through qualifying trades and other activities, such as adding funds to your account. Higher tiers unlock better trading conditions, including lower prices and enhanced support.

How long will I stay in my account tier?

Your account tier will remain based on your accumulated points. As long as you continue meeting the required points threshold, you’ll stay in your current tier. If your points decrease over time, you may be moved to a lower tier, but you can continue earning points to climb back up.

What activities can earn me points?

Points are earned every time you place a qualifying trade. Different asset classes and trade sizes are worth varying amounts of points. Additionally, you can earn points by funding your account, further boosting your potential to upgrade to higher tiers.

Our Insights

The Saxo Rewards program offers an excellent opportunity for traders to receive valuable perks by simply engaging in more trades. With no minimum deposit required to start, clients can easily begin earning reward points, which can help them qualify for better pricing, enhanced service, and priority support.

The program provides clear transparency, as users can track their points balance in real time. Whether you’re just starting or are an experienced trader, the Classic, Platinum, and VIP tiers cater to a variety of needs, making Saxo a compelling option for those looking to enjoy a better trading experience.

How to Open a Saxo Bank Account

Opening a Saxo Bank account is a straightforward process that can be completed in a few simple steps. Here’s a guide to help you get started:

1. Step 1: Visit Saxo’s Website

Go to the Saxo Bank website and click on the “Open Account” button. This will direct you to the registration page.

2. Step 2: Choose Your Account Type

Saxo offers various account types, such as Individual, Joint, Corporate, or Professional accounts. Select the account type that best suits your needs.

3. Step 3: Fill in Your Details

You’ll be asked to provide basic personal information such as:

- Name

- Date of birth

- Contact details (email, phone number)

- Residential address

- Employment details (profession, source of income)

You’ll also need to create a username and password for secure login.

4. Step 4: Verify Your Identity:

Saxo Bank requires identification documents to verify your identity and ensure compliance with regulatory requirements. This may include:

- A valid government-issued ID (passport or national ID card)

- Proof of address (e.g., a utility bill or bank statement)

- Upload the documents directly through the secure platform.

- Complete a Risk Profile Questionnaire

Saxo will ask you to fill out a brief questionnaire about your trading experience, risk tolerance, and investment goals. This helps the bank assess whether their services are suitable for you.

5. Step 5: Fund Your Account:

Once your account is verified, you’ll need to deposit funds to start trading. There is no minimum deposit requirement, though different tiers may be available depending on the amount you deposit. Saxo accepts various payment methods, including bank transfers, credit/debit cards, and e-wallets.

After funding your account, you can access Saxo’s SaxoTraderGO or SaxoTraderPRO platform to begin trading in a wide range of financial instruments such as stocks, ETFs, forex, bonds, and more.

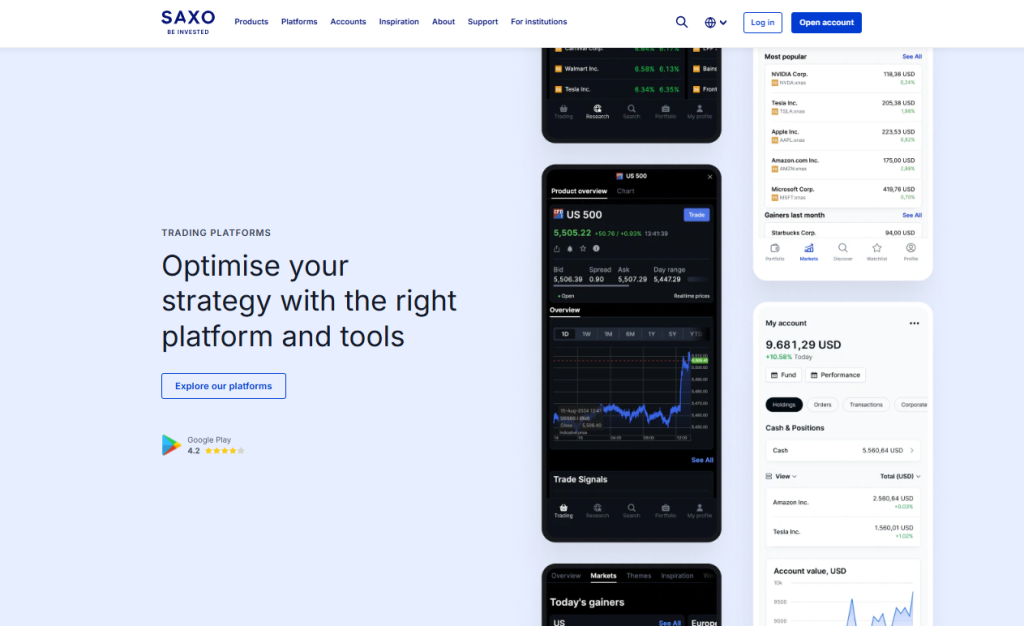

Trading Platforms and Tools

Saxo Bank provides a comprehensive suite of trading platforms that cater to all types of investors, whether you’re a beginner or a seasoned professional. Their platforms are available on web, mobile, and desktop devices, offering an intuitive and fast trading experience. Saxo’s platforms allow users to trade a broad range of financial products, including stocks, bonds, ETFs, forex, and more. With robust tools and market insights, Saxo ensures that you can trade efficiently and effectively, no matter your device or location.

Saxo’s platforms are recognized for their reliability and are consistently rated as some of the best in the industry, winning accolades such as “Best Trading Platform” from BrokerChooser in 2025. Whether you’re looking for simplicity or advanced features, Saxo has something to suit every trader’s needs.

Frequently Asked Questions

How do I access Saxo’s trading platforms?

You can access Saxo’s trading platforms by visiting the Saxo Bank website or downloading mobile apps from Google Play or the Apple App Store. You’ll need to create an account and log in to start trading.

Are Saxo’s platforms free to use?

Yes, Saxo’s platforms are free to use for clients with a registered account. However, certain features may depend on your account tier or the type of service you subscribe to, such as the VIP offering.

Can I try a stock market simulator or paper trading with Saxo?

Saxo does not offer a traditional paper trading account, but you can explore the platform with demo accounts to simulate trades and get familiar with the interface before committing real money.

Can I see the platforms before signing up?

Yes, Saxo offers detailed platform information, including demos and tutorials, on its website. You can also access the platforms after signing up for a free demo account to explore their features.

Our Insights

Saxo Bank offers one of the most versatile and user-friendly platforms in the trading industry. Whether you’re a beginner or a professional trader, Saxo’s platforms provide the flexibility to trade a wide range of assets across various devices. With cutting-edge technology, superior customer support, and award-winning services, Saxo continues to stand out as a top choice for traders worldwide.

Markets Available for Trade

Saxo Bank offers an extensive range of trading options, providing access to over 70,000 financial instruments. You can trade global stocks, ETFs, bonds, and forex pairs, including both major and minor currencies. Additionally, you can trade CFDs on a variety of assets such as commodities, equities, and indices, allowing for a diverse and flexible investment portfolio. Other options include commodities like gold, silver, and oil, as well as cryptocurrencies such as Bitcoin and Ethereum.

Saxo also provides access to options and futures, mutual funds, and structured products, enabling traders to diversify their strategies. Whether you’re interested in long-term investments or short-term speculative trading, Saxo Bank’s wide range of instruments and advanced platforms make it a great choice for traders of all levels.

Frequently Asked Questions

What asset classes can I trade with Saxo Bank?

You can trade stocks, ETFs, bonds, forex, commodities, CFDs, options, futures, mutual funds, and cryptocurrencies.

Is there access to global markets on Saxo Bank?

Yes, Saxo Bank provides access to global markets, including major exchanges like the NYSE, NASDAQ, London Stock Exchange, and more.

Can I trade cryptocurrencies with Saxo Bank?

Yes, Saxo Bank allows you to trade major cryptocurrencies like Bitcoin, Ethereum, and other digital currencies.

Are there any fees for trading with Saxo Bank?

Saxo Bank offers competitive spreads and low commissions, but the fees can vary depending on the asset class and account type. It’s always a good idea to check the pricing overview for detailed information.

Our Insights

Saxo Bank is an excellent platform for anyone looking to trade a wide array of financial instruments. From stocks and forex to cryptocurrencies and commodities, Saxo provides diverse trading opportunities. Their advanced platforms, low fees, and access to global markets make them an appealing choice for both beginner and experienced traders.

Whether you’re looking to trade actively or hold long-term investments, Saxo Bank’s comprehensive product range ensures you have the tools to succeed.

Fees, Spreads, and, Commissions

Saxo Bank offers highly competitive fees, spreads, and commissions across a wide range of asset classes. Whether you’re trading stocks, ETFs, bonds, futures, or options, Saxo provides ultra-competitive pricing, with even better rates for higher trading volumes. For example, you can trade US stocks starting at just $1 per transaction and US-listed ETFs with similar low commissions.

Futures contracts have commissions starting at $1 per contract, and listed options begin as low as $0.75 per contract. They also offer mutual funds with no commission, custody, or platform fees, making it easy and affordable to invest in top funds. Saxo Bank’s transparent pricing structure ensures clients know what they’ll pay upfront, without hidden fees.

Their focus on delivering excellent value is matched by 24/5 expert support and dedicated relationship managers for active traders.

Frequently Asked Questions

What is the commission for trading US stocks on Saxo Bank?

The commission for trading US stocks starts from just $1 per trade.

Are there any fees for trading mutual funds with Saxo Bank?

Saxo Bank charges no commission, custody, or platform fees for mutual funds, making it cost-effective for investors.

What is the commission for trading futures on Saxo Bank?

Commissions for futures contracts start at $1 per contract.

Do Saxo Bank’s fees depend on trading volume?

Yes, Saxo offers better rates for clients with higher trading volumes, rewarding frequent traders with even lower spreads and commissions.

Our Insights

Saxo Bank stands out for its low and transparent pricing across a broad spectrum of asset classes. With competitive spreads and commissions that benefit both high-volume traders and casual investors, Saxo delivers an excellent value proposition.

The flexibility to enjoy lower fees with increased trading activity, combined with no fees for mutual funds, makes Saxo Bank an attractive choice for traders at all levels. Their world-class support ensures that traders have the help they need, whenever they need it.

Deposit and Withdrawal

Saxo Bank provides a variety of deposit and withdrawal methods, allowing clients flexibility and convenience when funding their accounts or retrieving their funds. Deposits can be made via bank transfers, credit and debit cards, or e-wallets, ensuring a smooth and easy process. Bank transfers are free of charge, though they typically take 2-3 business days to process.

In contrast, credit and debit card deposits are processed instantly, enabling quick access to your trading account. For withdrawals, Saxo Bank supports bank transfers, which are a secure and reliable way to access your funds.

Frequently Asked Questions

Are there any fees for depositing money with Saxo Bank?

Saxo Bank does not charge any fees for bank transfer deposits. However, third-party fees may apply depending on your bank.

How long does it take for a bank transfer deposit to be processed?

Bank transfers usually take 2-3 business days to arrive in your Saxo Bank account.

Are credit and debit card deposits instant with Saxo Bank?

Yes, credit and debit card deposits are typically processed instantly, giving you immediate access to funds.

Can I withdraw money using a method other than bank transfers?

Currently, bank transfers are the only option available for withdrawals at Saxo Bank.

Our Insights

Saxo Bank provides multiple deposit and withdrawal methods to suit the needs of different traders. With no fees on bank transfers and instant card deposits, Saxo ensures a user-friendly experience. However, while withdrawals are limited to bank transfers, the process is secure and efficient, making it a dependable way to access your funds.

Customer Reviews

🥇 Reliable and Professional Trading Experience

I’ve been using Saxo Bank for several months now, and the overall experience has been fantastic. The platform is intuitive and easy to navigate, making it simple for both beginners and seasoned traders. Deposits are quick, and withdrawals are smooth without any hidden fees. I especially appreciate the wide range of assets and the excellent customer support. Saxo has truly exceeded my expectations! – Gaby

🥈 Top-Notch Service and Features

Saxo Bank has been a game-changer for my trading. Their platforms are among the best in the industry -whether you’re on mobile or desktop, everything runs smoothly and efficiently. The asset variety is impressive, and I’ve found the spreads and commissions to be competitive. Customer support is prompt and helpful whenever I have questions, and the overall experience is seamless. I’m very happy with the service! – Tony

🥉 Great Platform with Strong Customer Support

Saxo Bank stands out with its comprehensive trading features and exceptional customer service. The platforms, especially SaxoTraderGO, are easy to use, and I appreciate how everything is in one place. Trading across various asset classes is a breeze, and the tools they offer are invaluable for making informed decisions. Their customer support is always responsive, and I’ve never had a bad experience. Highly recommend Saxo for both novice and experienced traders alike. – Amy

Pros and Cons

| ✅ Pros | ❌ Cons |

| User-friendly platforms | Limited educational resources |

| Wide range of assets | High minimum funding for some tiers |

| Competitive spreads | No demo account for all platforms |

| Excellent customer support | Fees can be complex |

In Conclusion

Saxo Bank combines cutting-edge trading technology, strong regulation, and a vast array of financial products, making it an ideal choice for both individual and institutional investors looking for a trusted trading partner.

References:

Faq

The minimum deposit requirement varies depending on the account type, and you can find more details during the registration process.

Yes, Saxo provides comprehensive customer support, including live chat, phone, and email assistance, to ensure a smooth trading experience.

Yes, Saxo’s trading platforms are available on both desktop and mobile devices, making it easy to trade on the go.

Saxo offers a variety of market insights, tutorials, and resources to help traders stay informed and make better investment decisions.

Saxo Bank operates with high levels of security, adhering to strict regulatory standards to ensure that clients’ investments are well-protected.

- Overview

- Detailed Summary

- Safety and Security

- Affiliate Partnership

- Refer a Friend

- Minimum Deposit and Account Types

- Reward Tiers

- How to Open a Saxo Bank Account

- Trading Platforms and Tools

- Markets Available for Trade

- Fees, Spreads, and, Commissions

- Deposit and Withdrawal

- Customer Reviews

- Pros and Cons

- In Conclusion