The US Dollar is Fighting Fit Again… and Beating Up All the Major Currencies

What a day in the markets! The US dollar is just ripping. Yen strength is nowhere to be found, the Canadian dollar is history, the Australian dollar is far down under, the Swiss franc got hammered, and the Euro is sliding. The only major that didn’t weaken too much against the US dollar today was the British pound, which lost only about 25 pips. The dollar has been strong since Friday when Janet Yellen delivered her speech. Today the US consumer confidence numbers surprised expectations with a print of 101.1 versus an expected number of 97.0. Although the dollar didn’t really react to this data print immediately, perhaps this added to the dollar strength that persisted throughout the rest of the day. Let’s look at a few pairs:

AUD/USD

This pair is definitely still one of my favorites. My short trades have made very good progress and I hope you also took your slice of this cake. I think what I like best about the pair is that the technical picture has been very clean since about the 13th of August when the preceding weekly candle started to show signs that the Aussie was becoming exhausted. Even when the US dollar was still relatively weak against most of the majors, the Australian dollar already started to show definite signs of weakness. Let’s look at a weekly chart:

AUD/USD Weekly Chart

What a beautiful setup. This was an opportunity that I just couldn’t let go by. The next hurdle this pair has to face is the 20 EMA. It doesn’t look like the pair is going to have a lot of trouble clearing this moving average, however. Of course, the nonfarm payrolls numbers on Friday have massive market moving potential, and for the dollar strength to keep its momentum we need to see at least a decent print. If we get a very strong print again on Friday we could expect to see some more dollar strength over the near term. Let’s look at the Aussie’s decline today:

AUD/USD Daily Chart

The sell zone I mentioned in yesterday’s article has clearly not been touched yet. We might still get a run up to this zone, but the odds are getting less for this to happen soon. If you are not short yet, I would not recommend chasing the market by entering now. I never like to chase the market, although it is often very tempting to do that. As I mentioned, I have already opened short trades on this pair several days ago, but I might be interested in adding some more short positions if the price pulls back to a level which is closer to the 20 EMA. Over the long run, it is definitely more rewarding to wait for retracements to utilize than to chase the price all the time. Patience makes money ( if used correctly of course). Let’s look at the USD/JPY:

USD/JPY

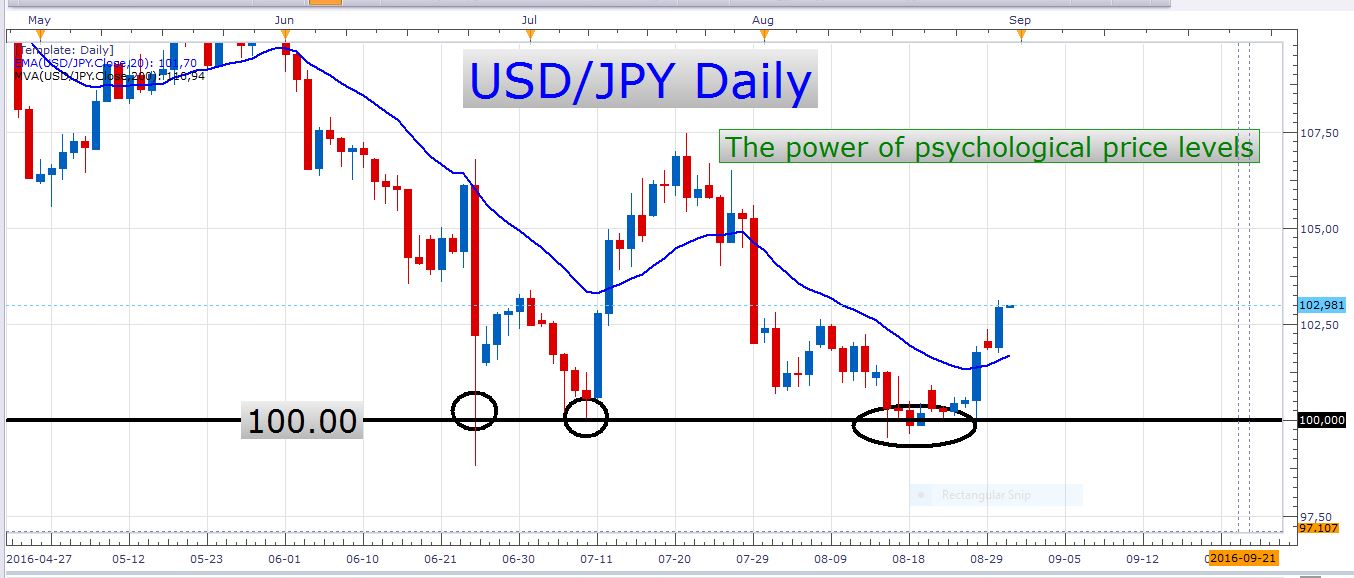

This pair looks like it has found some solid support at the 100 area. The bears tried to overcome this level quite a couple of times in the last 50 odd days, but the bulls defended this level aggressively and kept pushing back the sellers. I thought that the 100 level would eventually give way because of the numerous times the price rammed against it. The price might still conquer this big psychological level, but at the moment the market is strongly heading in the other direction. Look at a daily chart:

Amazing, isn’t it! Here we see the determination with which the bulls kept buying this pair at the big 100 level. I cannot say that I have a particular bias on this pair right now, as the longer term trend is clearly down, but we currently have price rising aggressively. Scalpers and intraday traders could take advantage of this upward momentum. Longer term traders can watch out for opportunities to short the pair. I would definitely not short the pair at the moment because of the tremendous bullish momentum which is still intact. If you know the FX market well you will know that trader sentiment and fundamentals can change in the blink of an eye. Hence we can always be on the lookout for short opportunities on the USD/JPY that may arise suddenly.

Economic data to watch tomorrow

Tomorrow’s data might be somewhat muted by the anticipation of the much more important US nonfarm payrolls numbers on Friday. We have the ADP nonfarm payrolls release tomorrow, but this is often not a very great market mover. Out of Europe, we have German unemployment numbers and European CPI numbers. We also have Canadian GDP numbers and US pending home sales numbers. Lastly, there are some US crude oil inventory numbers which could have an effect on the Canadian dollar of course.

Have a prosperous trading day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account