Commodity Currencies are Showing Some Weakness – The Australian Dollar in Focus

The Australian dollar has been showing signs of weakness for quite a couple of days already. What I like about the Aussie is that even while the other majors were gaining ground against the US dollar during last week, the Aussie weakened against the Greenback. The technical picture of the AUD/USD looks very negative, and this could be something to take advantage of over the next few days or even weeks. Let’s take a look at a weekly chart of the AUD/USD:

AUD/USD Weekly Chart

This looks like a splendid opportunity to sell the Aussie. Notice how the black trend line is acting as important resistance to the price. What I like about this setup is that we have two pin bar candles next to each other forming a tweezer top which is also a type of a double top formation. This indicates a high probability of a price reversal. Especially because these two candles rejected off of such an important price level. The fact that last week printed a red candle also strengthens the bearish bias on this pair. Furthermore, we see that a lower high has been formed which tells us that the bullish momentum has been halted, at least for now. Look at the chart below:

AUD/USD Weekly Chart

When price fails to reach the former swing high like in the chart above, it opens up the risk for a decline. This is a clear signal to bullish market players to start reconsidering their bias. Remember that we are looking at a longer term time frame here. Oftentimes candlestick formations on a weekly chart are much more reliable than on an hourly chart for example.

I would like to see a resumption of the long-term downtrend soon. My first target would be the 20 EMA (the blue moving average) with larger targets as displayed in the setups below. Aggressive traders might want to enter a trade as soon as possible. A more conservative approach would be to enter on a retracement in order to be able to use a tighter stop. Look at the following setups:

AUD/USD Weekly Chart – Aggressive Entry

AUD/USD Weekly Chart – Conservative Entry

Traders can, of course, combine both entry types mentioned above by opening two separate trades. If price declines from the current level and the conservative entry is not triggered, the aggressive trade will at least be active.

The trade setups mentioned above might require a lot of patience and may not be suitable for every trader. Scalpers and day traders will probably use different entry criteria, stop loss, and take profit distances. Let’s look at a daily chart:

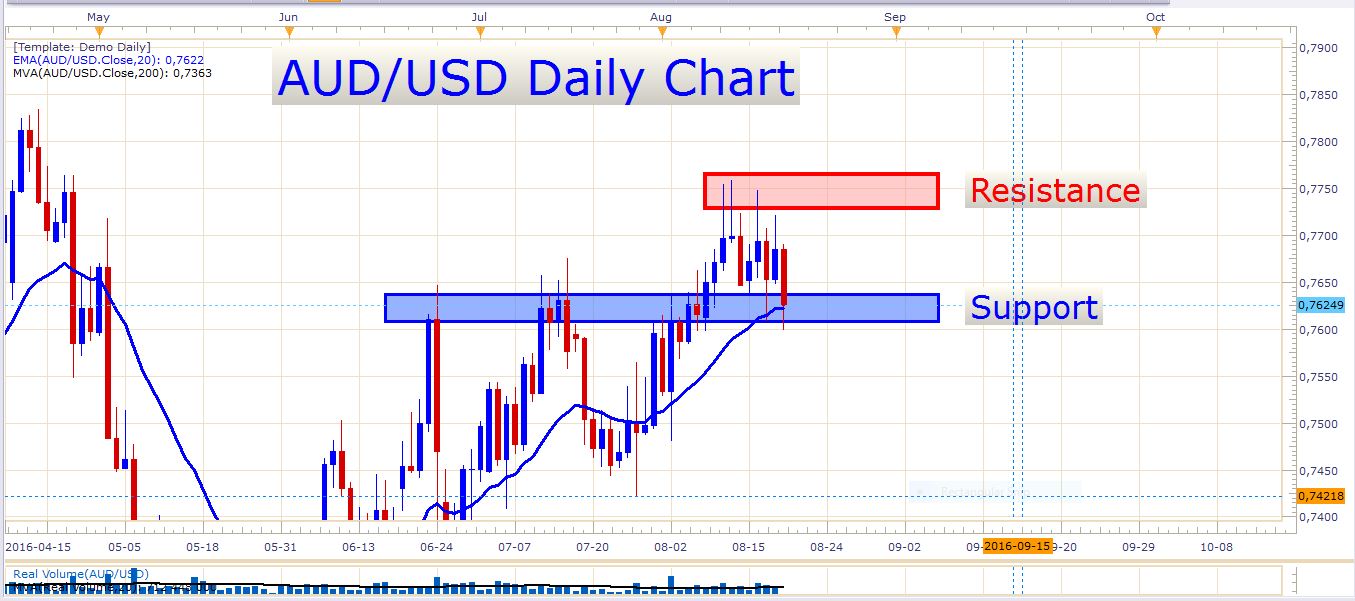

AUD/USD Daily Chart

As you can see the 20 EMA (blue moving average) is currently supporting price, and the support zone marked on the chart above is still valid. I wouldn’t be surprised however if price breaks through the 20 EMA soon and then becomes resisted by it. If perhaps we see the US dollar strengthen over the next week or so, the AUD/USD could be the ideal pair to play.

USD/JPY

This pair is still very heavy, and it doesn’t look like it’s going to attract a lot of buyers soon. I still think we could soon get a decisive break through the very important big psychological level at 100 Yen per USD. We’ve already had a daily close below 100 on Thursday last week. Here is a daily chart:

USD/JPY Daily Chart

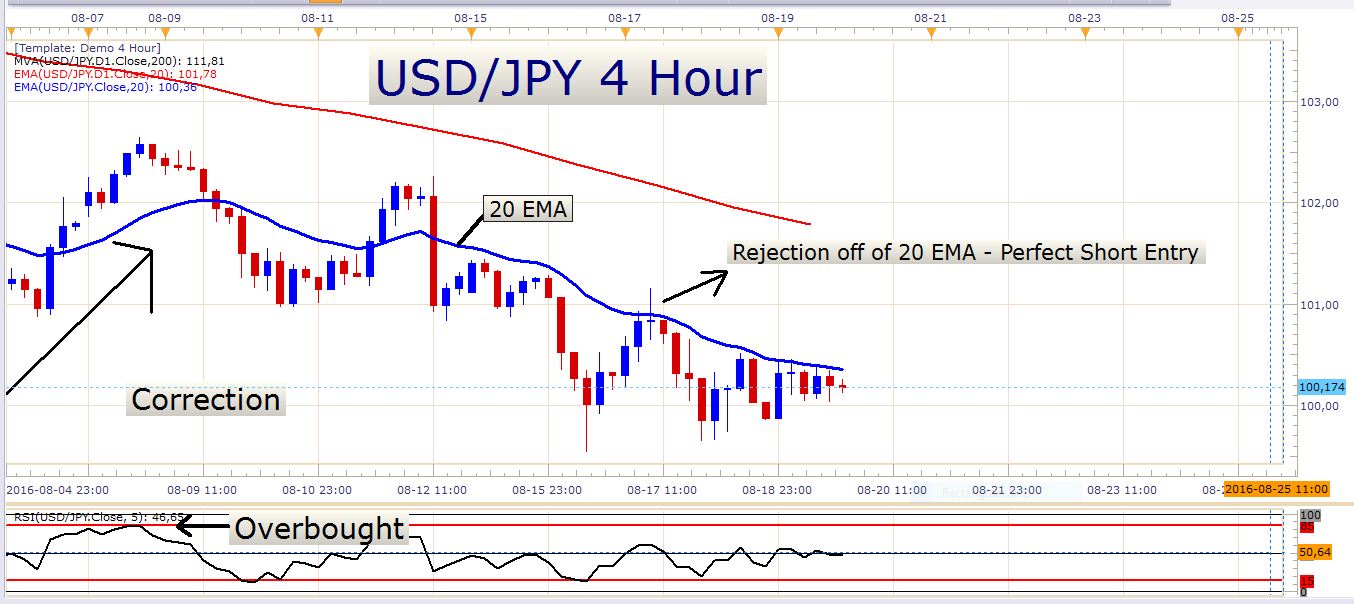

Would I enter a short position at the current price? Not necessarily, but perhaps there might be some juicy setups on smaller timeframes during the week. Perhaps a pullback to the 20 EMA on a 4-hour chart preceded by an aggressive decline. Look at the example on a 4-hour chart:

USD/JPY 4-hour Chart

Looking at the economic calendar, we don’t have any important events scheduled for tomorrow. It’s a rather slow start to the week in terms of data releases. However, this doesn’t necessarily mean that we’re not going to see big moves in FX tomorrow.

The US dollar might experience some further weakness in the week ahead, and the only major currency that looks particularly prone to weaken against the US dollar is the Australian dollar. I would like to sell the US dollar against major currencies like for example the Canadian dollar and the Swiss Franc. Obviously, I would not just enter trades blindly, but wait for high probability setups.

That’s all for today. May you have a flying start to your trading week tomorrow!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account