Trading the USD/JPY Currency Pair – A Beginner’s Guide

Last Update: August 1st, 2022

The United States Dollar/Japanese Yen currency pair denotes the exchange rate between the U.S. Dollar and the Japanese Yen and is expressed as the number of Japanese Yen needed to buy one U.S. Dollar.

For example, if the USD/JPY exchange rate is 130.00 in 2022, it means you need 130 yen to buy one U.S. Dollar. The U.S. Dollar is the base currency, and the Japanese Yen is the quote currency.

Both currencies are some of the most traded globally, with each being a safe-haven asset. The U.S. Dollar is the world’s reserve currency, while the Japanese Yen is a commonly used reserve currency in Asia.

History of the Japanese Yen

The Japanese yen was brought into circulation in July 1871. The Meiji government officially adopted the yen in an act that was signed on June 27, 1871. Yen literally means ‘round object’.

.jpg)

5-Yen Coin

History of the United States Dollar

The U.S. Dollar has been the United States’ standard monetary unit for more than 200 years. It has also been the world’s official reserve currency since the Bretton Woods Agreement in 1944.

How the USD/JPY is Traded

Although there are other ways to trade this currency pair, we’ll focus only on how it’s done with retail forex trading.

Pip Value of the USD/JPY

To establish the pip value of the USD/JPY, we first need to consider what a pip is. If the USD/JPY is trading at 110.01 and the exchange rate moves to 110.02, it has moved one pip higher. The second digit after the decimal point in this scenario is called a pip.

To calculate the pip value of the USD/JPY, we’ll use a 1k lot as an example. On the USD/JPY, one pip is 0.01, or 1/100 of one Japanese yen. Multiply this by 1000, and you get 10 yen. At the current exchange rate in 2022, one dollar is valued at around 130 yen.

To get the pip value in dollars, we calculate the dollar value of 10 yen at the current USD/JPY exchange rate (130 yen per one dollar) – 10 yen divided by 130 = $0.07692. Let’s just round it up to $0.077. This is the pip value of a micro lot (1k lot) of the USD/JPY at the current exchange rate.

It’s important to know that the USD/JPY pip value (in U.S. Dollars) changes with the exchange rate. For example, when the USD/JPY exchange rate rises, the pip value of the dollar decreases due to the devaluation of the yen. Remember, the pip value for a 1K lot is always 10 yen. This means that when the yen is worth less, the pip value in other currencies will also fall.

Let’s say the yen depreciates against the U.S. dollar until the USD/JPY trades at 220.00. The pip value would then be half of what it is at the current exchange rate of 110.00. To work it out, we’d have to divide 10 yen by 220 (the exchange rate), which would give us a pip value of $0.04545.

.jpg)

Are you doing your calculations correctly?

Here at FX Leaders, we go the extra mile to offer traders the best forex signals possible, with the USD/JPY pair being one of our strong suits.

Let’s calculate how much money you’d make if you traded a USD/JPY signal with 12 micro lots, bought at 110.000, and hit a profit target of 276 pips at 112.760. 12 micro lots are 12,000 units of the USD/JPY currency pair. If we multiply 276 pips by the current pip value of $0.090909, we will definitely get the wrong answer: 12 micro lots X 276 pips X $0.090909 = $301.09.

But if we take the target price of 112.760 and subtract the entry price of 110.000, we get 2.76 yen. If we multiply this by 12000 (12 micro lots of the pair) we get a profit of 33,120 yen. Remember, the new exchange rate is 112.760, which means the yen has lost some of its value. If we convert our profit of 33,120 yen to dollars, we’ll only get $293.72, and not $301.09.

Because of the dynamic pip value of this pair, we can’t use the current pip value at any point in time to accurately project take profit or stop loss values for trades. We can use this as an estimate, especially if the target is relatively small.

But when we need to make exact calculations, we need to calculate the profit or loss in Japanese yen and convert this number to U.S. dollars at the new USD/JPY exchange rate, like in the example above. Just like the pip value (in U.S. dollar) decreases as the pair moves higher, the pip value increase when the pair moves lower. The pip value in yen always remains the same because the quote currency is yen.

USD/JPY Lot Size

A standard lot in forex is 100,000 of the particular currency pair. However, most retail forex brokers offer lot sizes as small as 0.01 lots, which is 1000 of the particular currency pair. This is called a micro lot. Some trading platforms denote this as a 1k lot size. Others refer to a 1k lot as one unit.

For a really small investor, a 1k lot sounds like a lot (pun intended). After all, how would someone with a $500 account be able to open a $1000 position? Well, the great thing about trading forex is that retail brokers allow you to trade with leverage.

The leverage offered by retail forex brokers generally varies between 1:5 and 1:1000. Some brokers offer ridiculously high leverage of 1:2000, 1:3000, and even 1:5000. Of course, some countries regulate the amount of leverage you can use as a retail forex trader to protect us against liquidation, like the United States which allows maximum leverage of 1:50.

Let’s use 1:100 leverage as an example. If you have a $500 account and you want to open a 1k trade on the USD/JPY, you will need $10 to open the position. Without using leverage, this would not be possible because a 1K lot of the USD/JPY is worth $1000.

Yen Correlations

There are a few interesting relationships that the USD/JPY pair has with other financial instruments. One of those is with U.S. Treasuries. Treasury bonds, notes, and bills have what’s known as a yield, which is defined as the rate of interest paid on one of these instruments.

When yields rise, the yen tends to weaken against the dollar. This is because higher yields make a country’s currency more attractive to investors, so people borrow the yen to buy higher-yielding dollars, increasing demand for the dollar against the yen and driving USD/JPY higher.

Gold is also generally positively correlated to the Japanese Yen, which makes sense as both assets are seen as safe havens during times of economic uncertainty. However, the relationship is much more complex than that, with gold prices sometimes reflecting negative correlations with the yen. This can be down to comments by the Bank of Japan, economic indicators, and much, much more.

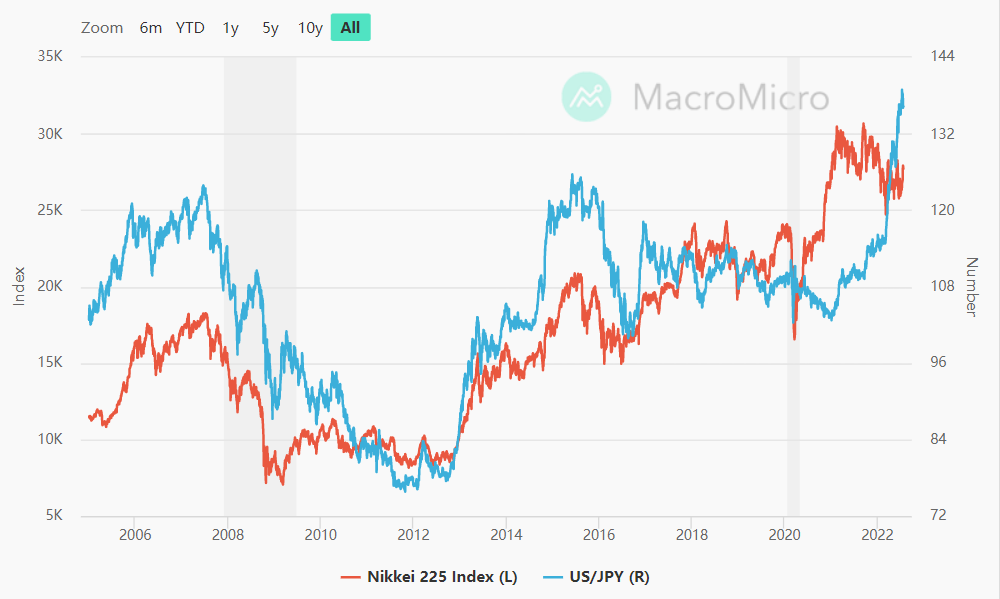

One of the pair’s closest links is with the Nikkei 225, the Japanese stock market. Similar to the way the dollar behaves with the S&P, a falling yen makes exports cheaper, which is generally good for an economy. This can be seen with many other currencies, with a falling currency encouraging investors to look elsewhere to put their cash, such as equities, and where forward-looking growth is now probabilistically higher.

What Moves USD/JPY?

Of the many economic events that influence the USD/JPY, there are a few things that can cause substantial volatility in this exchange rate:

1. Monetary Policy – Actions and Comments by Central Banks

Monetary policy can have a significant impact on the USD/JPY pair. When the Federal Reserve or Bank of Japan takes action or indicates future action, it can force investors to buy or sell the pair.

If the Bank of Japan remains dovish (allowing the currency to fall), as they are in 2022, then, everything else being equal, the yen will fall, and USD/JPY will rise. If the Fed announces quantitative easing (printing money), the dollar will fall, and so will USD/JPY.

Other elements, like indications for the future and economic growth forecasts, can provide an overall sentiment for each currency, causing prices to fluctuate as data emerges.

2. Economic Indicators

Speaking of indications for the future, economic indicators take historical data and give traders an idea of what to expect in the future. There are three main categories of economic indicators: leading, lagging, and coincident indicators.

When economic data is positive, investors tend to flock to that currency. There’s somewhat of a compounding effect here, where traders know others are looking to buy that currency and want to get in on the action.

Releases like Gross Domestic Product figures, the Consumer Price Index (a measure of inflation), manufacturing output, and unemployment rates demonstrate to investors how well that country’s economy is performing.

When Balance of Trade and Exports YoY (both important figures for Japan, an export-focused economy) came out in Japan on 04/20/2022, for example, both were well under forecasted figures. As a result, the dollar appreciated against the yen as investors looked to leave the Japanese yen. Combined with positive U.S. data, the pair finished that day 1.49% up.

.jpg)

Excessive unemployment is negative for economic growth and can weigh on a country’s currency

Although economic news out of Japan can move the USD/JPY exchange rate considerably, the most market-moving economic news releases typically emanate from the United States.

3. The Cross Rate Effect

Occasionally, the USD/JPY pair is affected by movements in the exchange rates of other yen pairs, like EUR/JPY or GBP/JPY. All eyes might be on GBP/JPY, for example, and when the pair appreciates, investors expect general yen weakness elsewhere. This can cause the USD/JPY pair to fall, even if there isn’t a direct strengthening of the dollar.

Forex Signals and Valuable Trading Info

If you’re looking for a breakthrough in your trading career, why not check out our forex signals page today? It could be the key to your trading success!

That’s not all, though. We have an amazing library of forex trading strategies, live market updates, broker recommendations, and of course, our forex trading course.

What are you waiting for? Join the FX Leaders community now!