Sideways price action, low volatility, range bound don’t be caught off guard!

When I think of the last couple of trading days, one word fitly describes it – boring. Besides the powerful move in the USD/JPY last week, most of the majors (and many other pairs) have been either ranging, or have been slow movers. The holiday today in Japan (Ocean day) possibly subdued market volatility even more, however, the ECB rate decision and a speech by ECB president, Mr. Mario Draghi on Thursday might also be keeping market players from engaging in heavy speculative positions. Nevertheless, I am ready to take advantage, should the market suddenly awake to various uncertainties again.

I am not particularly expecting extreme volatility tomorrow, despite the important economic data releases scheduled. Extreme readings might, of course, resurrect the quiet markets in an instant. I do think, however, that more important news is anticipated by the market to be on Thursday with the ECB (the European Central Bank) releasing data and Mario Draghi’s speech. Nevertheless be sure to keep an eye on the Bank of England’s consumer price index (CPI) figures tomorrow at 08:30 GMT which could spark some decent movement in the Sterling. There is some news out of Australia early tomorrow morning (RBA July meeting minutes) and also dairy prices out of New Zealand, but you will only read this article after the news has been released. Perhaps you can trade the effect of these releases, though. Let’s dive into some charts immediately…

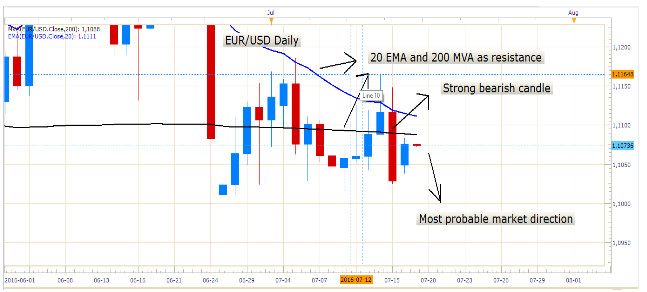

EUR/USD Daily chart

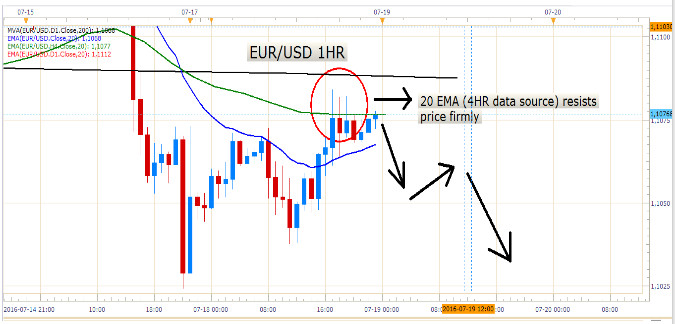

I am still very bearish on the EUR/USD, and the fact that the 20 EMA has resisted price action pretty well these last few days just establishes my view. I also like the aggressive bearish bar that was printed on Friday. I am definitely not ignorant of the fact that we still see range bound price action on this pair, but there might certainly be scope for some pre-ECB short positioning here. The ECB is expected to be dovish at their next meeting, so to enter short tomorrow might offer some profitability. I would never advise traders to enter trades based on fundamentals only, so be sure to use your own strategic technical analysis to take advantage of possible opportunities. I am also interested in intraday short trades on this pair. See the 1HR chart below:

EUR/USD Hourly chart

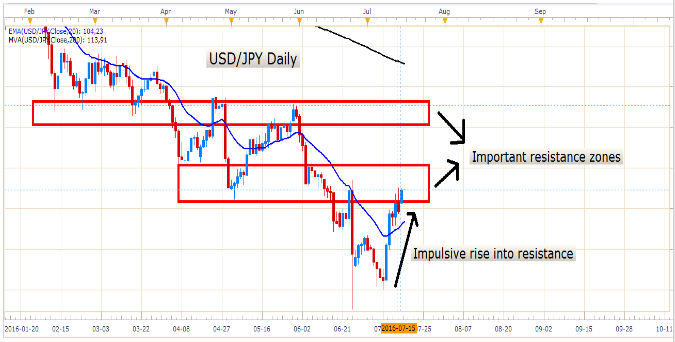

USD/JPY Daily chart

The USD/JPY has impulsively pressed into the first important resistance zone as seen above. How price reacts to this zone should give us some insight into what to expect further. I am concerned about the pair possibly getting a little bit exhausted, but on a short-term, intraday basis, I am still bullish while price stays supported by the 20 EMA on a 4HR chart. See the chart below:

USD/JPY 4HR chart

AUD/USD Daily chart

The AUD/USD remains supported by the 20 EMA, however, upward momentum is clearly starting to fade, especially when you look at Thursday’s bearish engulfing daily candle. Short term momentum might push short intraday positions into profit tomorrow, but the news in a few hours’ time could drive the market in either direction.

The USD/CAD is still very sideways – I have no short term ambitions concerning this pair.

The GBP/USD is losing some of its recent bullish steam, and with two daily candles recently rejecting off of the 20 EMA, this indicates that the bears are defending their territory.

.jpg)

GBP/USD Daily chart

I will be monitoring the UK’s CPI numbers tomorrow, however, I suspect that the Bexit theme will probably overshadow the results as market players are more concerned about the ‘’what next?’’ concerning the UK and their new political stand point.

Good luck trading tomorrow!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account