Best Asset Management Award

Receiving the “Best Asset Management” award from the Global Forex Awards clearly indicates a company’s exceptional performance in the financial industry.

In this in-depth guide, you’ll learn:

- What is the “Best Asset Management” Award?

- Who are the firms with Award-Winning Asset Management?

- Exploring the Criteria for The Best Asset Management Award

- Strategies and Practices to Earn the “Best Asset Management Award”

- Implementing Effective Asset Management Strategies

- Comprehensive Discussion on Asset Management Services in Forex Trading

- In Conclusion

- FAQ’s

and much, MUCH more!

| Broker | Review | Regulators | Min Deposit | Website | |

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

Best Asset Management – a Comparison

| 🏆Firm | 🌟Best Asset Management Award | 🖋️Investment Strategies | 💵 AUM |

| 🥇Merrill Wealth Management | ✅ Yes | Personalized wealth management (banking, investing, estate planning) | $3.8 trillion in client balances |

| 🥈Vanguard Group | ✅ Yes | Pioneering low-cost index fund investing | ±$7.7 trillion |

| 🥉Charles Schwab | ✅ Yes | Low-cost investing, a wide range of Index Funds and ETFs | $7.1 trillion |

| 🥇JP Morgan Chase & Co. | ✅ Yes | Robust client service, innovative solutions (including ESG Solution Sets) | $2.9 trillion |

| 🥈Fidelity Investments | ✅ Yes | Diversified portfolios with automatic rebalancing, access to live financial advisors | $4.9 trillion |

Award-Winning and Best Asset Management (2024)

- ☑️Merrill Wealth Management – Overall, The Best Asset Management Firm

- ☑️Vanguard Group – Commendable Low-Cost Investing

- ☑️Charles Schwab – Impressive Asset-Weighted Average Fee

- ☑️JP Morgan Chase & Co. – Excellent Technological Endeavors

- ☑️Fidelity Investments – Exceptional Investment Platforms

What is the “Best Asset Management” Award?

Our investigation into the financial industry’s top honors has led us to examine the significance of the “Best Asset Management” Award.

This esteemed recognition is bestowed upon companies that demonstrate exceptional proficiency in efficiently overseeing investments and assets throughout their lifespan.

Our discoveries extend beyond the mere enhancement of portfolio returns; they illuminate companies committed to ground-breaking strategies and exceptional client service.

Our research indicates that these awards hold significant importance in finance. They highly value the expertise and accomplishments of top asset management firms while maintaining a strong focus on quality and innovation.

Consider them as beacons, illuminating the path for firms that excel in strategic asset management and prioritize client satisfaction. The selection process is comprehensive, considering factors such as innovation, performance, customer satisfaction, and industry impact.

Winning such an award can have a significant impact on asset management firms. This enhances their reputation, making them more attractive to potential clients and securing the loyalty of existing ones. Furthermore, it demonstrates trust and reliability in a highly competitive financial landscape.

This analysis confirms that these awards are strong indicators of exceptional service and standards, showcasing the firms that truly provide value to investors and push the limits of asset management.

Merrill Wealth Management

Overview

Our research indicates that Merrill Wealth Management, a division of Bank of America, offers a comprehensive approach to wealth management. The company provides extensive services, such as banking, investing, and trust and estate planning.

We found that Merrill’s approach is highly personalized, which is a key aspect. They place a high importance on comprehending each client’s individual financial circumstances and objectives.

Merrill can provide a wide variety of investment options customized to meet individual needs, thanks to the extensive resources provided by Bank of America.

The personalized approach, along with abundant resources, is particularly beneficial for clients with intricate financial needs.

The accessibility of Merrill’s services is commendable, as they do not impose a minimum account size for most advisory accounts, allowing a wide range of individuals to benefit from their offerings.

The inclusivity of their services allows people at different financial stages to benefit from them, potentially making quality financial advice more accessible to a wider range of individuals.

Although Merrill caters to a wide range of clients, our research suggests they particularly excel in serving high-net-worth individuals. Their services are expertly tailored to meet this segment’s complex financial management needs.

| 💵Assets Under Management (AUM) | $3.8 trillion in client balances |

| 🖋️Investment Strategy | Personalized wealth management (banking, investing, estate planning) |

| 📌Diversification | Disciplined approach to diversification according to asset class, geography, and sector to build portfolios that can withstand market volatility |

| ➡️Performance Track Record | Emphasis on personalized strategies that suggest a focus on meeting investment goals rather than benchmarking |

| 💴Fee Structure | Varied, highest fees can go up to 2% of the AUM for client accounts up to $5 million or higher |

| 📈Investment Products | Various; stocks, bonds, alternative investments |

| 🫴🏻Client Services | Customized solutions and personalized service and support |

| 🪛Technology and Tools | Ideal for wealth management, like online portals and mobile apps |

| 🌟Reputation and Overall Trust | Bolstered by its comprehensive approach, backing of the Bank of America |

Pros and Cons Merrill Wealth Management

| ✅ Pros | ❌ Cons |

| Traders can access personalized investment strategies based on their portfolios | There are high management fees |

| There are extensive global resources and capabilities | The fee structure is complex |

| Traders can expect robust technology and tools for managing portfolios and financial planning | There are higher minimum investment thresholds |

| Offers a range of services and is integrated under the Bank of America | Does not feature tax-loss harvesting |

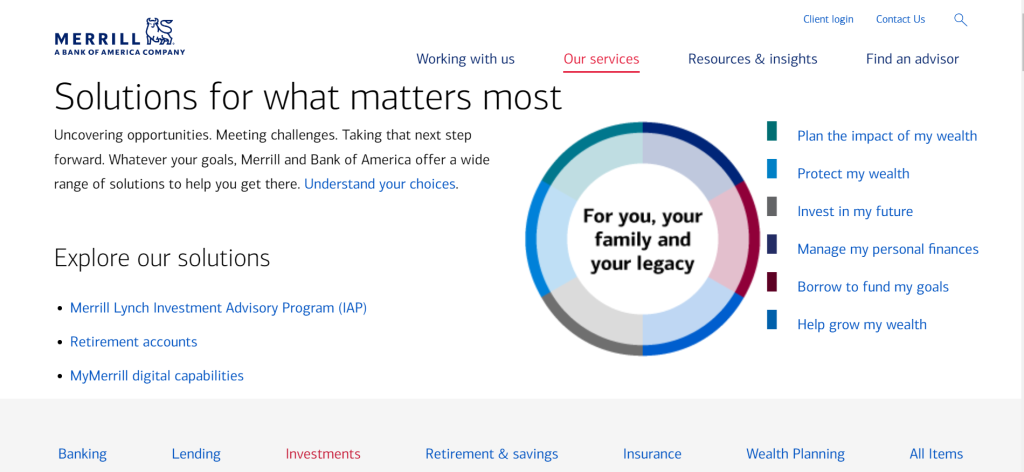

Vanguard Group

Overview

The Vanguard Group’s commitment to low-cost investing and investor-centric policies is commendable.

We were thoroughly impressed by their pioneering efforts in these areas. With an impressive $7.7 trillion in assets under management, Vanguard offers a diverse selection of mutual funds and ETFs.

Vanguard’s analysis highlights its commitment to offering passively managed funds that track different indices. This approach effectively reduces costs for investors.

One aspect that stood out to us during our research was Vanguard’s distinctive ownership structure. The shareholders own the company through its funds.

The structure ensures that Vanguard’s interests are closely aligned with those of its investors, resulting in the company’s success being directly tied to the value it provides to its shareholders.

Our findings highlight Vanguard’s dedication to keeping fees low, a fundamental aspect of its philosophy focused on maximizing long-term investor returns.

Exploring Vanguard’s offerings, we found various investment options and a clear focus on educating investors.

Vanguard’s commitment to investor education and its wide range of products cements its status as a prominent player in the asset management industry.

| 💵Assets Under Management (AUM) | ±$7.7 trillion |

| 🖋️Investment Strategy | Pioneering low-cost index fund investing |

| 📌Diversification | A broad selection of mutual funds and ETFs |

| ➡️Performance Track Record | Actively managed funds have a solid track record, with 91% outperforming the peer-group average over the past decade |

| 💴Fee Structure | Extremely low, the average expense ratio is 0.09% |

| 📈Investment Products | Various; brokerage services, ETFs, Mutual Funds, etc. |

| 🫴🏻Client Services | Investor education, various resources to help clients make informed decisions |

| 🪛Technology and Tools | Digital platforms and tools for portfolio management and trading |

| 🌟Reputation and Overall Trust | A reputation built on commitment to low-cost investing and the mutual ownership structure |

Pros and Cons Vanguard Group

| ✅ Pros | ❌ Cons |

| Renowned for its low-cost index funds | Limited active management options |

| Considered a leader in passive investment strategies | Customer support can be slow to respond |

| Offers a unique investor-owned structure | Less suitable for active trading |

Charles Schwab

Overview

Charles Schwab’s focus on core-oriented strategies caught our attention during our analysis. We were impressed that over 95% of the firm’s fund assets under management are invested in low-cost index products.

This approach presents a comprehensive strategy that is suitable for the majority of investors’ portfolios.

The investigation into Schwab’s recent initiatives, including direct indexing and the introduction of niche ETFs, showcases the firm’s ability to adapt and its commitment to addressing the evolving needs of investors.

It is impressive how Schwab maintains an asset-weighted average fee of only 0.09% across its mutual funds and ETFs, demonstrating its dedication to providing affordable options.

The research highlights Schwab’s proactive approach to keeping up with competitor fee reductions, which shows its dedication to providing value to investors.

Furthermore, Schwab’s focus on balancing costs and quality in investment options solidifies its position as a formidable player in the asset management sector.

| 💵Assets Under Management (AUM) | $7.1 trillion |

| 🖋️Investment Strategy | Low-cost investing, a wide range of Index Funds and ETFs |

| 📌Diversification | Significant emphasis on index products |

| ➡️Performance Track Record | Stellar performance and track record |

| 💴Fee Structure | Low fees for trading stocks and ETFs with a transparent fee structure that is easy to understand |

| 📈Investment Products | A broad selection of investment products, including mutual funds, ETFs, and specialized investment solutions |

| 🫴🏻Client Services | Superior customer support and a range of services (financial advice and portfolio management) |

| 🪛Technology and Tools | Advanced digital platforms and tools for investment management |

| 🌟Reputation and Overall Trust | Reputation is built on commitment to transparency, affordability, customer service |

Pros and Cons Charles Schwab

| ✅ Pros | ❌ Cons |

| Robust research tools are available | There are high fees for specialized services |

| There is a low barrier to entry from $0 | There are limited options for international trading |

| Known for its superior customer support | The number of platform options can overwhelm beginners |

JPMorgan Chase & Co.

Overview

The analysis of JPMorgan Chase & Co. reveals a dominant force in the banking sector that is also at the forefront of technological advancements.

JPMorgan Chase’s annual investment of $12 billion in technology showcases their unwavering dedication to driving the banking industry forward through state-of-the-art innovations.

This impressive investment is backing a team of 50,000 technologists, surpassing the tech workforce of major players like Facebook and X combined.

Our investigation into JPMorgan Chase’s technological endeavors uncovers various innovations, including machine learning, artificial intelligence, cybersecurity, and cloud computing.

The bank’s scope goes beyond traditional banking services, exploring mobile and electronic payments, big data, and distributed ledger technologies. JPMorgan Chase’s holistic approach to technology development positions them as a strong contender in both banking and the broader tech landscape.

JPMorgan Chase’s strategic vision extends beyond addressing current technological requirements to anticipate future demands.

| 💵Assets Under Management (AUM) | $2.9 trillion |

| 🖋️Investment Strategy | Robust client service, innovative solutions (including ESG Solution Sets) |

| 📌Diversification | Global reach ensures that there is diversification across regions, investment strategies, and asset classes |

| ➡️Performance Track Record | Stellar performance and track record in asset management |

| 💴Fee Structure | Commission-free trades on stocks and ETFs, $0.65 per option contract, 0.35% of managed assets on Robo-Advisors, Account fees of up to $50 per year |

| 📈Investment Products | Wide range of services and investment management |

| 🫴🏻Client Services | Strong client service and innovative financial solutions through a team of technical experts |

| 🪛Technology and Tools | Advanced technology and tools for investment management |

| 🌟Reputation and Overall Trust | Global presence, comprehensive services, innovative solutions |

Pros and Cons JPMorgan Chase & Co.

| ✅ Pros | ❌ Cons |

| There are a range of services apart from asset management, like banking and loans | There is a high and complex fee structure |

| The firm has a strong global presence that provides investors access to many international markets | The services are complex and could overwhelm beginners |

| There are strong research capabilities that support investment choices with comprehensive market insights | There might be conflict of interest between divisions because it is a multinational bank |

Fidelity Investments

Overview

According to our research, Fidelity Investments is a versatile option, providing a wide range of managed portfolio choices to meet the needs of diverse investors. They offer a range of service levels and pricing options, allowing investors to match their choices with their financial goals.

Fidelity provides two prominent platforms for robo-advisors: Fidelity Go and Fidelity Personalized Planning and Advice.

These platforms are exceptional at offering diversified investment portfolios with automatic rebalancing. For example, Fidelity Go has no minimum investment requirement and provides fee-free management for accounts under $10,000.

We also found that the management fee for accounts between $10,000 and $49,999 is set at $3 per month, which then transitions to an annual fee of 0.35% for accounts worth $50,000 or more.

Fidelity Personalized Planning and Advice enhances the robo-advisor experience by seamlessly incorporating live financial advisors.

This hybrid model provides a tailored investment strategy for a minimum investment of $25,000 and an annual management fee of 0.50%. Fidelity strives to provide a personalized investing experience by integrating automated investment management with expert financial advice.

Our exploration also showed that Fidelity offers a wide range of services. From portfolio advisory to in-depth wealth management strategies. To cater to the needs of investors looking for comprehensive wealth management solutions.

The services offered by these providers are designed to accommodate different investment levels, with minimums starting at $50,000 and going up to $250,000. The fees charged are determined by the amount of assets being managed.

Furthermore, Fidelity’s wealth management solutions prioritize personalized investment strategies, estate planning, insurance, and other services. Guaranteeing that every investor receives a tailored experience that caters to their unique needs.

| 💵Assets Under Management (AUM) | $4.9 trillion |

| 🖋️Investment Strategy | Diversified portfolios with automatic rebalancing, access to live financial advisors |

| 📌Diversification | Across various asset classes and investment strategies |

| ➡️Performance Track Record | Superior track record |

| 💴Fee Structure | Low fees, commission-free trading on Stocks, ETFs, OTC stocks, and various zero-expense ratio index funds |

| 📈Investment Products | Various; mutual funds, fully managed portfolios, ETFs, robo-advisors |

| 🫴🏻Client Services | Financial planning, access to financial advisors |

| 🪛Technology and Tools | Digital platforms and tools for trading and portfolio management |

| 🌟Reputation and Overall Trust | Built on its commitment to low fees, the best investment solutions, client-centric services |

Pros and Cons Fidelity Investments

| ✅ Pros | ❌ Cons |

| Offers zero-expense-ratio index funds | There are high fees involved with broker-assisted trading |

| The extensive research and educational tools will help many investors | The platform navigation is not user-friendly |

| There is a wide range of investment products across markets | There are limited crypto CFDs that can be traded |

Exploring the Criteria for The Best Asset Management Award

We delved deeply into the process that drives this prestigious award in our exhaustive examination of the “Best Asset Management” award criteria.

Our research is based on carefully reviewing the standards to identify outstanding companies in operational excellence, innovation, client dedication, and financial management.

This careful process guarantees that the award recognizes companies that are really at the forefront of asset management.

Investment Style and Results

Our research on the assessment procedure has clarified a crucial element: the company’s investment approach.

This covers the variety and creativity of the tactics used as well as how well they fit the client’s needs and the market’s state. Companies that take a proactive, forward-looking approach and are nevertheless flexible enough to adjust to changes in the market typically do well in this area.

Similarly important is the performance history. We find that it’s about long-term stability and growth as much as quick profits.

The best asset managers routinely achieve benchmark results or better them over a range of market cycles. This success demonstrates clearly how well the company allocates assets, manages risks, and takes advantage of market possibilities.

Diversification and Client Services

From investigating client services, we’ve seen that the best asset management companies thrive by building close, customized relationships with their clients.

This means offering specialized counsel, thorough reporting, and fast customer service. Our results highlight the need to successfully convey complex financial information and preserve operational openness, which is highly appreciated in the appraisal process.

Additionally, diversification strategies are also heavily weighted in the evaluation. According to our research, firms that demonstrate a smart strategy for diversifying investments to reduce risks and increase returns frequently lead the pack.

This includes distributing assets over several asset classes as well as geographically and sectorally to ensure that client portfolios are resilient to changes in the market and geopolitical unpredictability.

Code of Ethics and Innovation

Through our analysis, we could also see how important ethical standards are. Companies competing for this award have to follow the strictest moral guidelines, guaranteeing openness, adherence to legal requirements, and giving client interests first priority.

Throughout our assessment, we carefully looked at each of our identified firms’ market positions and the honesty of their financial procedures.

Innovation shows up as yet another essential component of the standards. We’ve discovered that innovating – through new product offerings, cutting-edge technology, or original investing strategies – is essential in today’s quickly changing financial environment.

Therefore, leading innovators respond to changes and establish new standards for the sector, influencing future developments.

Strategies and Practices to Earn the “Best Asset Management Award”

Our extensive evaluation of asset management techniques has led us to identify several essential procedures that propel this industry to greatness. These observations come from extensive research and practical use of several asset management strategies.

Taking a Comprehensive Approach and Prioritizing Investments

Our studies usually demonstrate the need for an all-encompassing strategy for asset management. This calls for combining strong investing plans with cautious risk control and emphasizing client results.

Firms should take a systematic, bottom-up approach to asset investing to make educated judgments based on in-depth study and knowledge of possible risks and returns.

Therefore, by enhancing the accuracy of our investment choices and coordinating with larger financial objectives, this approach encourages steady growth and stability.

Emphasizing Risk Management

We believe brokers and investment firms should develop an understandable system for ranking asset investments based on risk, expense, and performance.

This strategic prioritizing guarantees the effective use of resources, prioritizing important investments to maximize portfolio performance overall.

Furthermore, firms should prioritize anticipating and resolving any dangers connected to every investment. Over time, this proactive strategy contributes to preserving the performance and integrity of the investment portfolio.

Embracing Innovation

The industry’s asset management plans and standing depend heavily on innovation. Firms should welcome new technology and digital instruments to improve asset management skills.

Improved data analysis, more accuracy in asset tracking, and more knowledgeable decision-making processes are just a few of the benefits of embracing digital advances that we’ve found.

By being pioneers of these technologies, firms can easily establish industry norms and demonstrate their leadership in the asset management space.

Promoting Collaboration and Teamwork

Asset management firms must understand the need for cooperation and teamwork. Teams are encouraged to work together by organizational culture, which also promotes the exchange of ideas and tactics among levels.

We believe that this cooperative strategy makes it possible to handle assets more integrated, which is essential for negotiating the intricacy of contemporary investing portfolios.

Together, the efforts of staff will greatly improve asset management procedures and establish the firm as a serious competitor for industry recognition.

Commitment to Continuous Improvement

According to our findings, firms should continuously commit to improving asset management competence.

This includes keeping the asset management team trained and developing regularly, staying current with industry developments, and always improving procedures and planning.

Such dedication guarantees our flexibility to change client preferences and market conditions and enhance our asset management skills.

Comprehensive Discussion on Asset Management Services in Forex Trading

Through our comprehensive analysis of asset management in the forex trading industry, we have delved into the intricacies and challenges of this dynamic and interconnected market.

The investigation emphasizes the importance of specialized asset management services that help investors navigate the complex currency markets.

Our analysis reveals the crucial aspects that highlight the importance and benefits of professional asset management in forex trading and the challenges and factors that investors must consider.

Tailored Expertise for Forex Trading

Our research has revealed that forex trading requires a level of expertise and vigilance that surpasses what most individual investors can handle due to the market’s constant activity and high volatility.

Asset management services in this sector utilize sophisticated strategies and leverage extensive market knowledge to maximize returns while effectively managing risks.

Forex asset managers rely heavily on understanding global economic indicators, currency trends, and geopolitical events to make informed trading decisions.

We believe that expertise of this caliber is crucial in a market where even the slightest changes in economic conditions across various countries can greatly impact profit margins.

Benefits of Specialized Asset Management Services

Investment firms and brokers that specialize in asset management services provide a diverse selection of investment opportunities. These options extend beyond forex and encompass equities, bonds, and commodities.

We’ve found that these entities frequently employ specialists who focus on specific asset classes, allowing them to customize strategies based on their client’s individual needs and objectives.

Furthermore, the pooling of resources from multiple clients by asset management companies (AMCs) allows for the achievement of economies of scale, enabling access to investment opportunities that individual investors may not be able to reach independently.

Overall, the pooling approach has the benefit of expanding the investment horizon and plays a crucial role in diversifying risk.

Impact of Technology and Tools

Our investigation found that integrating technology in asset management has showcased the remarkable impact of sophisticated software and analytical tools on investment management.

Platforms such as MetaTrader offer real-time data and advanced charting tools. These are essential for making quick trading decisions in the forex market.

In addition, we have observed the increasing popularity of robo-advisors. As a means of making asset management more accessible to a wider audience.

This automated platform efficiently manages investments. According to users’ risk tolerance and financial goals, providing a cost-effective alternative to traditional asset management services. However, it lacks the personalized guidance of a human advisor.

Challenges and Considerations

Although there are advantages, we have encountered several challenges related to asset management services.

We’ve found that the fees associated with these services significantly impact the overall investment returns, as they can vary greatly.

Understanding the fee structure and evaluating the performance of asset management firms against relevant benchmarks is essential for investors.

In addition, our research highlights the significance of considering the firm’s reputation, transparency, and regulatory compliance to protect investments.

In Conclusion

While researching the companies that receive the “Best Asset Management” accolade. We came across an environment marked by outstanding successes and significant setbacks.

Merrill Wealth Management, Vanguard Group, and other such firms demonstrate how superior asset management may be achieved. By combining strong investing strategies with cutting-edge technology and customer-centric services.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime. Even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading. You must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose. You could lose part of your original investment.

Faq

Asset management gradually increases wealth by acquiring, keeping, and exchanging investments with growth potential. Furthermore, we found it refers to various financial services businesses offer to manage various asset kinds on behalf of clients.

Some criteria for the “Best Asset Management” award often include the firm’s investment success, client service quality, financial innovation, and ethical business practices.

Asset management firms improve client investments by using smart asset allocation to maximize returns. Furthermore, they often personalize their investing plans to meet the client’s financial objectives and risk tolerance.

Asset management services manage various investments, including stocks, bonds, mutual funds, ETFs, and alternative investments such as real estate and commodities.

Asset management businesses charge a fee based on the percentage of assets under management (AUM). However, some also impose performance or fixed fees.

Diversification is important in asset management because it spreads investment risks across different asset classes, sectors, and geographical regions.