10 Best Forex Brokers with USD Accounts

The 10 Best Forex Brokers with USD Accounts revealed. Choosing the correct broker is crucial for successfully navigating the markets, particularly when trading with a base currency such as the US Dollar (USD).

Having carefully conducted extensive research and rigorous testing, we have compiled a list of the top 10 forex brokers that provide USD accounts.

In this in-depth guide, you’ll learn:

- Why Should I Use a USD-denominated Trading Account?

- The 10 Best Forex Brokers with USD Accounts

- Expert Tips for Choosing a Forex Broker with a USD Account

- Our Conclusion on The 10 Best Forex Brokers with USD Accounts

- Popular FAQs about The 10 Best Forex Brokers with USD Accounts

And lots more…

So, if you’re ready to go “all in” with The 10 Best Forex Brokers with USD Accounts…

Let’s dive right in…

Why Should I Use a USD-denominated Trading Account?

Choosing a USD-denominated forex trading account provides strategic benefits, particularly regarding liquidity and market analysis. The US dollar dominates the forex market, involving more than 88% of all currency transactions.

This prominence guarantees exceptional liquidity, allowing traders to enter easily and exit positions without experiencing significant slippage. In addition, the widespread use of the USD makes economic analysis easier.

Many global economic reports, commodities, and indices are focused on the USD, which helps to create a clear story for market movements.

Operating with the mindset of a quantitative analyst, this account not only simplifies trading across various currencies but also stays closely connected to the latest global financial news, providing a strategic advantage in predicting and reacting to market movements.

10 Best Forex Brokers with USD Accounts

- ☑️Pepperstone – Low-cost MetaTrader platform experience.

- ☑️Exness – Award-winning Broker in 2024*

- ☑️Tickmill – The Best low spreads broker.

- ☑️Axiory – The Best Global financial market.

- ☑️AvaTrade – Award-winning FCA-regulated trading platform.

- ☑️HFM – Best trading conditions and promotions.

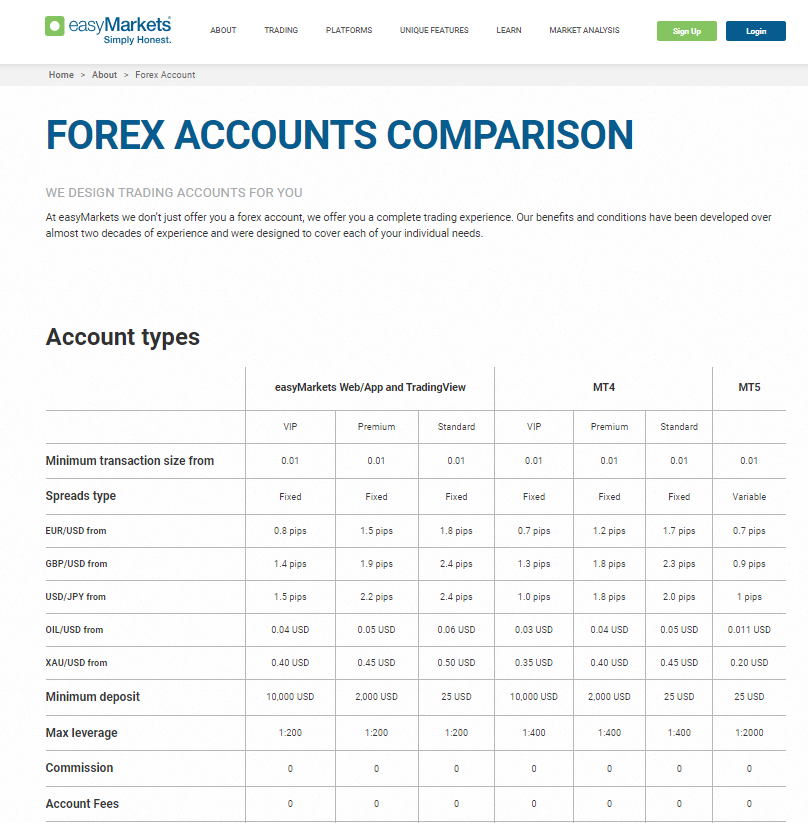

- ☑️easyMarkets – Best trading services.

- ☑️GO Markets – Offers multiple trading account types.

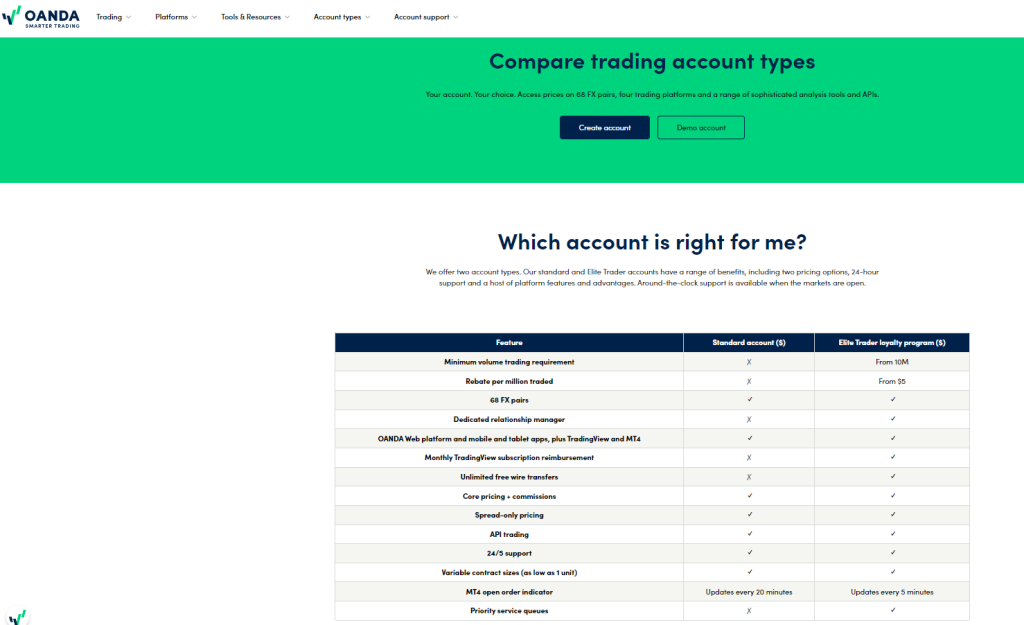

- ☑️OANDA – Voted multi-asset platform Broker.

- ☑️Eightcap –Best customer service.

Best Forex Brokers with USD Accounts

| 👥 Brokers | 👉 Open Account | 💰 Minimum Deposit | ⚖️ Regulators | 📊 Starting spread |

| 1. Pepperstone | 👉 Open Account | 200 AUD | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | Variable, from 0.0 pips EUR/USD |

| 2. Exness | 👉 Open Account | Depends on the payment system | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | 0.0 pips EUR/USD |

| 3. Tickmill | 👉 Open Account | 100 USD | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA | From 0.0 pips |

| 4. Axiory | 👉 Open Account | 1 USD | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA | 0.0 pips, Variable |

| 5. AvaTrade | 👉 Open Account | $100 | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | 0.9 pips EUR/USD |

| 6. HFM | 👉 Open Account | $0 | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | 0.0 pips |

| 7. easyMarkets | 👉 Open Account | 25 USD | BVI FSC, CySEC, ASIC, FSA | 0.5 pips EUR/USD |

| 8. GO Markets | 👉 Open Account | 200 AUD | ASIC, FSA Seychelles, FSC Mauritius, CySEC | From 0.0 pips |

| 9. OANDA | 👉 Open Account | 0 USD | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC | From 0.1 pips |

| 10. Eightcap | 👉 Open Account | 100 USD | CySEC, SCB, ASIC, FCA | 0.0 pips |

10 Best Forex Brokers with USD Accounts

Pepperstone

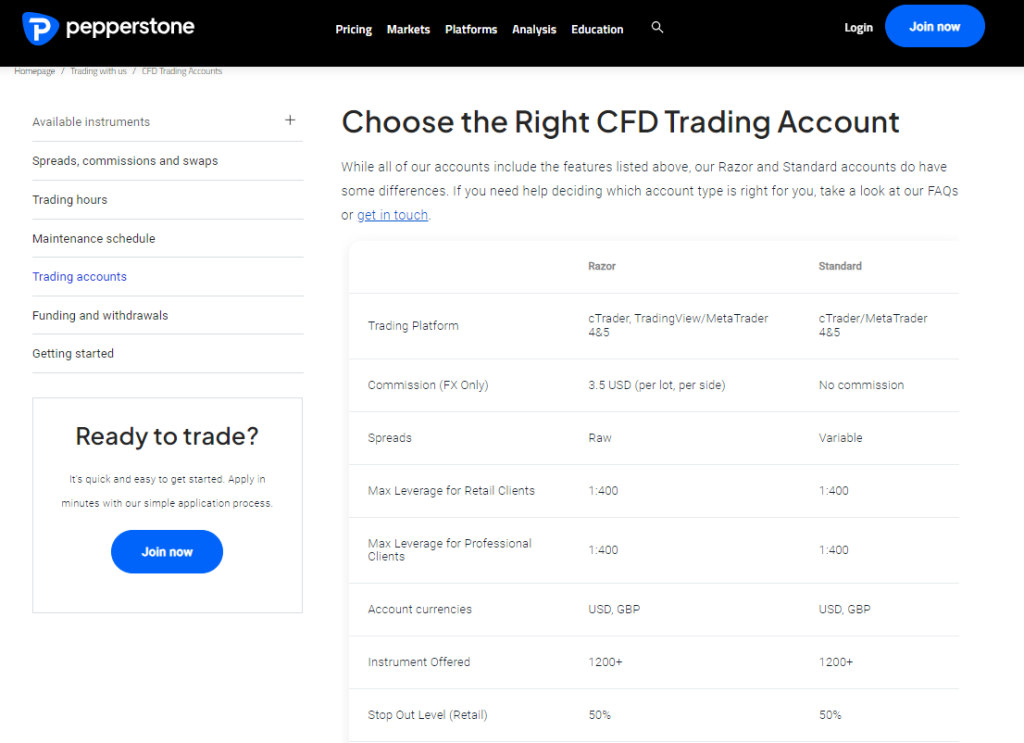

Pepperstone offers a competitive environment for USD-denominated accounts with advanced technology and access to liquidity providers.

It offers competitive spreads and quick trade execution. With diverse platforms like MetaTrader and cTrader, it caters to various trading styles.

Pepperstone’s commitment to affordable trading and exceptional customer service makes it an attractive option for beginners and experienced market participants.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 💻 Maximum Leverage | • 1:500 (Professional) • 1:200 (Retail) –Depending on the jurisdiction |

| 💵 Minimum Deposit | 200 AUD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 100 lots |

| 📊 Deposit Currencies | AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD, HKD |

| 📱 Account Base Currency | USD, GBP |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Pepperstone has tight spreads on most USD forex pairs | There are limited educational materials compared to competitors |

| Traders can expect fast trade execution | Inactivity and other fees apply |

| Pepperstone is well-regulated | |

| Traders can use MetaTrader 4, 5, and cTrader to get the best out of their trading experience | |

| Customer support is dedicated and helpful |

Exness

Overview

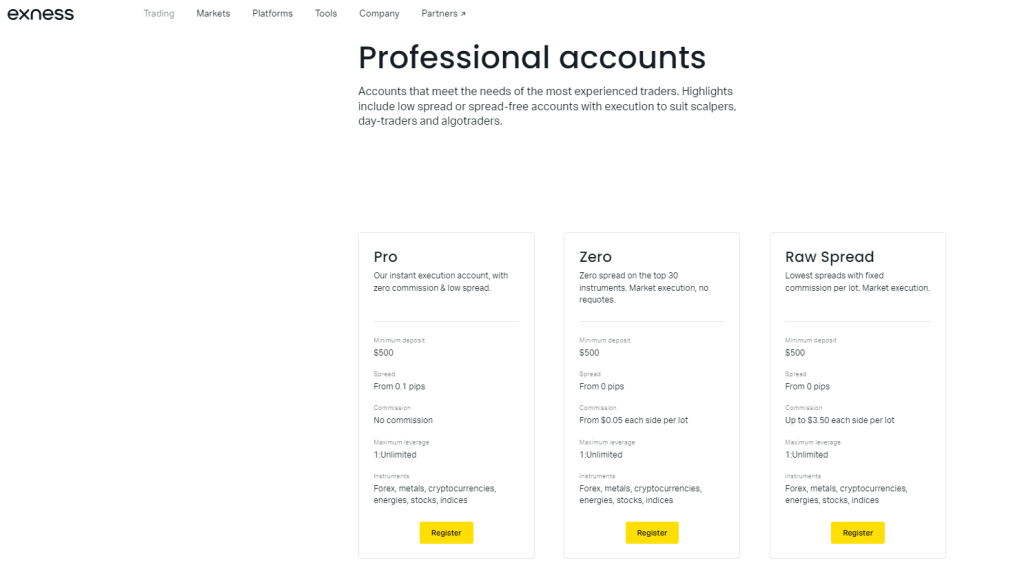

Exness is known for its exceptional leverage options and robust execution speeds, making it a top choice for USD account users.

Traders focused on USD markets will find the broker’s commitment to transparency and reliability and its user-friendly interfaces highly appealing.

Exness provides a variety of account types to accommodate different trading strategies, along with competitive spreads and affordable commission structures.

Its global economic calendar and analytical tools are extremely useful for traders who want to make well-informed decisions with their USD accounts.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA |

| 💻 Maximum Leverage | Unlimited |

| 💵 Minimum Deposit | Depends on the payment system |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | Unlimited |

| 📊 Deposit Currencies | All |

| 📱 Account Base Currency | ZAR, AUD, ARS, AZN, BDT, BHD, BND, BRL, BYR, CAD, CHF, CLP, CNY, COP, CZK, DKK, DZD, EUR, GEL, GBP, GHS, HKD, HUF, IDR, ILS, INR, JOD, JPY, KES, KRW, KWD, KZT, LBP, LKR, MAD, MXN, MYR, NGN, NOK, NZD, OMR, PHP, PKR, PLN, QAR, RON, RUR, SAR, SEK, SGD, SYP, THB, TND, TRY, TWD, UGX, USD, UAH, UZS, VND |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness charges ultra-low spreads on USD major pairs | Exness’ demo account expires |

| There are instant withdrawals in USD | There are limited financial instruments that can be traded |

| Traders can register all trading accounts in USD | Exness does not accept traders from the US |

| Traders can register all trading accounts in USD | |

| Exness is well-regulated and guarantees fund security |

Tickmill

Overview

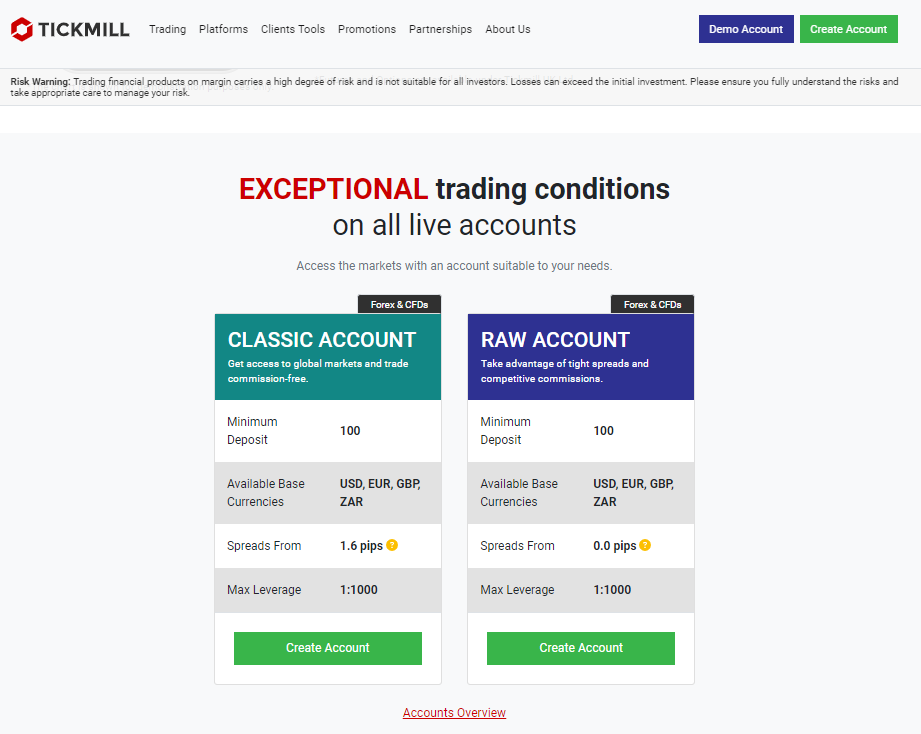

Tickmill is well-known for its competitive spreads and commission-free accounts, which makes it a popular choice for trading in USD. Ensuring regulatory compliance across multiple jurisdictions guarantees a secure trading environment.

Tickmill’s focus on education and market analysis resources helps USD account holders easily navigate forex markets. Trading tools and platforms like MetaTrader 4 and 5 improve the trading experience by providing accuracy and versatility in executing USD trades.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Seychelles FSA, FCA, CySEC, Labuan FSA, FSCA, DFSA |

| 💻 Maximum Leverage | 1:500 |

| 💵 Minimum Deposit | 100 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 100 lots |

| 📊 Deposit Currencies | USD, EUR, GBP, ZAR, IDR, CNY |

| 📱 Account Base Currency | USD, EUR, GBP, ZAR, PLN |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Spreads on major forex pairs like EUR/USD start from 0.0 pips | There are limits on the available instruments that can be traded |

| Traders can use MetaTrader 4 and 5 across devices | There are leverage restrictions according to the region |

| Traders can deposit and withdraw funds in USD without incurring currency conversion fees | |

| Tickmill caters to beginners and professionals |

Axiory

Overview

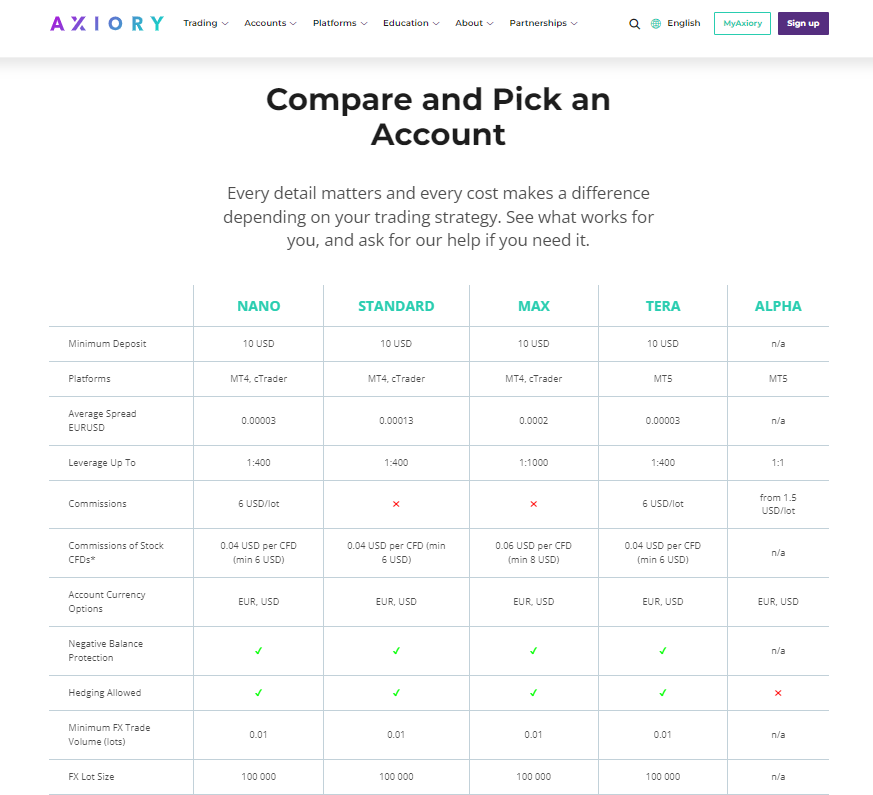

Axiory differentiates itself with a customer-focused strategy, providing customized services and instructional materials specially designed for USD account traders.

With its transparent pricing model and lightning-fast execution speeds, traders can efficiently manage their USD investments.

Axiory’s dedication to technological advancement is demonstrated through its range of platform options and trading tools to provide USD account holders with a distinct advantage in the market.

With its emphasis on sustainable trading practices and commitment to exceptional customer service, the broker offers added value for those who trade in USD.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA |

| 💻 Maximum Leverage | • 1:30 (Retail) • 1:500 (Professional) |

| 💵 Minimum Deposit | 1 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 200 lots |

| 📊 Deposit Currencies | All |

| 📱 Account Base Currency | AUD, USD, ZAR, EUR, GBP, CHF, BGN, CZK, HRK, HUF, PLN, RON, JOD, AED |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Axiory is known for its comprehensive educational suite | The spreads on some forex pairs can be wider than others |

| Traders can access several USD-specific trading tools | There are leverage caps on retail accounts |

| Supports the use of cTrader and MetaTrader |

AvaTrade

AvaTrade is well-known for its wide range of trading instruments, making it a great choice for traders who want to diversify their portfolios, particularly those with USD accounts.

Its fixed spreads and strong regulatory framework provide a stable and secure environment for USD trading. AvaTrade is a great choice for USD account holders, no matter their level of experience.

Their educational materials and dedicated support ensure you have everything you need to succeed. With the integration of various trading platforms like AvaTradeGO and MetaTrader, you will have the flexibility and tools required to excel in USD trading.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 💻 Maximum Leverage | • 1:30 (Retail) • 1:500 (Professional) |

| 💵 Minimum Deposit | 100 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | Unlimited |

| 📊 Deposit Currencies | AUD, USD, GBP, EUR, CHF, JPY, ZAR |

| 📱 Account Base Currency | ZAR, USD, GBP, or AUD |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade offers over 1,260 instruments, including major, minor, and exotic currency pairs with USD | The spreads charged are wider than what competitors charge |

| AvaTrade’s spreads are fixed and start from 0.9 pips on EUR/USD (retail) | There are expensive inactivity fees charged |

| AvaTrade offers multi-currency deposit and withdrawal methods | |

| Traders can access comprehensive educational materials |

HFM

Overview

HFM offers a wide range of trading options, including competitive spreads and leverage up to 1:2000. Traders using USD accounts will appreciate its flexibility for different trading sizes and styles.

With its exceptional customer service and comprehensive educational resources, USD account holders have the knowledge to make informed and strategic decisions.

HFM offers a wide range of account types and trading platforms to cater to the needs of USD traders, allowing them to find the ideal match for their trading strategy and level of experience.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 💻 Maximum Leverage | 1:2000 |

| 💵 Minimum Deposit | 0 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 60 lots |

| 📊 Deposit Currencies | USD, AED, EUR, GBP, CHF, JPY, NZD, CAD, ZAR, and more. |

| 📱 Account Base Currency | EUR, USD, NGN, ZAR |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| There are several USD-denominated accounts to choose from | HFM has a limited range of instruments that can be traded |

| There are zero-pip spreads on major forex pairs | High leverage can lead to substantial capital loss regardless of negative balance protection |

| HFM offers copy trading | |

| There is a strong focus on trader education | |

| HFM offers a demo account across platforms |

easyMarkets

easyMarkets provides USD account holders exclusive features such as deal cancellation and Freeze Rate, enabling traders to manage risks effectively. With its fixed spreads and no slippage guarantee, this platform ensures transparency and predictability in trading costs.

easyMarkets’ platform and educational resources are ideal for beginners in USD trading, providing a simple way to understand the intricacies of forex markets.

Unique Features

| Feature | Information |

| ⚖️ Regulation | BVI FSC, CySEC, ASIC, FSA |

| 💻 Maximum Leverage | • 1:200 (easyMarkets/TradingView) • 1:400 (MetaTrader 4) • 1:2000 (MetaTrader 5) |

| 💵 Minimum Deposit | 25 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 50 lots |

| 📊 Deposit Currencies | Any, it will be converted to the base currency |

| 📱 Account Base Currency | EUR, CAD, CZK, JPY, NZD, AUD, PLN, TRY, CNY, HKD, USD, SGD, CHF, GBP, MXN, NOK, SEK, ZAR, BTC |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| easyMarkets has a no-slippage guarantee | There are fewer USD forex pairs offered compared to rivals |

| Traders can start trading with a deposit of 25 USD | There are limited advanced charting tools |

| There are no commission fees charged | |

| easyMarkets is well-regulated and trusted | |

| There are several currencies to choose from as the base currency |

GO Markets

GO Markets is known for its advanced technological tools and services, including MetaTrader 4 and 5. It is a great choice for USD account traders who value analytical depth.

Its competitive spreads and reliable execution speeds are perfect for traders looking to optimize their USD trading strategies.

GO Markets prioritizes education and customer support to enhance the trading experience, equipping USD account holders with the necessary resources for success.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| 💻 Maximum Leverage | 1:500 |

| 💵 Minimum Deposit | 200 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 250 lots |

| 📊 Deposit Currencies | AUD, USD, GBP, EUR, SGD, NZD, HKD, CAD, CHF |

| 📱 Account Base Currency | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| GO Markets is a trusted and reliable platform | The minimum deposit is much higher than the industry standard |

| There are decent educational materials available to beginners | There are limits on leverage according to the trader’s region |

| GO Markets supports MetaTrader 4 and 5 across devices | |

| There are competitive trading conditions | |

| Traders can register a USD account within minutes |

OANDA

OANDA is highly regarded for its extensive market research tools and clear pricing structure, making it an outstanding option for accounts denominated in USD.

Its robust regulatory standing and sophisticated charting tools on platforms like MetaTrader4 create a safe and knowledgeable trading environment for USD traders.

OANDA’s focus on innovation and education caters to traders of all levels, providing a strong base for individuals interested in investing and trading with USD accounts.

Unique Features

| Feature | Information |

| ⚖️ Regulation | IIROC, ASIC, CFTC, NFA, FCA, FFAJ, JFSA, MAS, MFSA, BVI FSC |

| 💻 Maximum Leverage | 1:888 |

| 💵 Minimum Deposit | 0 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 1,000 lots |

| 📊 Deposit Currencies | All, per region |

| 📱 Account Base Currency | USD, EUR, HKD, SGD |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| OANDA is known for its excellent analytical and research tools | OANDA’s platform can be intimidating for beginners |

| There is a transparent fee schedule | The commission fees can be expensive |

| OANDA’s platform is extremely user-friendly | |

| OANDA has a strong reputation as a Forex and CFD broker | |

| Traders can use leverage up to 1:888 |

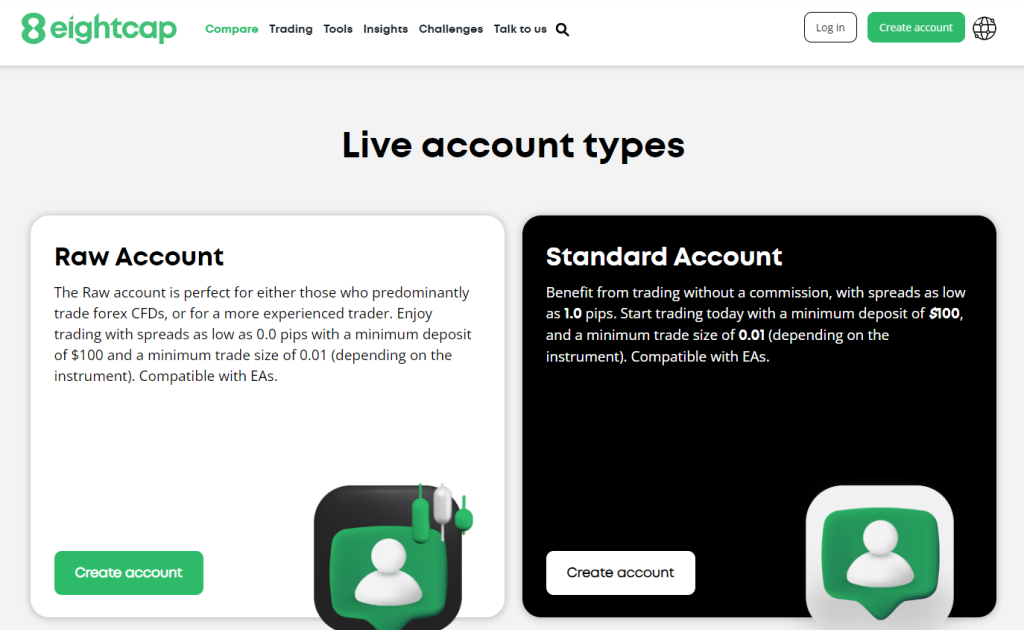

Eightcap

Overview

Eightcap is known for its highly competitive spreads and extensive range of trading instruments. It is a top choice for USD account traders who value diversity and cost-effectiveness in their trading strategies.

Its platforms, such as MetaTrader 4 and 5, provide traders with powerful charting and analytical tools, enabling them to execute complex USD trading strategies precisely.

With a strong emphasis on customer satisfaction and regulatory compliance, Eightcap provides a secure and supportive trading environment for those who operate USD accounts.

Unique Features

| Feature | Information |

| ⚖️ Regulation | CySEC, SCB, ASIC, FCA |

| 💻 Maximum Leverage | 1:500 |

| 💵 Minimum Deposit | 100 USD |

| 💸 Minimum Trade Size | 0.01 lots |

| 📱 Maximum Trade Size | 100 lots |

| 📊 Deposit Currencies | AUD, USD, GBP, EUR, NZD, CAD, SGD |

| 📱 Account Base Currency | AUD, USD, EUR, GBP, NZD, CAD, SGD |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Eightcap offers deep liquidity, which is ideal for high-volume USD trades | There is limited focus on education, making it less beginner-friendly |

| Traders can expect zero-pip spreads on EUR/USD and other major pairs | |

| Traders can expect raw pricing models with fast execution | |

| There are multi-currency accounts, deposits, and withdrawals | |

| Traders can expect guaranteed fund security |

Expert Tips for Choosing a Forex Broker with a USD Account

Understanding Your Trading Needs

Before choosing a forex broker for a USD account, it is essential to have a clear understanding of your trading requirements. What type of trader are you? Do you prefer short-term or long-term investments? The type of broker that best suits you will depend on your trading style.

For example, day traders need brokers who offer low spreads and commissions to optimize their frequent, short-term trades. Meanwhile, long-term investors may place high importance on security, regulatory compliance, and the availability of comprehensive research tools.

Consider factors like leverage, the types of instruments you want to trade (such as major or exotic currency pairs), and whether the broker provides services like copy trading or automated trading solutions.

Regulatory Compliance and Fund Safety

Ensuring the safety of your funds is a crucial factor to consider when selecting a forex broker. Choose brokers that are regulated by well-known authorities.

Ensuring regulatory compliance guarantees your broker’s reliability and provides you with legal protection and options for resolving disputes.

Additionally, it is important to ensure that the broker separates client funds from their operational funds. This practice is crucial in safeguarding your investment from potential misuse or insolvency.

Transaction Costs and Fees

Every forex trade incurs expenses, such as spreads (the variance between a currency pair’s purchase and sale price) and commissions. Understanding a broker’s fee structure is crucial, especially if you trade frequently or in large volumes, as these fees can significantly impact your profits.

Brokers may have different pricing structures, with some offering lower spreads and higher commissions while others do the opposite.

Furthermore, it is important to consider any other possible fees, such as withdrawal charges or fees for inactive accounts. Striking the right balance between transaction costs, trading frequency, and strategy is crucial for optimizing your returns.

Trading Platform and Tools

The platform provided by the broker is at the core of your trading experience. Many brokers provide well-known platforms such as MetaTrader 4 or 5, which are highly regarded for their reliability, ease of use, and extensive selection of technical analysis tools.

Make sure the platform has all the necessary analytical tools and trading features you require, including advanced charting, technical indicators, and automated trading capabilities.

In addition, a reliable broker must provide a mobile trading app that enables you to conveniently monitor and execute trades while on the move, ensuring flexibility and continuous market access.

Customer Service and Support

Access to reliable customer support is crucial for a smooth trading experience, particularly when dealing with market fluctuations or technical difficulties.

Evaluate the broker’s customer service responsiveness and the various channels available for support, such as live chat, email, and phone. It would be ideal if your broker provides support 24/5 or 24/7, given that the forex market operates continuously. In addition, it is important to evaluate the broker’s educational resources, including webinars, tutorials, and articles. These resources can provide valuable insights for traders of all levels of experience.

Account Types and Customization

Forex brokers usually provide a range of account types to meet the requirements of different traders. These options include micro, mini, and standard accounts. Every account type has specific conditions for leverage, minimum deposit requirements, and risk management tools.

Certain brokers offer Islamic accounts that adhere to Sharia law principles, ensuring the absence of interest charges. Assess if the broker allows you to select or personalize an account that matches your trading strategy and financial objectives.

Execution Speed and Slippage

Executing trades quickly and at the expected price is crucial for brokers, especially in fast-moving markets. Slippage happens when there is a discrepancy between the anticipated trade price and the actual execution price.

Excessive slippage can be quite costly, so it is important to keep it in check. Therefore, opt for brokers renowned for their exceptional execution speed and minimal slippage, guaranteeing efficient trade execution at the most favorable prices.

For more information on FXLeaders

Conclusion

After thoroughly examining the leading forex brokers for USD accounts, we found that trading with a USD-denominated account provides access to exceptional market liquidity and stability.

Our evaluated brokers offer the necessary flexibility and efficiency to compete with the USD’s worldwide dominance. However, traders must carefully navigate the complex fee structures and different levels of customer support.

The main point is the undeniable importance of USD accounts in providing a strong basis for participating in the extensive forex market.

In our experience, traders equipped with a reliable broker can leverage these accounts to their benefit, fine-tuning their trading strategy and taking advantage of the inherent advantages of the world’s primary reserve currency.

Faq

Seek brokers that promote narrow spreads on major USD pairs, such as EUR/USD, and clear commission structures. Evaluate various brokers’ offerings to identify the most cost-efficient choice for your trading preferences.

Several brokers, including HFM, Exness, easyMarkets, and others, offer quick deposits and withdrawals across several payment methods.

Some of the most widely used platforms include MetaTrader 4 and MetaTrader 5, which provide a wide range of charting tools and customization options.

Yes, numerous brokers provide micro or cent accounts that enable you to commence trading with minimal deposits in USD.

Yes, reputable brokers often offer demo accounts with simulated USD balances. These accounts are perfect for gaining experience and evaluating strategies before engaging in live trading.