6 Best Forex Brokers with Minimum $5 USD Deposit

6 Best Forex Brokers with a Minimum $5 USD Deposit In this article, we’ll look at the top ten Forex brokers for budget-conscious traders, concentrating on their features, services, and unique chances for financial success.

In this in-depth guide, you’ll learn:

- The 6 Best Forex Brokers with $5 USD Minimum Deposit

- Various Account Types and Minimum Deposits

- What is a Minimum Deposit?

and much, MUCH more!

| 🔍Forex Broker | ✏️Sign Up Here | 💵Minimum Deposit | ⬆️Leverage |

| 🥇XM | 👉 Click Here | $5 USD | 1:1000 |

| 🥈FBS | 👉 Click Here | $5 USD | 1:3000 |

| 🥉Axi | 👉 Click Here | $5 USD | 1:2000 |

| 🏅Alpari | 👉 Click Here | $5 USD | 1:3000 |

| 🏆FXGT | 👉 Click Here | $5 USD | 1:5000 |

| 🥇HFM | 👉 Click Here | $5 USD | 1:2000 |

6 Best Forex Brokers with $5 USD Minimum Deposit (2025)

- ☑️XM – Overall, The Best Forex Broker with $5 USD Minimum Deposit

- ☑️FBS – Outstanding Mobile Trading App

- ☑️Axi – Best Forex Trading Platform

- ☑️Alpari – Best CFD Provider

- ☑️FXGT – Best Affiliate Program

- ☑️HFM – Best Introducing Broker Provider

XM

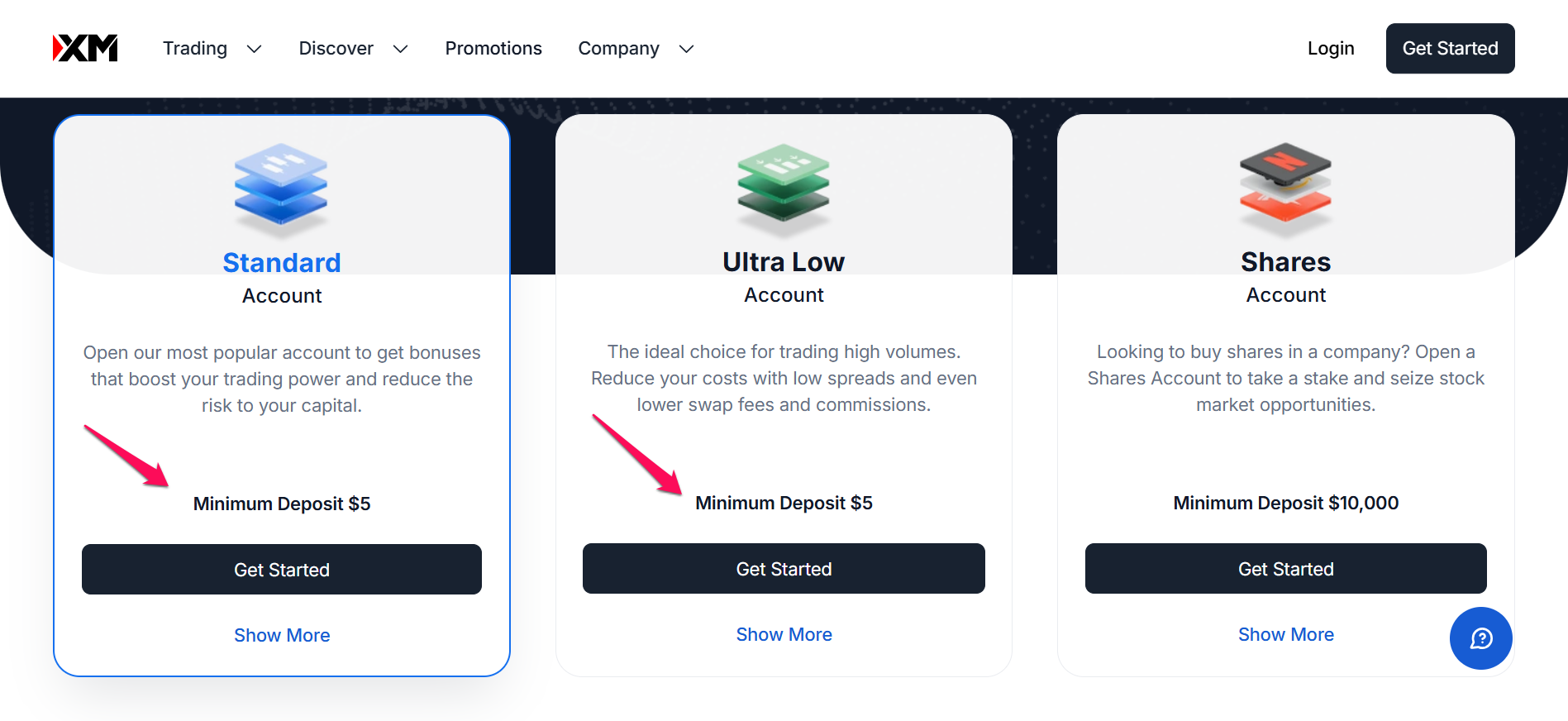

XM is a globally recognized forex and CFD broker known for its beginner-friendly features, tight spreads, and strong regulatory compliance. It offers a minimum deposit of just $5, making it accessible to new traders and those looking to start with a small investment.

XM is particularly well-suited for new traders thanks to its low entry threshold, free demo accounts, and strong educational tools.

Frequently Asked Questions

What is the minimum deposit at XM?

The minimum deposit is $5 for Micro and Standard accounts, making XM ideal for beginners and low-budget traders.

What account types does XM offer?

XM provides 4 main account types: Micro Account, Standard Account, Ultra Low Account, and Shares Account.

What trading platforms does XM support?

You can trade on MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Does XM offer a demo account?

Yes. XM offers a free demo account with virtual funds so you can practice without risking real money.

Our Insights

XM stands out as a reliable, beginner-friendly forex and CFD broker with a low $5 minimum deposit, making it accessible for new traders around the world. With strong regulation, excellent customer support, multiple account types, and access to both MT4 and MT5 platforms, XM offers a balanced trading experience.

FBS

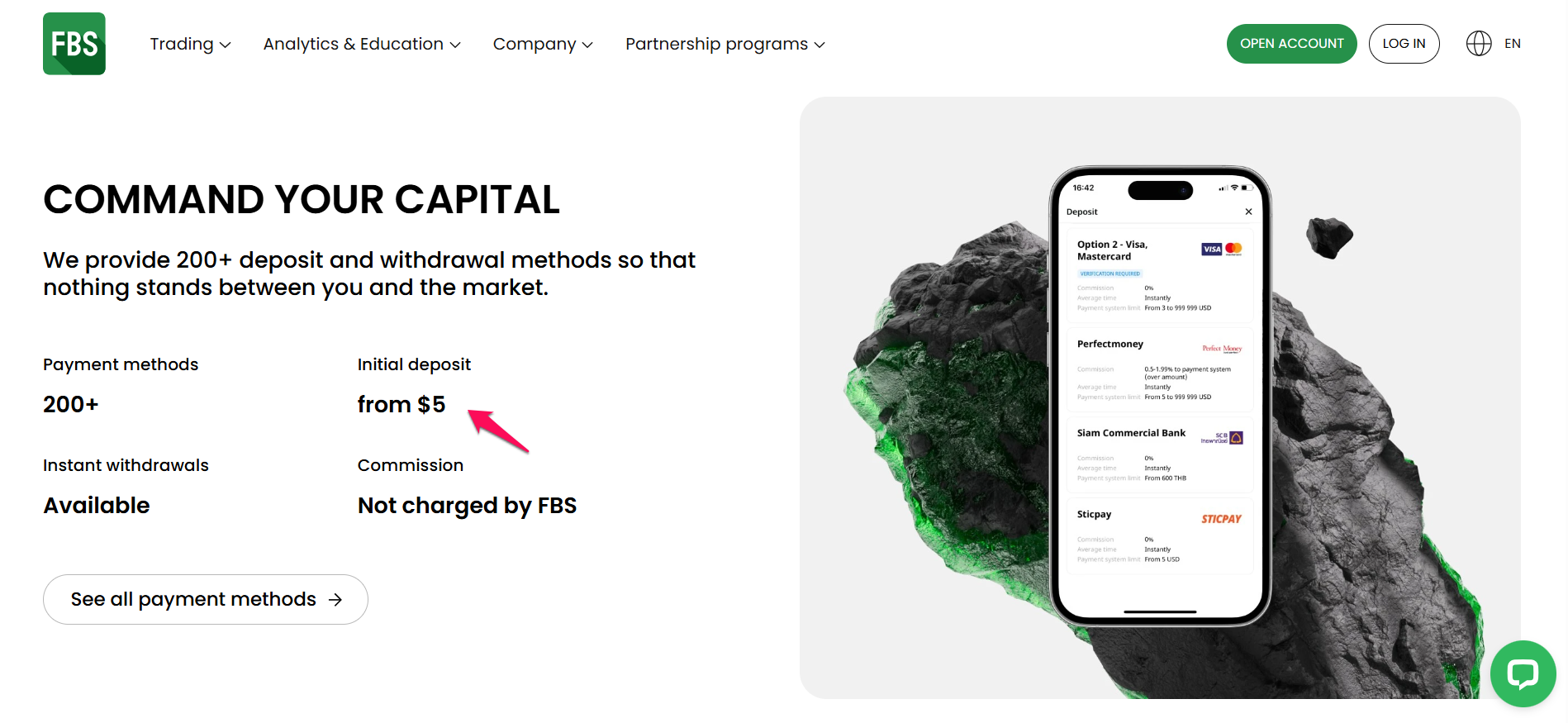

FBS is a globally recognized forex and CFD broker known for offering flexible trading conditions, including a minimum deposit starting from $5, depending on the account type.

It caters to both beginners and experienced traders with a variety of account options, promotional bonuses, and competitive trading tools. With its low-cost entry, strong mobile experience, and promotional incentives, FBS is ideal for beginners looking to start small and grow their trading skills step by step.

Frequently Asked Questions

What is the minimum deposit at FBS?

The minimum deposit starts at $5 for Cent and Standard accounts. Other accounts, like Pro and ECN, may require higher deposits.

Does FBS offer demo accounts?

Yes, FBS offers free demo accounts for all account types, allowing beginners to practice trading with virtual funds.

What platforms can I use with FBS?

You can trade using: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and FBS Trader.

Is FBS beginner-friendly?

Yes. With low minimum deposits, a Cent account, educational resources, and copy trading, FBS is suitable for new traders.

Our Insights

FBS is a globally accessible forex broker that offers a low $5 minimum deposit, making it a solid choice for beginners who want to start trading with minimal risk. With multiple account types, strong regulatory backing, high leverage (up to 1:3000 for international users), and beginner-friendly tools like cent accounts and copy trading, FBS provides the flexibility and support needed for traders at all levels.

Axi

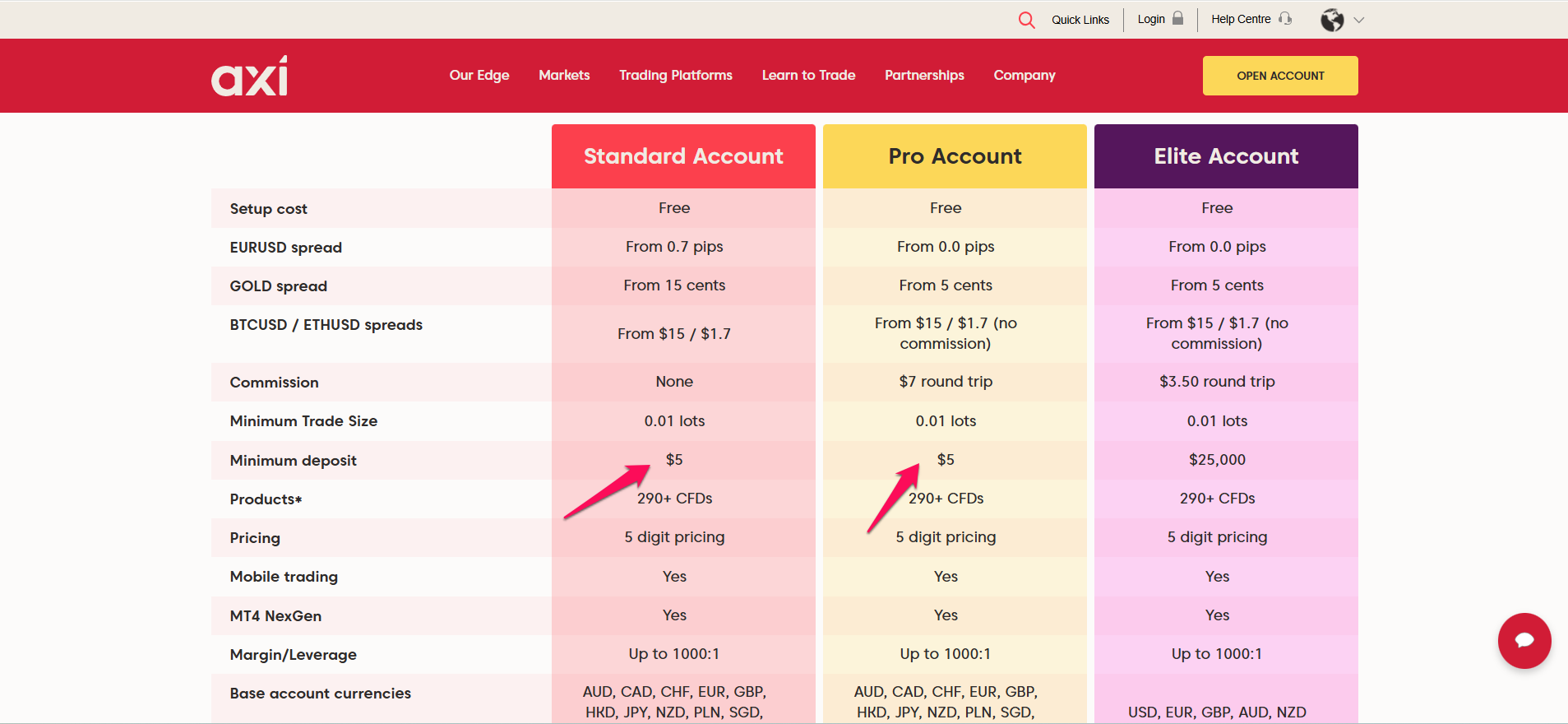

Axi is an Australian-based, globally trusted forex and CFD broker known for its strong regulation, low spreads, and beginner accessibility.

It now offers a minimum deposit starting from $5 in some regions, making it easier for new traders to get started.

With its $5 minimum deposit, powerful MT4 tools, and reliable support, Axi is a solid broker choice for both beginners and experienced traders looking for low-cost, regulated trading.

Frequently Asked Questions

What is the minimum deposit at Axi?

Axi offers a minimum deposit starting from $5 in some regions and payment methods. Standard deposits are usually $10 – $200, depending on account type and location.

Which trading platforms does Axi support?

Axi uses the MetaTrader 4 (MT4) platform — one of the most trusted platforms globally — available for desktop, web, and mobile.

What account types does Axi offer?

Axi provides two main account types: Standard Account and Pro Account.

Are Islamic (swap-free) accounts available?

Yes. Axi offers Islamic accounts (swap-free) for clients who request them, compliant with Sharia law.

Our Insights

Axi is a well-regulated and globally trusted forex broker that combines professional-grade trading tools with beginner-friendly features, including a $5 minimum deposit in some regions. Whether you’re starting small or scaling up, Axi provides a solid foundation for confident trading.

Alpari

Alpari is a long-established forex and CFD broker that has served millions of traders globally since 1998. Known for its flexible account options and accessibility, Alpari allows beginners to start trading with a minimum deposit of just $5 on its Micro account.

With its low entry barrier, user-friendly platforms, and broad range of tools, Alpari remains a popular choice among beginners and experienced traders alike.

Frequently Asked Questions

What is the minimum deposit at Alpari?

The minimum deposit is $5 for the Micro account, making it accessible for new traders.

What account types does Alpari offer?

Alpari provides four main account types: Micro, Standard, ECN, and Pro ECN.

Can I practice with a demo account?

Yes, Alpari offers free demo accounts for all platform types.

Does Alpari offer copy trading?

Yes, Alpari has a PAMM account system that allows users to invest in strategies managed by other experienced traders.

Our Insights

Alpari stands out as a beginner-friendly forex broker with a low $5 minimum deposit, making it ideal for new traders looking to start small. With flexible account types, high leverage options, and access to both MT4 and MT5 platforms, Alpari offers the tools and accessibility needed to grow in the forex market.

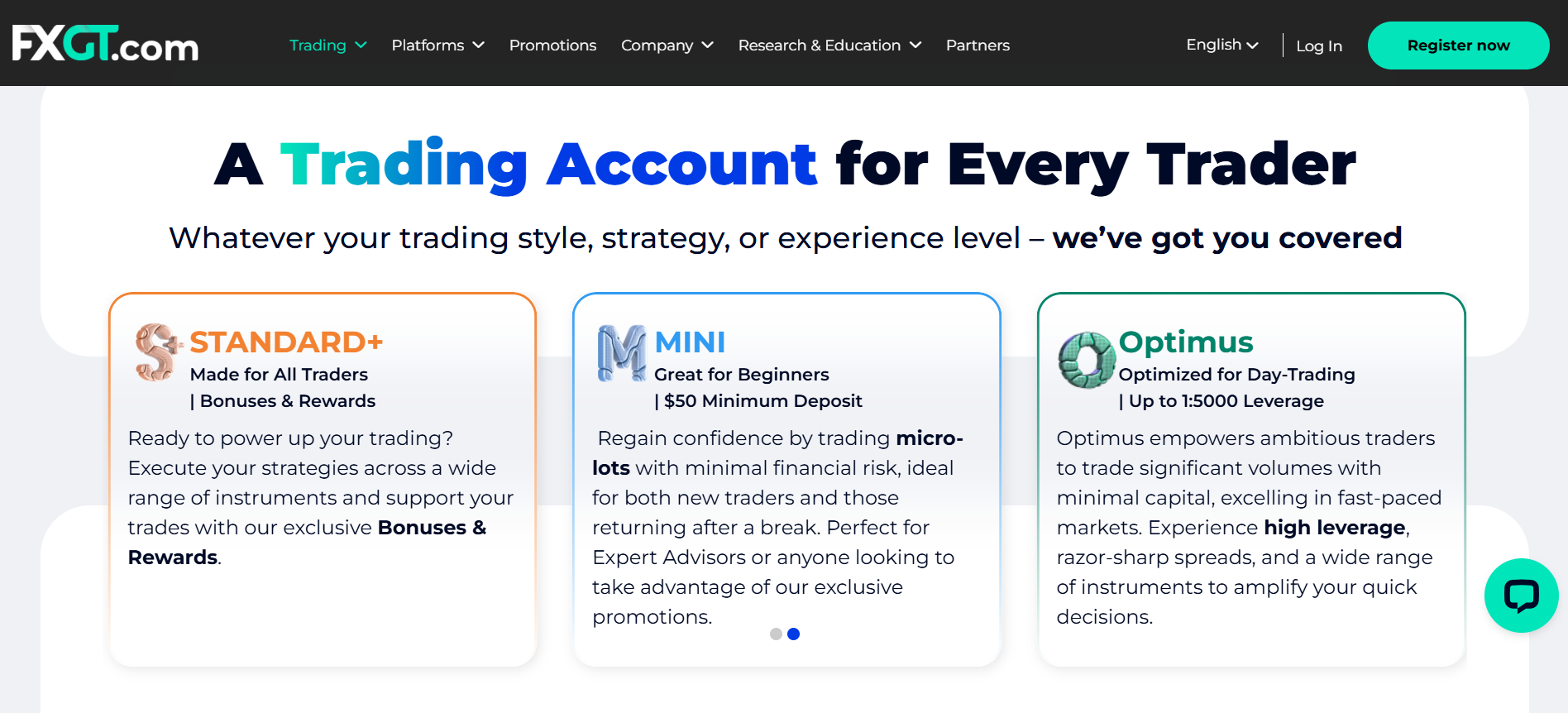

FXGT

FXGT is a multi-asset online broker that offers trading in forex, cryptocurrencies, commodities, indices, and shares.

With a minimum deposit starting from just $5, FXGT caters well to beginners and traders who want to start small while accessing a broad range of markets.

With its low entry requirement, modern MT5 platform, and diverse asset coverage, FXGT is an attractive choice for both beginner and intermediate-level traders seeking flexibility and variety in one platform.

Frequently Asked Questions

What is the minimum deposit at FXGT?

The minimum deposit is $5, available for Cent and Mini accounts, making it accessible for beginners or low-budget traders.

Which trading platform does FXGT offer?

FXGT exclusively uses MetaTrader 5 (MT5) — a modern, multi-asset platform with advanced features for technical and fundamental analysis.

What account types does FXGT provide?

FXGT offers several account types: Cent Account, Mini Account, Standard Account, ECN Account, and Pro Account.

Our Insights

FXGT is a versatile and beginner-friendly broker that combines a $5 minimum deposit with access to a wide range of trading instruments, including forex, crypto, and stocks. FXGT offers flexible account types, generous leverage, and useful extras like Islamic accounts and trading bonuses.

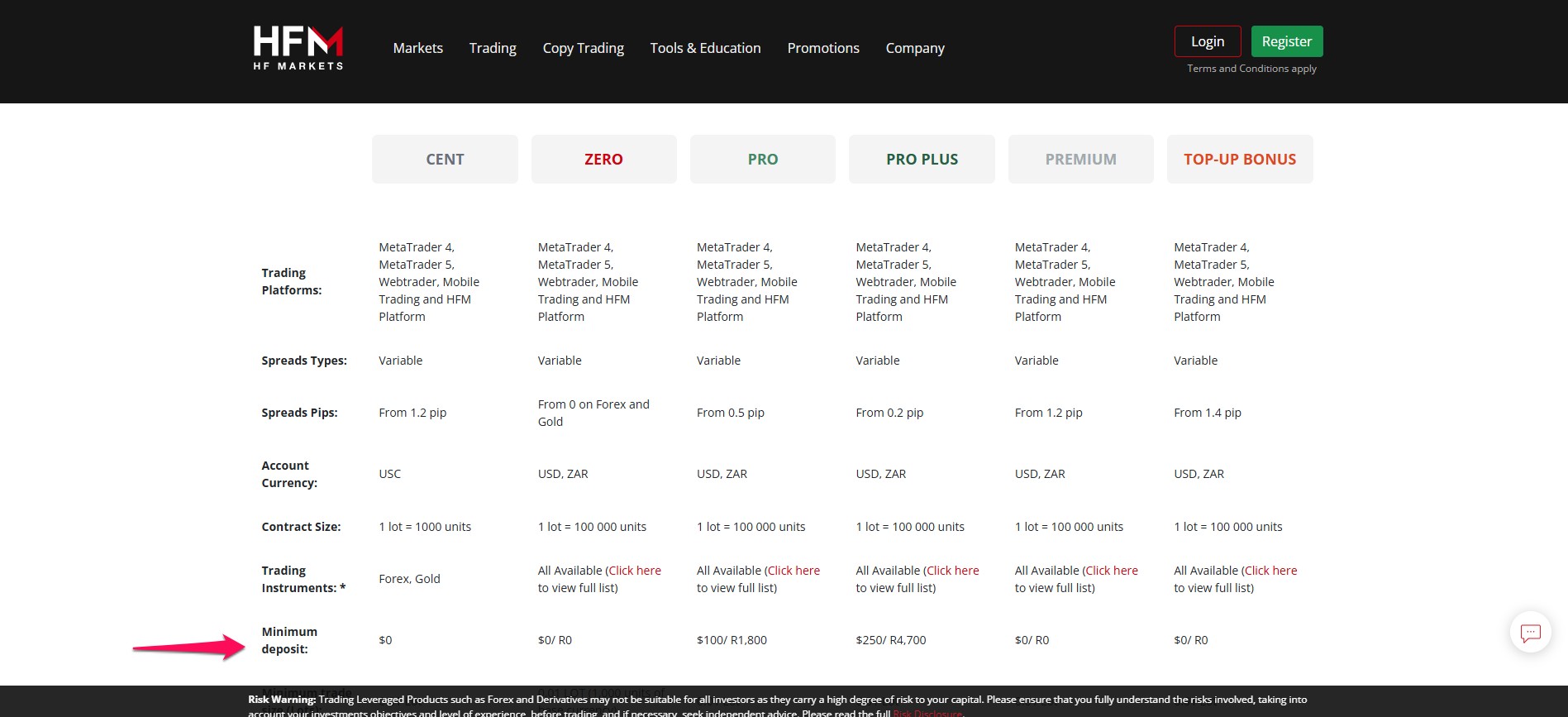

HFM

HFM is a globally trusted forex and CFD broker known for its low entry requirements, tight spreads, and broad regulatory coverage.

With a minimum deposit starting from just $5, it’s a solid choice for beginners looking to trade affordably with access to professional tools.

With its $5 deposit requirement, strong global presence, and beginner-focused tools, HFM is a great entry point for new traders seeking a trusted and feature-rich broker.

Frequently Asked Questions

What is the minimum deposit at HFM?

The minimum deposit is $5 for the Micro account, making it highly accessible for beginners.

Which trading platforms does HFM support?

HFM supports both: MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

What account types are available with HFM?

HFM offers several account types to suit different needs: Micro, Premium, Zero Spread, Pro, and Cent Account.

Does HFM offer a demo account?

Yes, you can open a free demo account to practice trading without risking real money.

What is the maximum leverage available?

Leverage can go up to 1:1000, depending on your region, account type, and instrument.

Our Insights

HFM is a reputable and beginner-friendly broker offering a $5 minimum deposit, multiple account types, and access to popular platforms like MT4 and MT5. HFM is well-suited for new traders who want a low-cost yet reliable entry into the financial markets.

What is a Minimum Deposit?

A minimum deposit is the smallest amount of money that a trader must deposit to open a live trading account with a broker. It acts as the initial capital needed to start trading and varies depending on the broker and account type.

Key Points

- Purpose: Ensures you have enough funds to place trades and cover potential losses.

- Amount: Can range from $1 to several hundred dollars.

- Low minimums (like $1 or $5) are ideal for beginners wanting to learn with real money but minimal risk.

- Higher minimums may come with extra features like tighter spreads or premium support.

In Conclusion

Forex brokers with a $5 minimum deposit provide a low-risk, accessible entry point for beginners who want to trade without committing large sums of money. Whether you’re testing strategies, learning the ropes, or trading on a budget, these brokers make it possible to start trading affordably while still enjoying professional tools and support.

You Might also Like:

Faq

Yes, if the broker is regulated by reputable authorities like ASIC, CySEC, or FSCA. Always check the broker’s license and compliance status.

Yes, you can open a live account and start trading with as little as $5. However, your position sizes and potential profits/losses will be limited due to the small balance.

While it’s enough to get started, scaling up your deposit over time is recommended for better risk management and larger trade opportunities.

Look for: Regulation and security, Customer support, Low spreads and fees, Trading platform quality, and Educational resources.