The 5 Best Forex Brokers in Belgium – Rated and Reviewed. We have listed the Best Forex Brokers accepting traders in Belgium.

In this in-depth guide, you will learn:

- The Best Forex Brokers in Belgium – a List

- Is forex trading legal in Belgium?

- Can I trade Forex in Europe?

- Where do I trade Forex in Belgium?

- What is the Best Forex Broker in Europe?

- Top Brokers for Beginners and Foreigners

- Best MT4/MT5 Forex Brokers

and much, MUCH more!

5 Best Forex Brokers in Belgium – a Comparison

5 Best Forex Brokers in Belgium (2024)

- ☑️ Saxo Bank – Overall, the Best Forex Broker in Belgium

- ☑️ Tickmill – Low BEF Minimum Deposit Broker

- ☑️ CMC Markets – Best Forex Broker for Beginners

- ☑️ IC Markets – Best MetaTrader and cTrader Broker

- ☑️ FP Markets – Best Overall Offering

Saxo Bank

Saxo Bank is a trusted and well-established multi-asset broker that provides a selection of over 70,000 tradeable instruments. Moreover, it is one of the Highest-Regulated Providers, and 14 Tier-1 Regulators govern it. Moreover, additional security measures include adherence to Danish Legislation plus the implementation of anti-laundering measures.

Accounts offered include Classic, Platinum, and, VIP. No Minimum Deposit is required. Trading Platforms offered are SaxoTraderGO and SaxoTraderPRO. The following trading instruments and products are available:

- 185 Forex spot pairs and 140 futures

- Approximately 23,500 equities

- Various commodities

- 250 futures contracts

- 45 FX vanilla options

- Over 3,200 listed options

- 7,000 exchange-traded funds

- Online and offline government and corporate bonds

Moreover, mutual funds from top providers are available, with no commissions or platform fees. Deposit and Withdrawal Options include Bank Transfers, FAST, PayNow, and, MEPS.

Pros and Cons

Our Insights

The benefits of Trading with Saxo Bank include Brilliant Educational resources and an excellent Proprietary trading platform.

Tickmill

Tickmill is a trusted and highly regulated Forex and CFDs Broker. The Seychelles FSA, FCA, CySEC, Labuan FSA, and, the FSCA govern it. Moreover, Bonus Offers and Promotions are available. Account offers are VIP, Classic, Pro, Islamic, and, Demo. The minimum deposit is 100 USD. Accepted Base currencies include USD, EUR, GBP, and, PLN.

Trading Platforms available are MetaTrader 4 and MetaTrader 5. Moreover, a proprietary trading app allows for mobile trading. The following trading instruments and products are available:

- 62 currency pairings

- 23 Indices

- 3 energy contracts

- 4 precious metals

- 4 bond instruments

Moreover, a selection of eight cryptocurrencies is available. Deposit and Withdrawal options include Bank Transfer, Crypto Payments, and, Skrill.

Pros and Cons

Our Insights

The benefits of trading with Tickmill include educational resources and training tools for beginners.

CMC Markets

CMC Markets is a trusted, UK-based provider of online trading and investment. The Financial Conduct Authority regulates it. Additional security measures include Client fund segregation and cutting-edge encryption technology. Accounts offered include CFD, Spread Betting, Corporate, and, Demo. No Minimum Deposit is required.

Trading Platforms available are MetaTrader 4 and Next Generation. Moreover, a Proprietary Trading App offers access to Mobile Trading. The following trading instruments and products are available:

- Over 330 currency pairings

- 80+ indices

- 12 cryptocurrencies

- 9,500+ shares

- Share Baskets

- 50+ treasuries

Moreover, over 10,000 ETFs are available. Deposit and Withdrawal Options include Bank transfers and Online Banking.

Pros and Cons

Our Insights

The benefits of trading with CMC Markets include ease of use, Low trading costs, and, leading educational resources.

IC Markets

IC Markets is a renowned Forex CFD Provider. ASIC, CySEC, FSA, and, the SCB regulate it. Additional security measures include segregating client funds, negative balance protection, and industry-standard encryption technologies.

Accounts offered are cTrader, Raw Spread, and, Standard. The minimum deposit is 200 USD. Trading platforms available are MetaTrader 4, MetaTrader 5, cTrader, Signal Start, and, IC Social. Moreover, ZuluTrade provides a copy trading platform. The following trading instruments and products are available:

- 64 currency pairings for trading

- 22 commodities

- 25 indices

- 11 distinct bond instruments

- 18 cryptocurrency alternatives

- 1,600 stocks

Deposit and withdrawal options include PayPal, Neteller, Skrill, and, FasaPay.

Pros and Cons

Our Insights

The Benefits of trading with IC Markets include its suitability for active day traders and scalpers.

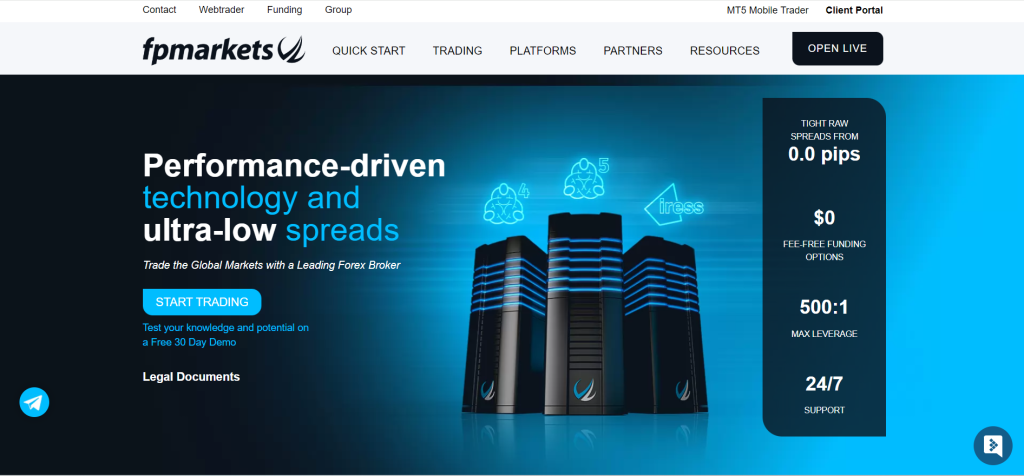

FP Markets

FP Markets is an Australian Brokerage Firm that provides contracts for differences and forex trading. The Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC) regulated it.

Accounts available are Standard, Raw, Islamic Standard, Islamic Raw, and, Demo. The Minimum deposit is AU$ 100. Trading Platforms available are MetaTrader 4, MetaTrader 5, IRESS, and, cTrader. Moreover, a proprietary trading app is offered. The following trading instruments and products are available:

- 70 currency pairings

- More than 10,000 Direct Market Access (DMA)

- 3 precious metals

- 4 energy commodities

- 17 indices

- 11 cryptocurrencies

- 2 separate bonds

Moreover, 5 agricultural commodities are accessible. Commodities available include Gold, Silver, Oil, and, Coffee.

Pros and Cons

Our Insights

The benefits of trading with FP Markets include impressive educational resources and trusted customer support.

The European Union (EU)

The European Union (EU) is a supranational political and economic union. The EU has 27 member states that are located primarily in Europe.

The Financial Services and Markets Authority (FSMA)

The Financial Services and Markets Authority is the financial regulatory agency in Belgium. It ensures honest and equal treatment of Financial Consumers.

In Conclusion

Forex Trading in Belgium has seen a notable rise in popularity as the country borders Forex Hotspots, including the Netherlands and Germany. Moreover, Belgium is a member country of the European Union (EU). Therefore, the country follows all EU regulations and directives on financial trading.

Forex Trading specifically is regulated by the Financial Services and Markets Authority (FSMA).

Our Insights

While reviewing the Best Forex Brokers that accept Belgian Traders, we found 5 excellent options. Each broker has its list of Benefits, ranging from multiple account types to multilingual customer support. Finding the Best Forex Broker will depend on a trader’s individual trading needs.

You might also like: