Understanding Forex and Letting the Market Guide You – Forex Trading Strategies

Last Update: June 25th, 2019

The forex market is never the same, what happens today does not mean that the same thing will happen tomorrow. The market might increase from positive economic data today but next week it could crash after those same numbers are published. How many times have we seen this over the years? The answer is way too often.

We know trading forex is a tough business in the best of times, let alone during times when the market is irrational and goes against all reason. So what do we do? Well, we can´t change the market, we can only follow it. As the saying goes, ‘ours is not to reason why – ours is but to do or die’. The number one cause of death to forex accounts is trying to fight the market. But how do we follow the market, how do we know when to continue the trend or how the trend has changed against the logic? The following examples will show you how to understand the market and answer these questions.

For how to trade in an irrational market: The Right Strategy in an Irrational Market – Forex Trading Strategies

If you cannot figure out the direction, then let the market guide you

If you cannot figure out the direction, then let the market guide you

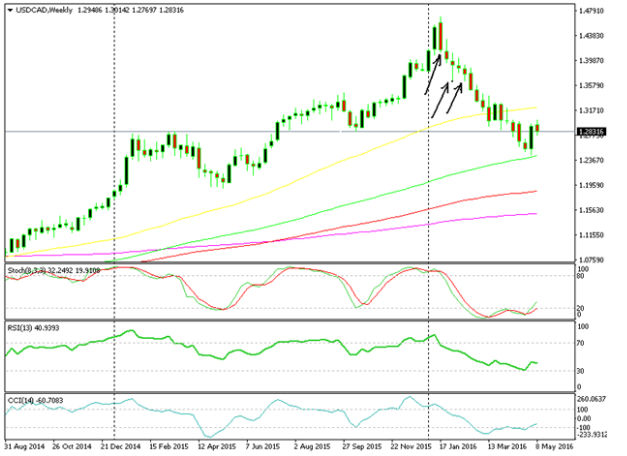

USD/CAD

USD/CAD has been in a long-term uptrend since 2011 and it picked up the pace in 2014 and 2015. This is justified because the US economy has improved since 2011 and the FED entered a monetary tightening cycle by ending the QE program and has planned to raise interest rates. The Canadian economy, on the other hand, has been getting weaker, and the inflation is near zero. Over the last year, the monthly economic data suggested the economy was in a recession several times. On top of that, the drop in oil prices has played a role to further weaken Canada, which has the third-largest oil reserve in the world. So, this USD/CAD uptrend has made complete sense.

But from mid-January of this year, the pair reversed and declined about 23 cents over a few months. This move totally goes against reason as the flow was to the downside – but we must always go with the flow. By mid-February, the market had given us three big signs that the flow had switched, at least in the short term, from bullish to bearish. What were these signs?

1. The first sign of the shift was the bearish engulfing candle in the third week of January. After two big bullish candles in the first two weeks of this month, we had an even bigger bearish candle. Now, that tells us that some big market players had closed their long-term buy positions or, even worse, that they may have opened large sell positions.

2. The market gave us a second sign in the first week of February. At some point during that week, the price reached 1.3630s from the 1.47 peak in mid-January. That´s an 11 cent (or 1,110 pip) move in just a little more than two weeks. Such a big downward move makes you think that something very important had changed in the forex market.

3. The market gave us a third and ultimate sign in the second week of February. We know the Canadian Dollar is quite dependent on the price of oil and USD/CAD is closely correlated with it. However, in the second week, the oil prices were at their lowest point, in the $26-28/barrel region, while the Canadian Dollar was about 1,000 pips higher. How could that be? It didn´t make sense but the market was trying to tell us something. Going short on USD/CAD there didn´t make much sense but we must follow the market and the market was guiding us with signs. All we had to do as forex traders at this point is read the signs and follow the flow.

The three holy signs the market gave us

EUR/USD

The second example is a little easier to understand. On the second day of March this year, the ECB cut the REPO rates from 0.05% to 0%, cut the interest rates from -0.20% to -0.30%, and increased their QE asset monthly purchases from 60 billion Euros to 80 billion Euros. The logic tells you that when a central bank pours a lot more money into an economy and forces second-level banks to increase lending, the price of that currency will normally go down because currencies are still considered goods just like the rest. The Euro did fall 200 pips in the first moments after the statement release, but it reversed and closed the day 400 pips higher. Everyone was left scratching their heads by the end of the day.

The following day, all sorts of speculation surrounded the market, such as (1) now that the ECB took these steps they won´t intervene anymore; (2) now the ECB is left without any protection, or (3) the market is seeing this as a positive sign for the Eurozone economy in the long run. None of them were true, but whatever the reason, you just can´t ignore the market.

Looking at the daily chart, hindsight is 20/20 -, the market wanted to go up. There´s a big bullish daily candle and despite bearish fundamentals, the market hinted that its bias was bullish. And, as always, let the market be your guide. The market was telling us to buy, so the best place to buy was the retrace to the previous 1.1050 resistance level which had now turned into a support. Albeit slowly, this pair appreciated nearly 600 pips.

The market hinted a bullish trend was about to begin

As we said in the opening paragraph, the forex market can often be very irrational. But, if we keep a clear head and see the bigger picture it always gives us signs about which way it wants to go. These signs are its way of guiding us. The fundamentals might point us one way but the forex market doesn´t always follow this analysis. We have seen quite a lot of this irrational market behavior lately. Sometimes the best forex strategy is not having a strategy at all or at least putting the strategy aside until the forex market comes back to its senses.

If you cannot figure out the direction, then let the market guide you

If you cannot figure out the direction, then let the market guide you