The US Dollar Outlook Remains Negative; Canadian Dollar Strength Persists

Today we saw some big moves in the forex market. What a great day for speculators and traders! The most notable event was the UK retail sales data which beat expectations by far. The pound strengthened immensely and gained about 95 pips against the US dollar in only a few minutes after the release. The recent very strong economic data out of the UK has caught the market off guard while nobody has been expecting the economic data out of the region to improve. In contrast, most are expecting the worse after Brexit.

The pound wasn’t the only major currency to strengthen against the US dollar today. All of the majors advanced against the Buck today, with the Euro, Swiss Franc, Canadian dollar and the pound being the most active, with the Japanese Yen and Australian dollar posting less aggressive gains. Let’s look at a few charts.

USD/CAD

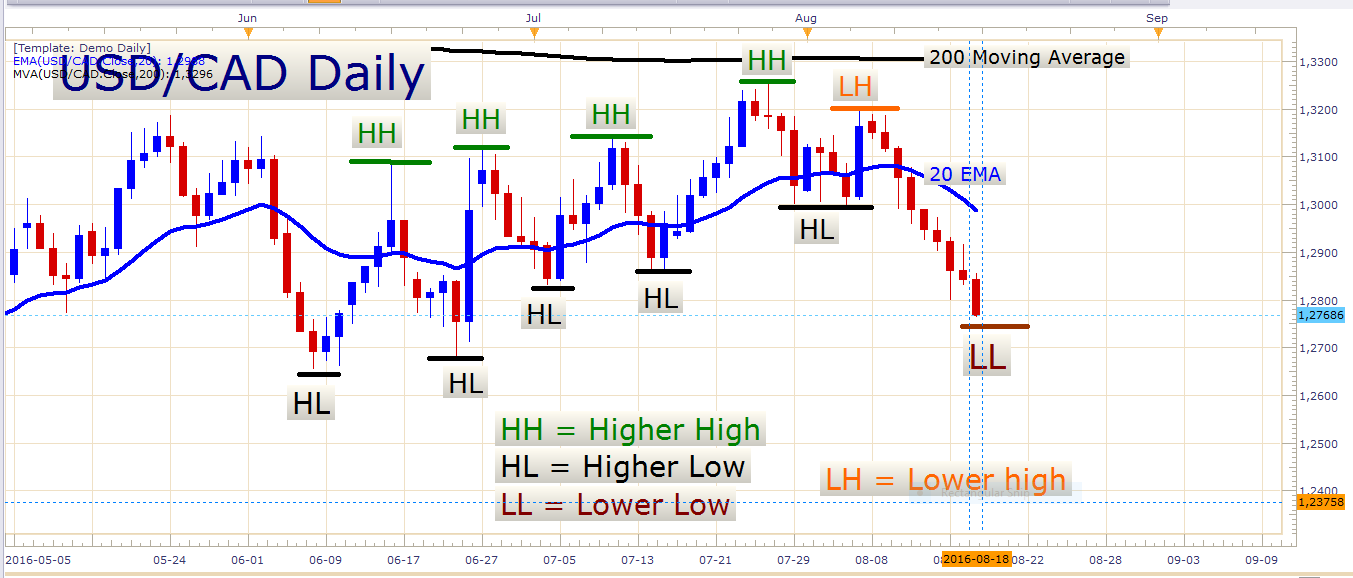

USD/CAD Daily Chart

What a massive decline! It seems like the Canadian dollar strength is just limitless. This is a good example of where traders lose money when they try to pick bottoms (and tops) on a currency pair. Picking tops and bottoms require great skill and experience and are often low probability endeavors. You can be sure that there were many traders who tried to fade this mighty decline in the USD/CAD and got stopped out at a loss. This is where institutional traders and other experienced traders and investors lay their hands on less experienced market players’ money. The trend is your friend and trading in the direction of prevailing trends greatly increases your probability of striking a winning trade.

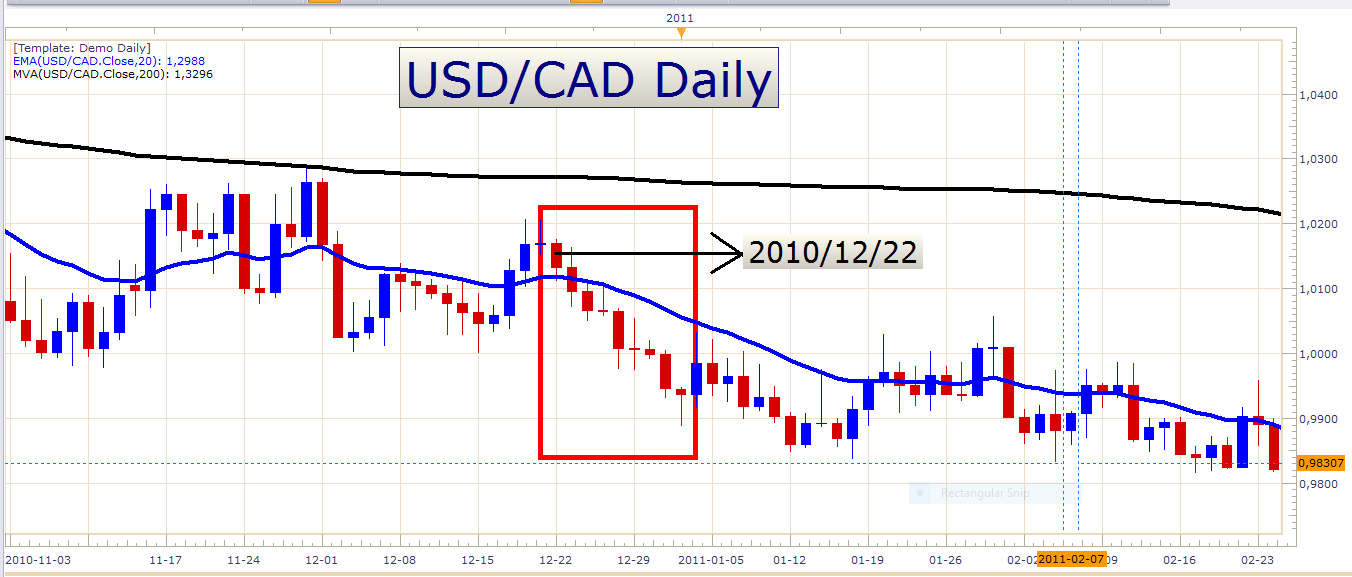

The last time we encountered nine consecutive bearish daily candles on this pair was back in 2010. And even then the decline was not nearly as impulsive and consistent. Look at the chart below:

USD/CAD Daily Chart (2010/12)

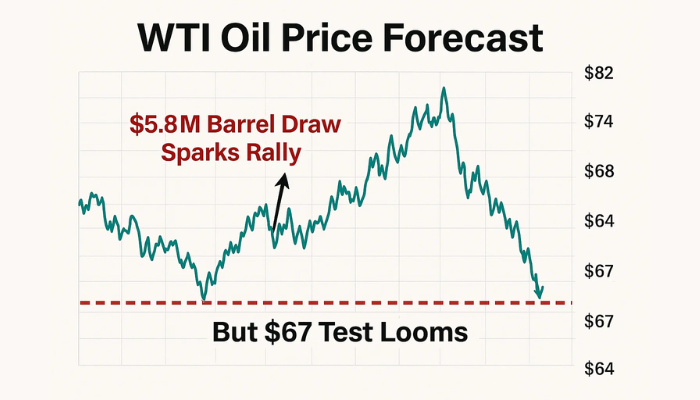

Tomorrow we have Core CPI and Core retail sales numbers out of Canada. This could cause some decent volatility in CAD pairs. If we get some vigorous numbers we might see the Canadian dollar strengthen even more. I am careful of chasing the price at this stage, but remember that although the pair is in an oversold condition, we can’t say that the decline is over until it’s over. The other important factor to consider is the oil price. Look at the chart below:

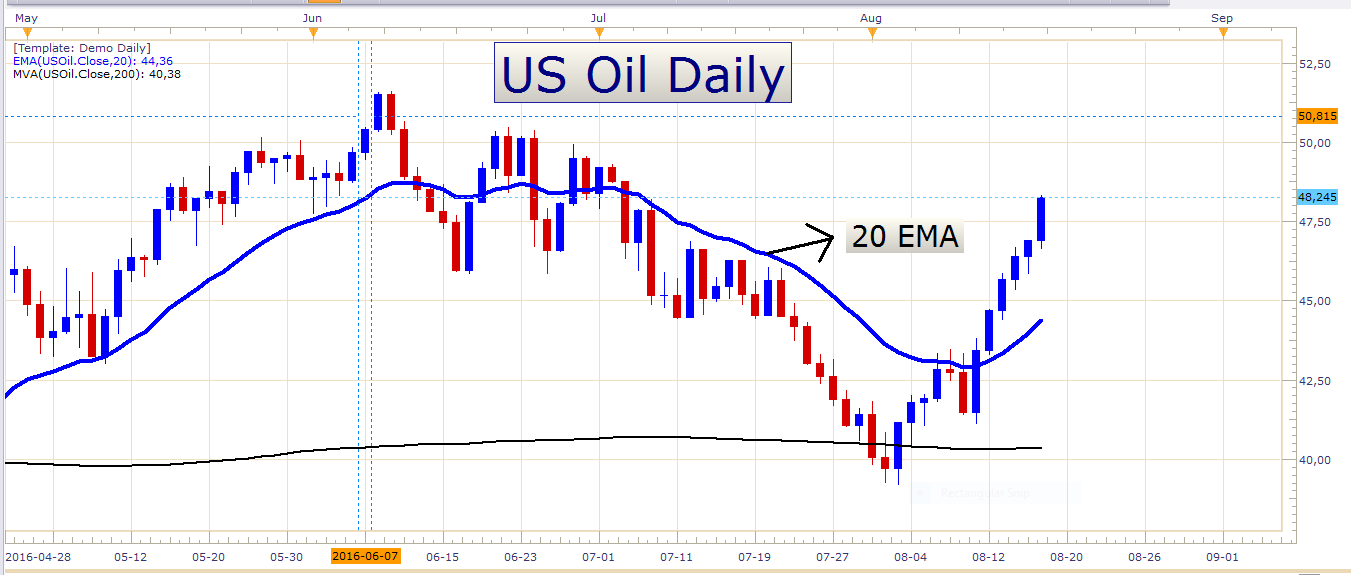

US Oil Daily Chart

This is a mighty impulsive rise and no wonder the Canadian dollar is so strong. Remember that Canada is very reliant on oil production and obviously oil prices. Therefore, the Canadian dollar and oil prices are highly correlated. At the moment it doesn’t look like the oil price is losing any steam. If perhaps we see it rise more, this could keep the Canadian dollar supported. Let’s look at an hourly chart of the USD/CAD:

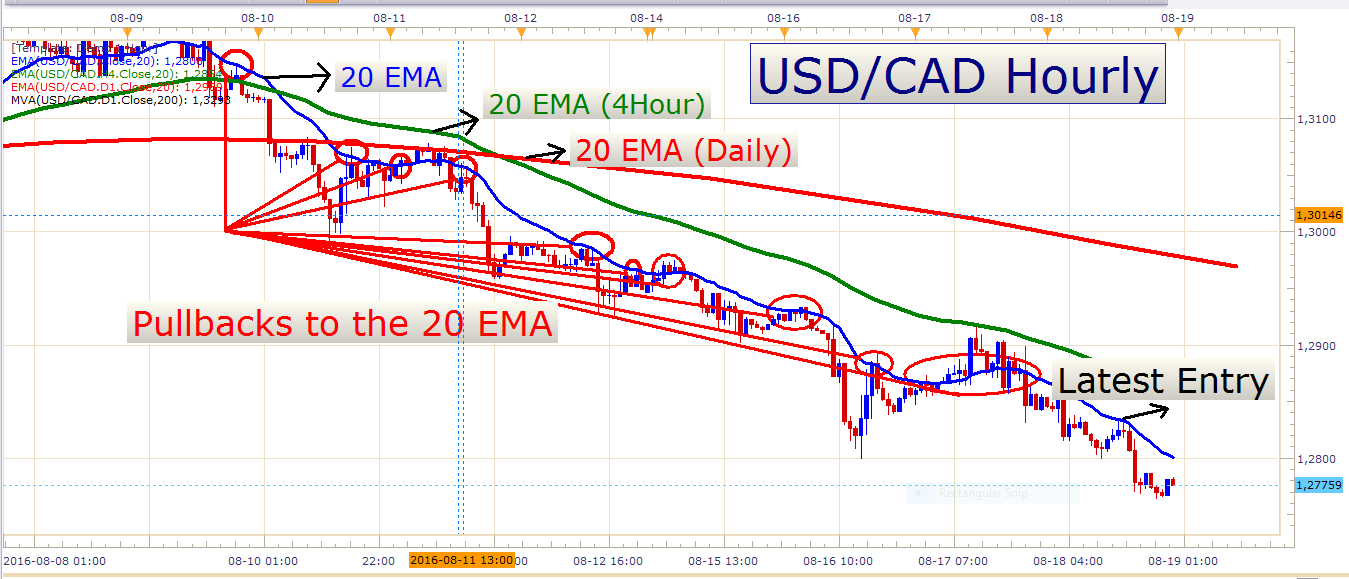

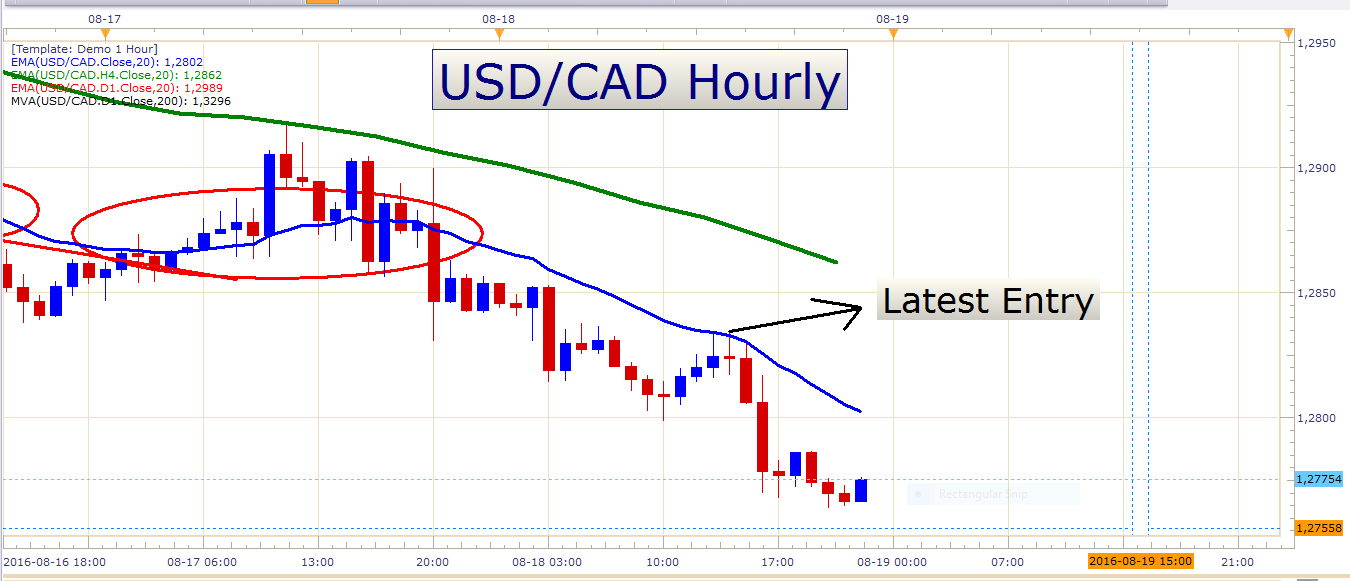

USD/CAD Hourly Chart

This is a chart I’ve posted a few times in the last couple of days with a recommendation of selling bounces to the 20 EMA (the blue moving average). As you can see, this was an easy way to make many pips so far. Look at the latest pullback to the 20 EMA on an hourly chart:

USD/CAD Hourly Chart

This entry, if taken, would have been 57 pips in profit by the time of this writing. Of course not all trades work out like this one, but at least you can see what a perfect entry this would have been. I was lucky enough to take this trade today, with an entry exactly on the 20 EMA. Perhaps we might get some more opportunities like this tomorrow. Just be careful of the data releases tomorrow, and remember that if we get some US dollar strength for some reason, or if oil sells off, we might get a correction on this pair. From a cyclical point of view, it is unlikely that we will get many more bearish days on this pair soon. For now I have no option but to maintain a bearish bias on the pair. I would just be mindful to lock in gains on open trades, and to be careful when opening new trades. The risk to reward ratio on new short trades is not nearly as favorable as it was six to nine days ago.

Looking at the FX market in general, the US dollar might perhaps weaken some more against the other major currencies over the next few days. Traders might want to be on the lookout for opportunities to sell the Greenback. Tomorrow is Friday, and sometimes market participation can be thinner than usual… which could limit market moves.

We don’t have a very heavy news docket tomorrow, except of course for the Canadian CPI and retail sales numbers as mentioned earlier in this article.

Good luck trading, and have a great weekend!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account