Algo trading – New Startups

How New Startups Can Beat the Large Hedge Funds

A couple of months ago, we published an article about the Renaissance Technologies (RenTec) hedge/investment fund that bases its trading on algorithmic forex signals. That was the first article in a series of algo hedge funds that we plan to publish over time. In this article, we will take a look at a couple of small hedge funds that use algorithmic trading. As we will show in this article, the small hedge funds can be successful too, which means that you don’t necessarily need complex, costly algorithm software, and hardware in order to be successful. The simpler algorithm systems can be profitable as well… it´s the strategy that matters most.

Starting a new hedge fund, which is based on algorithm signals and trading, is now easier than ever, so almost everyone with minimal knowledge of finance and coding skills can build a forex algorithm and start a small hedge fund. Learn how to develop your own trading algorithm in 4 easy steps. The MetaTrader4 platform has made it as easy as it gets to build an algorithm through the MQL coding program, but there are also other programs or websites which allow you to build your own. The Boston startup ‘Quantopian’ has a platform which allows forex traders to build and back-test several automated forex trading strategies. Recently, they have even started a monthly competition where traders can use their algorithmic software and the one with the biggest profit in terms of pips gets $100,000 worth of equity to trade in the following six months.

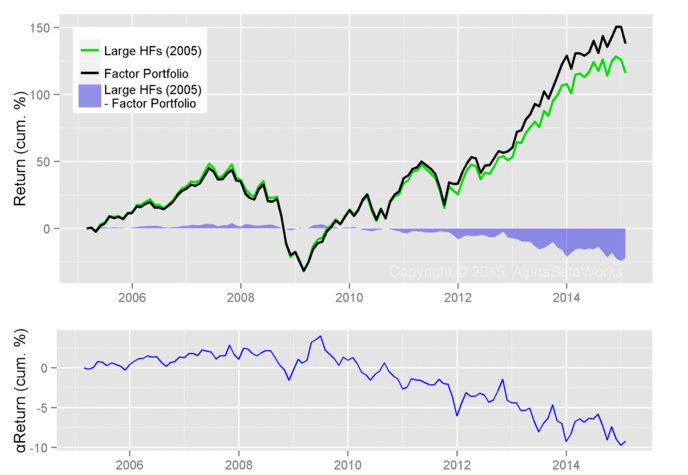

But let´s have a look at a couple of relatively small hedge funds which have been successful and have beaten the larger competitors with decades of experience in terms of return on equity. One of these small timers is ‘Sharekhan Limited’, based in Mumbai India. They had $20 million under management in 2006 and in just six years their trading, which is based on automated trading signals, generated a profit of around 150%. That means an average of 25% return annually, which is higher than the return of many large and experienced hedge and pension funds. That´s quite an impressive performance, taking into account that during the 2008 global financial crisis many funds suffered heavy losses. As you can see from the chart below, which shows the average return on equity of the hedge funds industry from 2005 to 2015, in the 2006 – 2012 time period the average return was just 30%. That´s quite a long way away from the 150% return that Sharekhan achieved during this period.

Sharekhan Limited was founded by Shripal Morakhia in 2000 and, later on, Rohit Srivastava joined the hedge fund. It started as a share-only trading hedge fund as the name suggests, but they have diversified their portfolio range to include other financial instruments such as forex. They also offer brokering service, where clients who want to trade by themselves can do so. But their primary business is managing and trading clients´ funds. They utilize both short and mid-term trend trading strategies as a base for their automated trading signals. That’s why they were profitable in 2008 and 2011 when the hedge funds industry suffered heavy losses (as the chart shows). Many of the large hedge funds tend to follow long-term trends… and the long-term trend in the stock market has been up, fueled by inflation and economic growth since the second world war. But in 2008, the financial crisis occurred and the stock markets around the globe crashed. A similar crash happened in 2011, so the large hedge funds failed to recognize the changes in time and inevitably they took a beating. Sharekhan’s automated trading signals, which focus on shorter-term charts and time periods, quickly adapted to the new changes in the market and reversed the strategy, from bullish on stocks to bearish. This enabled them to avoid the losses that the industry was suffering and instead they closed both these terrible events in profit.

As you can see, a relatively small hedge fund with a simple automated trading system can beat large hedge funds that use very expensive and complex trading software. Sometimes being small can be an advantage since smaller firms can be flexible and adapt faster to market changes, particularly during financial crises, as we have illustrated with Sharekhan.

- Click here to read more Forex Signal articles!